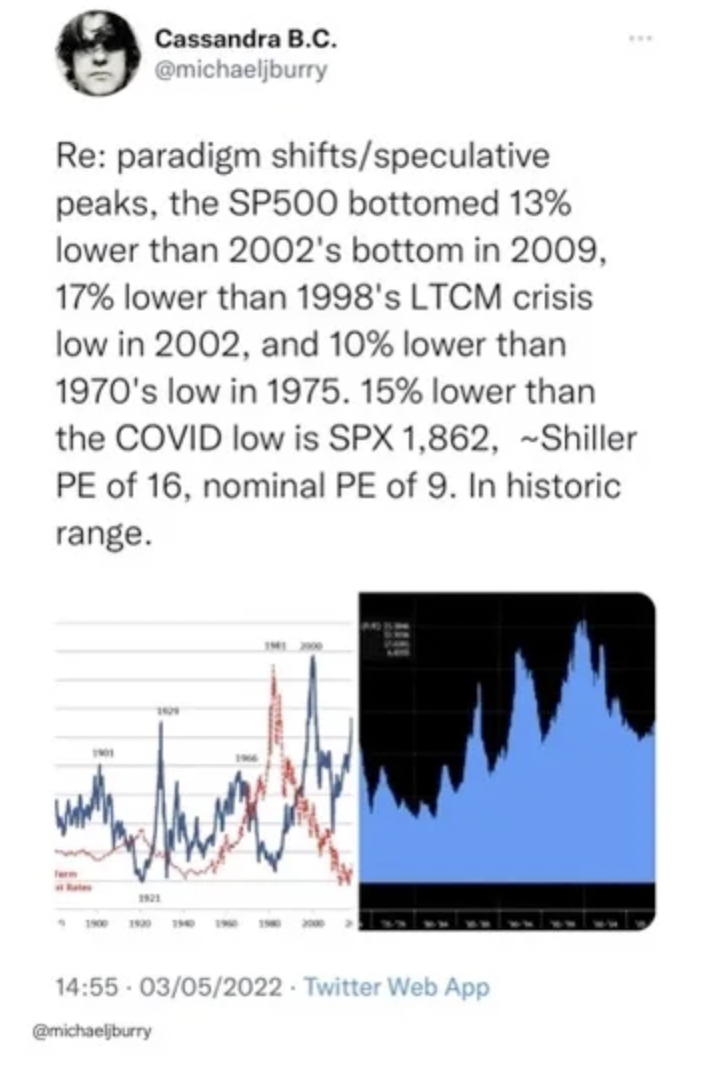

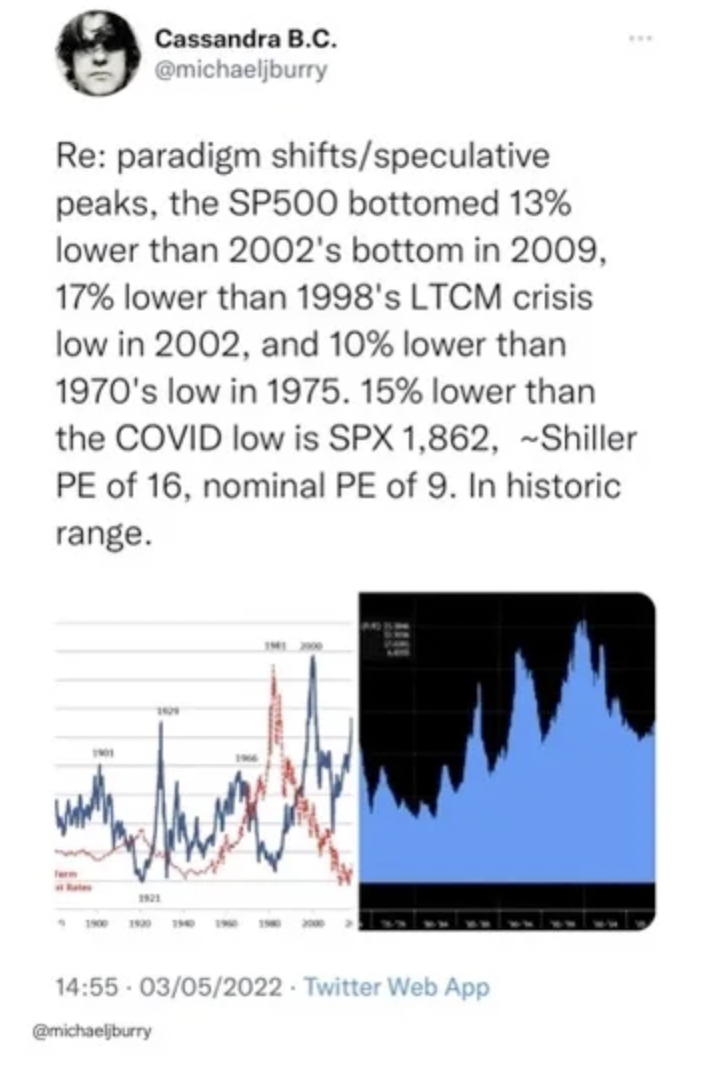

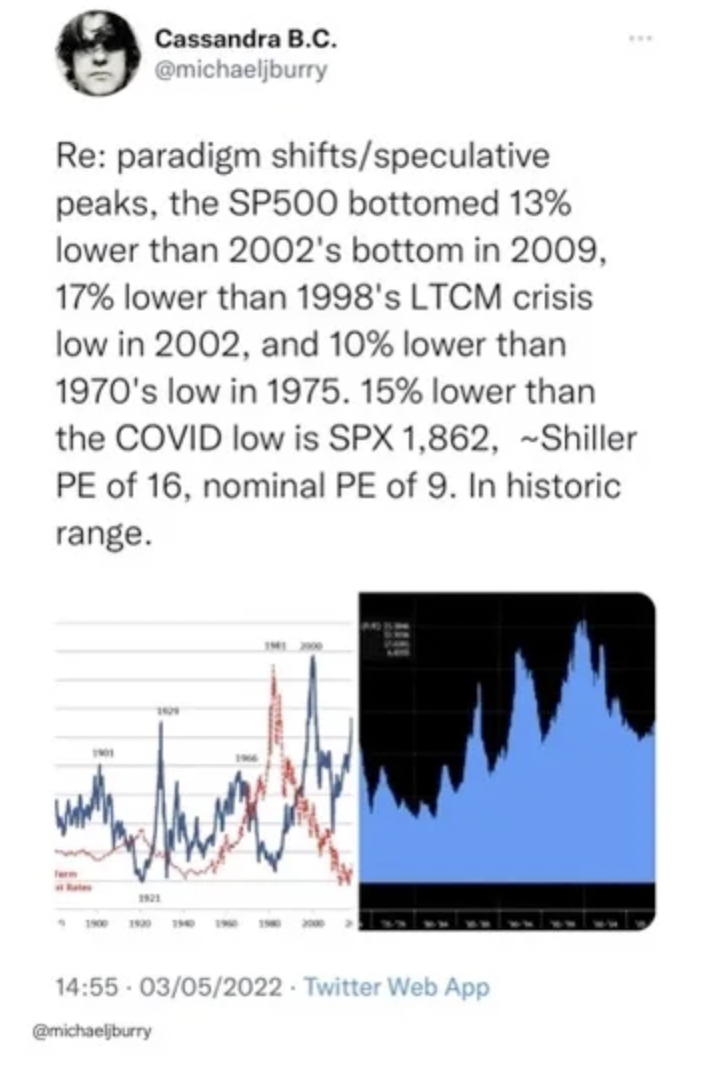

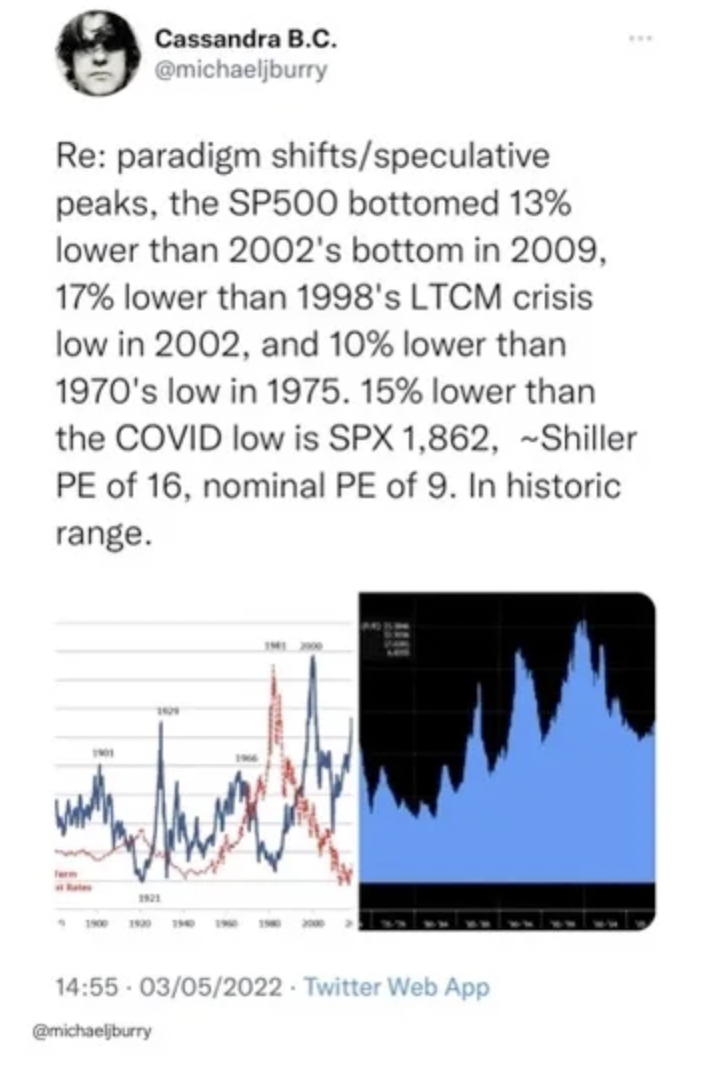

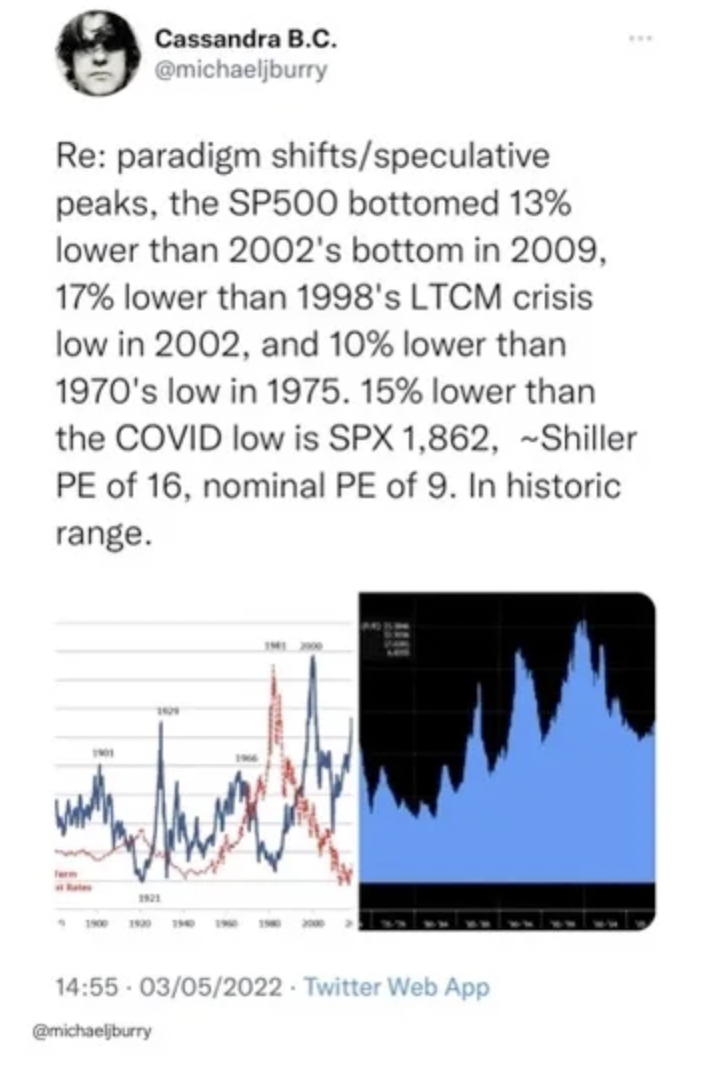

From this story about Michael Burry shorting Apple...Burry previously tweeted that based on previous declines, the bottom for the S&P in this bear market would be 1862.00. The S&P closed today at 3901.35. He later deleted the tweet.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

From this story about Michael Burry shorting Apple...Burry previously tweeted that based on previous declines, the bottom for the S&P in this bear market would be 1862.00. The S&P closed today at 3901.35. He later deleted the tweet.

AR closed at $40.05 today > https://www.cnbc.com/quotes/AR and natty gas at $8.85! Like KC says:I just bought AR at $36.01 this morning! Natty gas is over $8 and will easily go over $10 before fall. AR has ZERO % of their production hedged. Not sure if you are in deep enough to realize what that means; especially when most of the competition is heavily hedged around $4?

