Is it a hard cap because of the algorithm or is it because someone just decided to make one? I'd be more likely to believe there won't be changes if it's not physically possible to make more coins. However, if it remains possible for people to add more to the pool, I can guarantee you that at some point they will.There is a hard cap. Bitcoin will never mine more than 21 million BTC.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto tanking

- Thread starter Chuck C

- Start date

Is it a hard cap because of the algorithm or is it because someone just decided to make one? I'd be more likely to believe there won't be changes if it's not physically possible to make more coins. However, if it remains possible for people to add more to the pool, I can guarantee you that at some point they will.

It is encoded in Bitcoin’s source code. Won’t ever changed.

So what exactly makes Bitcoin have value?

Because it seems to me that the minute people stop wanting Bitcoin is the minute it stops having any value.

A dollar has value because it's backed by a government. All debts in this country are settled with dollars. If a court orders you to pay someone, you pay it in dollars. When you pay your taxes, you pay in dollars. If the government hires you or buys something from you, they pay in dollars.

A dollar unlike Crypto doesn't lose domestic value because some CEO made fun of it on SNL.

No one said it wasn’t volatile. Even though some value was lost you can still trade 1 Bitcoin for $50,000 USD.

It has value the same way we decided anything else has value. This is the direction the world is moving.

Maybe. I could see countries banning its use though because they won't have control over it. I read India is looking at laws to do just that. On the other hand, as others have mentioned, some countries like China and Russia have a vested interest in destabilizing the dollar so they may want to keep them around for a long time.No one said it wasn’t volatile. Even though some value was lost you can still trade 1 Bitcoin for $50,000 USD.

It has value the same way we decided anything else has value. This is the direction the world is moving.

No one said it wasn’t volatile. Even though some value was lost you can still trade 1 Bitcoin for $50,000 USD.

It has value the same way we decided anything else has value. This is the direction the world is moving.

It seems stupid to me. Seems like some computer programmer invented basically a form of fake money and a bunch of people joined in and decided they really wanted to get their hands on that fake money.

A bitcoin has value as a medium of exchange.So what exactly makes Bitcoin have value?

Because it seems to me that the minute people stop wanting Bitcoin is the minute it stops having any value.

A dollar has value because it's backed by a government. All debts in this country are settled with dollars. If a court orders you to pay someone, you pay it in dollars. When you pay your taxes, you pay in dollars. If the government hires you or buys something from you, they pay in dollars.

A dollar unlike Crypto doesn't lose domestic value because some CEO made fun of it on SNL.

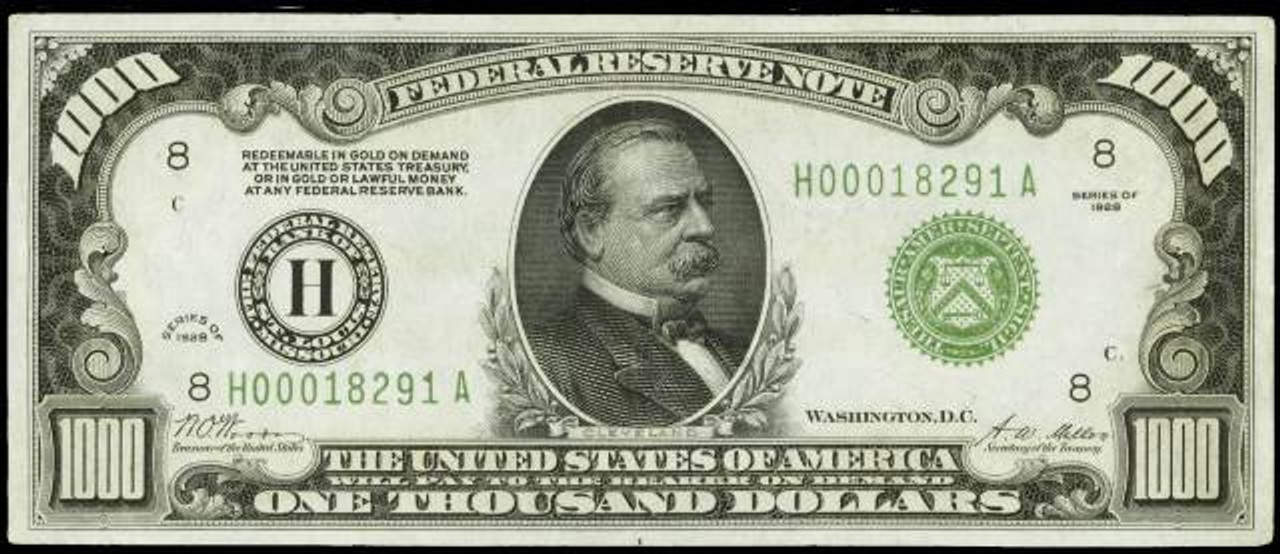

The government 'backing' of the dollar is a historical misnomer. Originally, the Federal Reserve notes represented a claim (a warehouse receipt) on a specific weight of gold. They were redeemable.

