Hey it’s completely normal for members of the media to completely fabricate articles.

Nothing to see here!

Nothing to see here!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

He’s cashed in a little before. I believe he’s sold some calls for $2 million and letting the rest roll. He’s set no matter happen from here.Another reason why "Roaring Kitty" has earned the respect of his peers is that unlike so many traders who make a buck on a trade and move on, Gill has demonstrated true diamond hands, and not only that but he is now literally doubling down on the company that brought him stardom and riches by exercising his call options and buying even more shares.

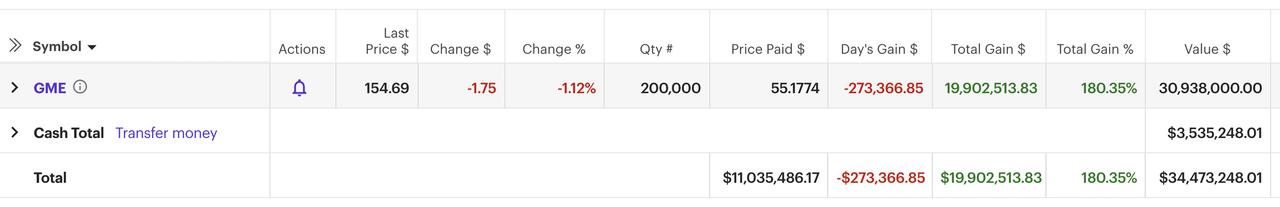

"Deep****ingValue" posted a screenshot of his portfolio showing that he has exercised 500 GameStop call options expiring Friday at a strike price of $12, giving him 50,000 more shares of a stock that closed at $154.69 on Friday, but will likely blast off on Monday once the Reddit animal spirits are reignited.

There's more: in addition to exercising his options, Gill also bought another 50,000 shares of the video-game retailer, doubling his holdings to 200,000 shares from 100,000 at the beginning of the month. His total investment in GameStop is now worth more than $30 million, giving him a profit of nearly $20 million. Bloomberg reached out to Gill’s mother, Elaine Gill at his childhood home in Massachusetts, who confirmed the Reddit screenshots were posted by her son.

Despite having earned the praise and admiration of most of his peers for executing what many have said has been the most astute short squeeze since Volkswagen, there were haters too and roughly around the time Gill was explaining to Maxine Waters how investing works, he was hit with a lawsuit that accused him of misrepresenting himself as an amateur investor. The suit alleged that he was actually a licensed securities professional who manipulated the market for profit, which he denied.

To be sure, it wasn't just Gill: some argue that the true mastermind behind the Gamestop squeeze was not Roaring Kitty at all but hedge fund Senvest which started buying GME shares all the way back in September - roughly around the time the post "The REAL Greatest Short Burn of the Century" appeared on Reddit and which made over $700 million on its GME position which has given it the top position in the HSBC hedge fund ranking for the third month in a row

Meanwhile, on Friday GameStop CEO George Sherman who is expected to leave, sold almost $12 million in shares. The company is looking for a new CEO as part of a shake-up spurred by activist investor and Chewy.com co-founder Ryan Cohen, Bloomberg notes.

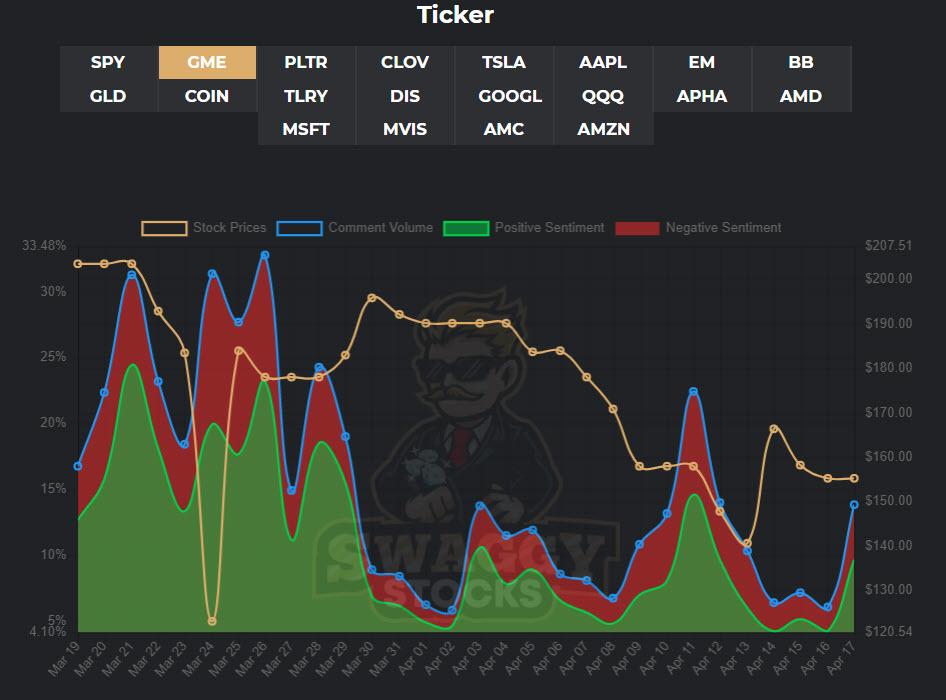

While shares of GameStop are up 721% YTD, though they are less than half of the peak level in January. However, now that Roaring Kitty has shown his Reddit peers that he is not only in it for the long run but doubling down, expect another squeeze on Monday as the latest generation of shorts which have entered the stock in recent weeks, is steamrolled, and as Reddit excitement in GME which had fizzled in recent weeks...