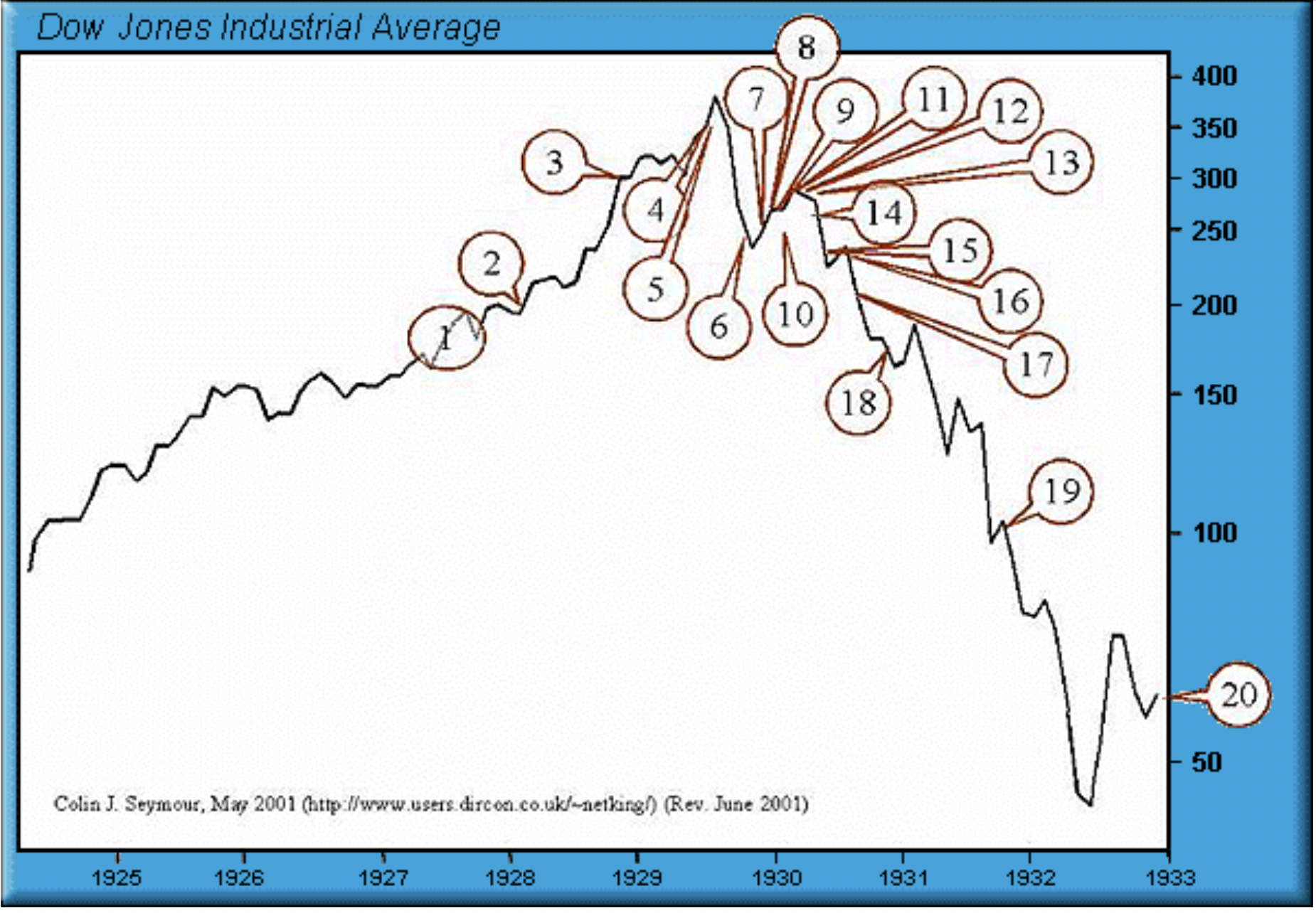

The Bear Markets of 2000 - 2002 and 2008 had massive drops in the indexes and there was not a depression.That’s a pretty pessimistic view. Would pretty much put us in a depression.

The Bear Markets of 2000 - 2002 and 2008 had massive drops in the indexes and there was not a depression.

Recessions are normal.

The key is to have some dry powder (cash) ready to put to work at the bottom.Yes, those were both 50% drops and what bury is forecasting would be a 62% drop. Not as bad as I thought at first glance, but still a monster decline.

Anyway, I don't think it will go down that far, but wouldn't be surprised with a 50% decline by the time all is said and done.

True, but the question is when?The key is to have some dry powder (cash) ready to put to work at the bottom.

Even better, is to have rolled into stocks that are going up in/against the Brandon Debacle! Inflation is eating your cash up at over 10%/year!! Energy is making new 52 week highs day in and day out!!The key is to have some dry powder (cash) ready to put to work at the bottom.

Mike Wilson at Morgan Stanley says S&P 500 at 3400 by end of summer.True, but the question is when?

www.wishingwealthblog.com

www.wishingwealthblog.com

I originally thought we would bottom in October but it might take longer. A 9 month Bear market is not that long.