Here's a note from 1921:

Notice the text to the left of Cleveland?

Through a series of steps the government changed the convertibility ratio, and then eliminated the convertibility altogether (Nixon 'closing the gold window' in '71).

The dollar is now 'backed' by nothing. It's a piece of cloth, and the government can and will make as many as the politicians and bankers running the Federal Reserve system see fit. This is inimical to the interests of producers and savers, as their purchasing power is siphoned into any newly created currency, essentially taxing their purchasing power to confer it upon the new money.

Thus fiat currencies like the dollar continually lose value relative to hard assets.

This is what Bernanke was promising as policy response in 2002. Check the price of gold today and tell me he's wrong:

As I have mentioned, some observers have concluded that when the central bank's policy rate falls to zero--its practical minimum--monetary policy loses its ability to further stimulate aggregate demand and the economy. At a broad conceptual level, and in my view in practice as well, this conclusion is clearly mistaken. Indeed, under a fiat (that is, paper) money system, a government (in practice, the central bank in cooperation with other agencies) should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero.

The conclusion that deflation is always reversible under a fiat money system follows from basic economic reasoning. A little parable may prove useful: Today an ounce of gold sells for $300, more or less. Now suppose that a modern alchemist solves his subject's oldest problem by finding a way to produce unlimited amounts of new gold at essentially no cost. Moreover, his invention is widely publicized and scientifically verified, and he announces his intention to begin massive production of gold within days. What would happen to the price of gold? Presumably, the potentially unlimited supply of cheap gold would cause the market price of gold to plummet. Indeed, if the market for gold is to any degree efficient, the price of gold would collapse immediately after the announcement of the invention, before the alchemist had produced and marketed a single ounce of yellow metal.

What has this got to do with monetary policy? Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Of course, the U.S. government is not going to print money and distribute it willy-nilly (although as we will see later, there are practical policies that approximate this behavior).

I posit we entered the 'willy nilly' stage last summer.

What is 'fake' about it?It seems stupid to me. Seems like some computer programmer invented basically a form of fake money and a bunch of people joined in and decided they really wanted to get their hands on that fake money.

The protocol itself stipulates the limit.Why not? Once all the coins have been mined what's to stop them from just creating a billion more coins?

1 bitcoin is currently divisible to 8 decimal places, but that could be increased if necessary. There is no reason to inflate the currency pool once established. No net benefit is thereby confered.

You would have to convince the holders of the currency it was in their benefit to adopt a new protocol that would guarantee a reduction in the value of their existing monetary stock. Why would they?

It seems stupid to me. Seems like some computer programmer invented basically a form of fake money and a bunch of people joined in and decided they really wanted to get their hands on that fake money.

Dis u?

Dude is NOT liking his Tinder matches...

I’m also on the ADA train. It was bound to go up with how efficient and green it is. How high is anyone’s guess 🤷🏽♂️

They would have if they thought they could get suckers to pay enough.Except investment bankers have been getting into crypto. Hard to imagine them buying up all the pet rocks when they were popular.

Just to add, bitcoin is pretty much the same as a pet rock. If you can find a sucker to pay you $50,000 for your pet rock, then that pet rock is, in fact, worth $50,000 - to you. If the sucker can find someone to pay him $51,000, then it's worth $51,000. To him.They would have if they thought they could get suckers to pay enough.

Not too high to be honest. There is 31.9 billion circulating supply compared to BTC - 19mil, and ETH 11.9Mil. Even if it ran to catch BTC's market cap it would only be around $15 per coin. With that said, I do think it has the greatest growth potential, since both of the front runners have already had their exponential growth.I’m also on the ADA train. It was bound to go up with how efficient and green it is. How high is anyone’s guess 🤷🏽♂️

Yah I was hoping around $10ish but if you have thousands and it goes up $8, that’s a nice profit. Look at TEZOsNot too high to be honest. There is 31.9 billion circulating supply compared to BTC - 19mil, and ETH 11.9Mil. Even if it ran to catch BTC's market cap it would only be around $15 per coin. With that said, I do think it has the greatest growth potential, since both of the front runners have already had their exponential growth.

Investment bankers will trade anything liquid that goes up.Except investment bankers have been getting into crypto. Hard to imagine them buying up all the pet rocks when they were popular.

Looks like the robinhooders are cashing in their bitcoin and pumping meme stocks now.

Word!And they will with crypto. The 2nd largest economy in the world is spending resources on gathering crypto currency. The largest financial institutions in the world are working on developing their own blockchain technology as are other sectors.

While the world is taking cryptocurrency seriously, others are thumbing their noses at it. You guys have been doing this for years on this board back when Bitcoin was worth around 1K. Well now it’s worth roughly 50k.

I get that not everyone understands it and that’s fine. But don’t sit there and look for an “I told you so” after the past several years of gains. Because you still look very silly.

When a country builds a hydro plant to produce electricity to mine...