... explodes afresh.

And speaking of Chewy, we remind readers that the reason why the stock rose as high as the mid-$400s in February is not only the presence of Chewy founder Ryan Cohen, but that as the September Reddit write up noted, "if GME was trading at the same P/S multiple as $CHWY, the share price would be $420."

In short, GME may be about to double all over again.

Which begs another question: is the daytrading, gamma-squeeze mania that shook markets in late January, about to send GME - and the whole batch of most shorted names - soaring higher all over again?

Meanwhile, on Friday GameStop CEO George Sherman who is expected to leave, sold almost $12 million in shares.

https://www.bloomberg.com/news/arti...sells-12-million-of-stock-in-video-game-chainFabricated. Calls legitimacy of the entire article and the author into question.

Thanks for the clarification. What does the company do with the stock?The shares weren’t sold, they were turned back over to Gamestop due to shit performance and the value of the positions was ~$12M.

Again these articles are fiction.

Thanks for the clarification. What does the company do with the stock?

Ah was good on Friday. Hoping this is the week it ticks back up.

the Reddit drama over GME is enough to turn me off from trying to read to much over there anymore though. WSB people hate the GME people, the GME sub split into two, and some of those people are cultish.

I like the idea of the stock still- I think the company is setup with good people for a turnaround. I think the valuation comparison to Chewy is valid, once they transition.

I think there’s some short exposure still, but I don’t believe the squeeze is going to happen just because the game is rigged.

You mean the price isn't going to 10 million a share and all of retail aren't going to be able to name their price and sell at the peak?the GME sub split into two, and some of those people are cultish.

Ha, yeah. One thread in particular had me rolling my eyes. It was like “things to do after you become a millionaire”, followed by legitimate suggestions like getting a lawyer and not disclosing your positions and sales and stuff.You mean the price isn't going to 10 million a share and all of retail aren't going to be able to name their price and sell at the peak?

All the echo chamber, confirmation bias, everything is tied to GME sentiment is a bit much, although I do enjoy reading some of the tinfoil hat stuff over there.

Just looked today and COIN is at $299.28 as of this moment.As much as today was a good day, it really is just recovery from several bad days. If it can continue throughout the rest of the week, it might take off.

I tried to jump on COIN at open, I had a limit order in for $300 and it was at $400 by the time it showed on my screen. Oh well.

another IPO I’m watching is EBET.

I plan to get in but I heard someone on TV talking about it before it went live and he was saying based on all the factors he thought it should be about $240-250, so when it went crazy I stayed on the sidelines. It's coming back to reality and then will be a good place to buy and hold.Just looked today and COIN is at $299.28 as of this moment.

I want in on this but not sure of the right number to buy in at. It's been at a high of $429.54 and a low of $282.07 in just this short time. $300 might not be a bad spot to buy in at.

Probably - because I sold my WeBull position today because I finally got back to even. So figures it will take off now.GME opened at $150 and is up to $186 after hours!

Is the MOASS finally starting???

I don't trust COIN at all - staying away from it and DOGE.

They're related in that they are both sketch to me.You can’t even buy Dogecoin on COIN. They are about as related as saying you don’t trust Fidelity because penny stocks are terrible when you can’t even buy them on Fidelity.

A pretty small percentage of people are buying cryptocurrency but that number is growing. A lot of transaction fees.

I wouldn’t buy the stock in the 300s. Maybe in a few weeks if the excitement wears off and the price drops to a better entry level. If it doesn’t, oh well.

GameStop announced that the sale had been completed at an average price of $157/share. So these were real shares issued by the company but they weren’t dumped into the market all at once, they were massaged in over a few weeks to avoid hammering the price with a flood of supply.So what was the deal with the sale of GME shares the other day to raise capital? What was it 3.5m shares?

It wasn't a super high volume day by GEM standards, but it moved ~30-40 points? Is that correleated to the actual sale of 'real' shares and not recycled fake shit thats been shorted and re-traded over and over to manipulate the price?

It’s was a good day of holding. Sounds like GameStop is introducing a crypto (crypto dividend) and NFTs to create a digital resale market.

I assume margin is making some phone calls to some big players in the short space. Banks are nearly at the cap of the reverse repo market with the feds so liquidity is going to take a tumble.

All signs point to the moon for GME.