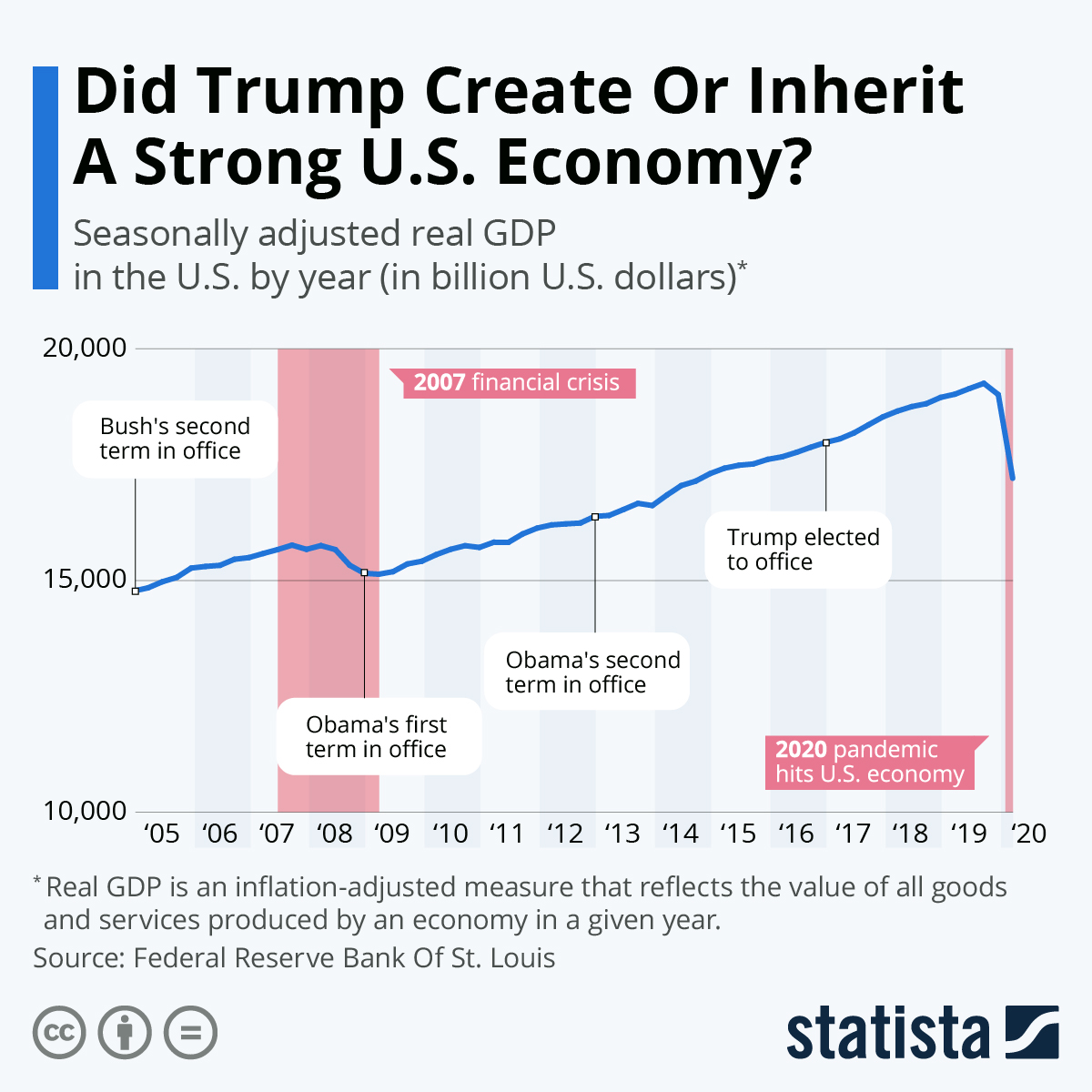

Thanks for posting.Jeremy Grantham says we are in a bubble that is bursting. Here are several interviews he has done in recent months and one from early last year. In the interview with Australian tv, he says that a 50% drop in the stock market from it's peak would not surprise him. That would take the S&P down to 2380.