And China outsources a mining plant in Canada because it can produce electricity cheaper, it's serious.

Canada, Future Home of China’s Crypto Mining Operations

The problem with that is there's no benefit to society to using all that power to mine bitcoin. In my simpleton understanding of it, there's no economic value added by validating the blockchain with more and more miners. Some of that cheap electricity could otherwise be used to displace fossil fuels.Word!

When a country builds a hydro plant to produce electricity to mine...

And China outsources a mining plant in Canada because it can produce electricity cheaper, it's serious.

Canada, Future Home of China’s Crypto Mining Operations

Moved the majority of my positions into Cardano last night, time to ride the wave.

The problem with that is there's no benefit to society to using all that power to mine bitcoin. In my simpleton understanding of it, there's no economic value added by validating the blockchain with more and more miners. Some of that cheap electricity could otherwise be used to displace fossil fuels.

There are other crypto currencies that are cheaper to mine....Cardano....ahem

Blockchain technology is the future and will be part of our everyday lives much like the internet is.

When you purchase a home, all improvements and upkeep will be verified through blockchain. If you replaced the shingles on your roof, it will be validated through blockchain for any prospective buyers. When you buy a car, all maintenance and repairs will be validated through blockchain... so on and so forth. That’s how big it will be.

Sounds a lot like Big Brother.There are other crypto currencies that are cheaper to mine....Cardano....ahem

Blockchain technology is the future and will be part of our everyday lives much like the internet is.

When you purchase a home, all improvements and upkeep will be verified through blockchain. If you replaced the shingles on your roof, it will be validated through blockchain for any prospective buyers. When you buy a car, all maintenance and repairs will be validated through blockchain... so on and so forth. That’s how big it will be.

Sounds a lot like Big Brother.

Sounds like it’s harder for people to bullshit when selling things.

So far crypto is just a ponzi scheme. A lot of people down the line are going to be caught holding the bag.But these are short term, not long holds.

Stuff like Dogecoin is buoyed by people who've seen the news of Gamestop and Bitcoin get highly inflated and try to get rich quick. There's no get rich quick scheme where millions of people become wealthy with a commodity so readily available, it's never worked and made everyone live happily ever after. There will certainly be a good number of people who profit, but it will pale in comparison to the number of people left holding the bag.

Cardano is single handedly causing all other cryptos to drop.Cardano 🚀🚀🚀🚀🚀🚀📈📈📈📈 #HODL #ADA

I’ve been seeing this bull cycle wil get up to $3.50-$4.00 ❤️ I’m hoping to get $8-10 by 2022Cardano is single handedly causing all other cryptos to drop.

I don’t have much in it. Threw some in a couple months ago at 1.1. Almost doubled.I’ve been seeing this bull cycle wil get up to $3.50-$4.00 ❤️ I’m hoping to get $8-10 by 2022

Hold!!!!!!!!!More tanking...when’s the next moon landing?

Cardano actually has some tech behind it and is more than just fake money. I like it. Where is the best place to buy? What is everyone's long term projections? I see it's currently $2. $.05 would have been better but I think this might have some legs to get to $20 plus inside 5 years.

For perspective, a Telsa model 3 can drive 263 miles on a 50 KWh batteryI transferred all my crypto to Cardano (ADA) last night. Everything is blood red and Cardano is up by 13%.

Currency Kilowatt hour (KWh) consumed per transaction XRP 0.0079 Dogecoin 0.12 Cardano 0.5479 Litecoin 18.522 Bitcoin Cash 18.957 Ethereum 62.56 Bitcoin 707

According to google news the chinese are banning/restricting cryptocurrency, which is opposite to what this threads been suggesting

https://www.reuters.com/world/china/what-beijings-new-crackdown-means-crypto-china-2021-05-19/

https://www.reuters.com/world/china/what-beijings-new-crackdown-means-crypto-china-2021-05-19/

According to google news the chinese are banning/restricting cryptocurrency, which is opposite to what this threads been suggesting

https://www.reuters.com/world/china/what-beijings-new-crackdown-means-crypto-china-2021-05-19/

Care to take a guess at which country is mining the most cryptocurrency? I’ll give you a hint. It starts with a C and ends with hina.

China is trying to corner the market and make their crypto the default "reserve currency".Care to take a guess at which country is mining the most cryptocurrency? I’ll give you a hint. It starts with a C and ends with hina.

Who else bought more yesterday?

I bought more Tezos and ADA 🚀📈📈❤️

I bought more Tezos and ADA 🚀📈📈❤️

Similar threads

- Replies

- 15

- Views

- 470

- Replies

- 35

- Views

- 503

- Replies

- 32

- Views

- 684

- Replies

- 0

- Views

- 115

- Replies

- 49

- Views

- 8K

ADVERTISEMENT

Latest posts

-

-

-

-

-

Hawkeyes Host Fast-Rising 2025 Three-Star DB, Graceson Littleton

- Latest: Eliot Clough

ADVERTISEMENT