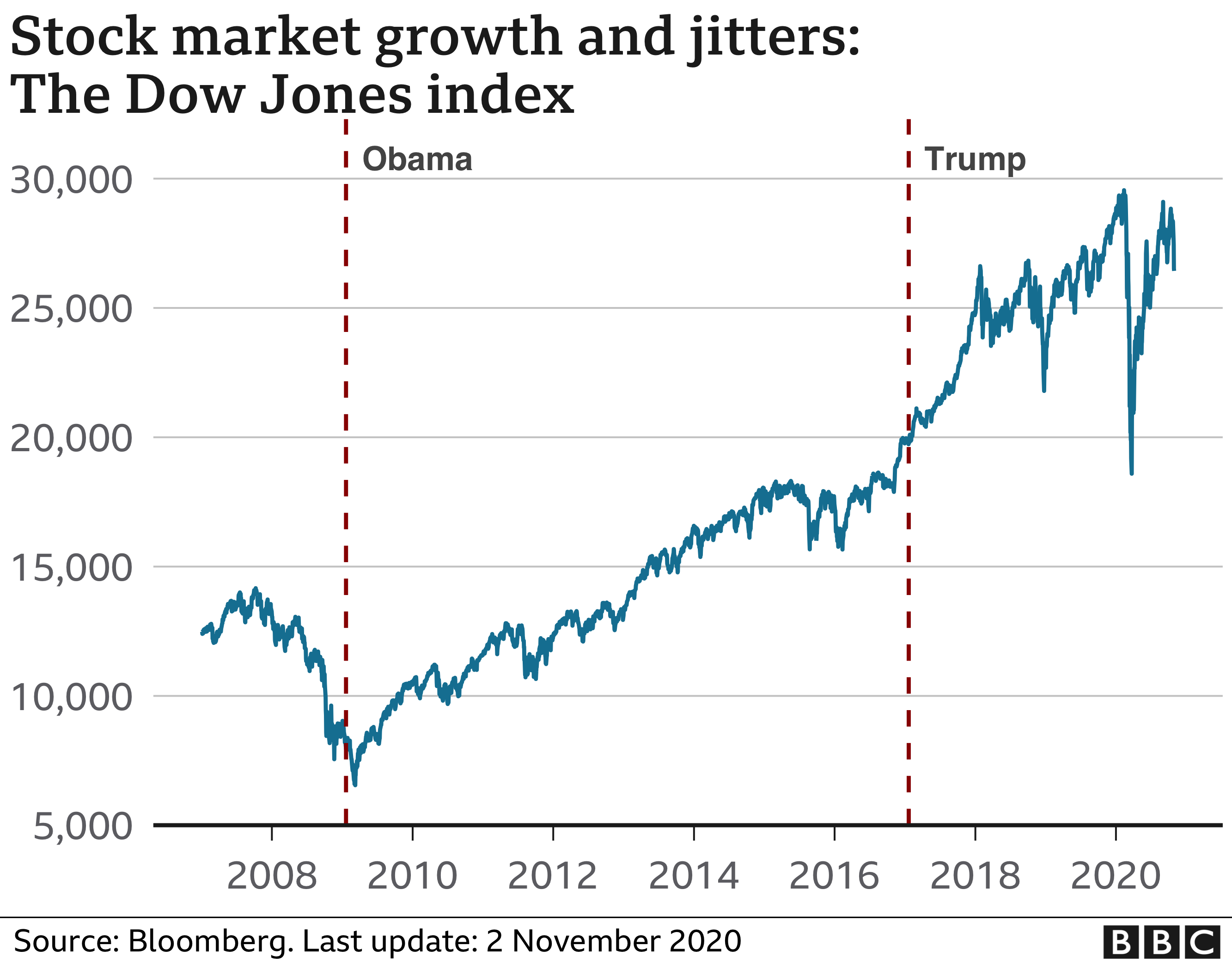

This makes a lot of sense. We had quantitative easing galore to inflate us out of the 2008 recession and we piled a lot of money printing on top of that in the last 10 years. Some of it was justified to keep the economy from imploding during the pandemic and some of it was an unnecessary gift to Wall Street with the repeated "Fed Put" that kept the markets from going through a needed and healthy correction.

Feb 2022 Fox Business

Jan 2022 Bloomberg

May 2022 CNBC

Feb 2022 ABC Australia

Jan 2021 Bloomberg

Yes, because 8 years of comrade 0bomanomics and an additional $9,000,000,000,000 added to the debt........never mind.......it's uselsss......

Thanks for posting.

Amazon fell 94% in the Dot-Com Bear Market. 50% - 80% drop is easy to see.

Stay in cash and keep your powder dry.

Very thankful for my stop losses.Thanks for posting.

Amazon fell 94% in the Dot-Com Bear Market. 50% - 80% drop is easy to see.

Stay in cash and keep your powder dry.

Show me anything in the Chinese economy that tells the truth....Eh, I've done better than you over a significant time period. I am willing to gamble a bit, and have done well enough in the past to do that. If XIN survives which I strongly think it will, it will be worth more than 10 cents on the dollar. Show me anything in the US market that is anywhere close to those valuations. The company has been a mess due to its own doing and also the property market sector in China. China is already starting to support the property market and XIN has 2 years to get their balance sheet in order, so essentially they have a pretty long road way.

If I am going to gamble I would rather do it on something that the valuations are in my favor, than the high flyer growth stocks of last fall.

From this story about Michael Burry shorting Apple...Burry previously tweeted that based on previous declines, the bottom for the S&P in this bear market would be 1862.00. The S&P closed today at 3901.35. He later deleted the tweet.

www.wishingwealthblog.com

www.wishingwealthblog.com