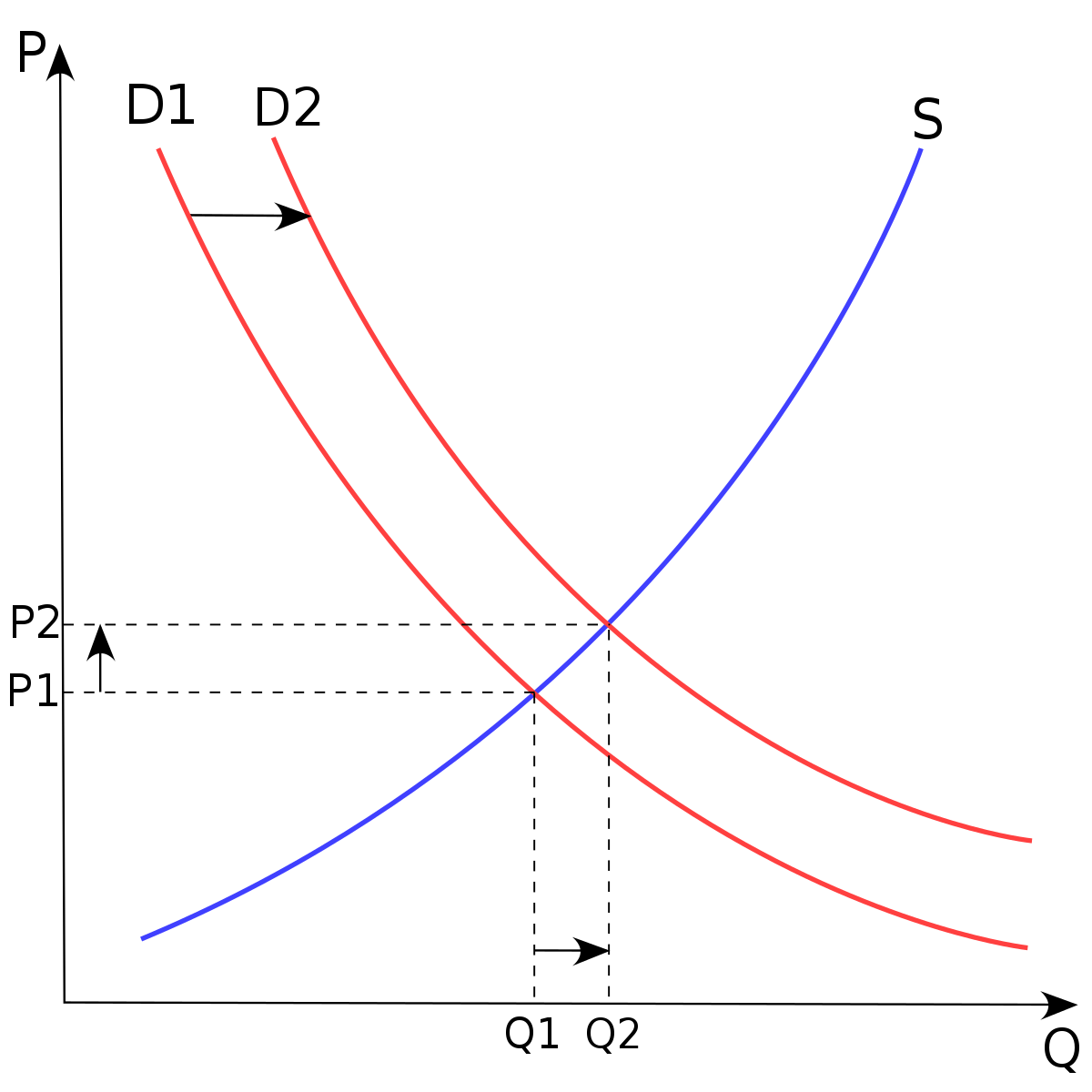

Remember that inflation is a hidden tax. It is a powerful (and often unseen and unstoppable) way for a government to pay for its goods and services without raising visible taxes that make people angry.

Warren Buffett is widely regarded as the best long-term investor in America. He clearly has moved from concerns about unemployment to concerns about inflation.

"We are seeing substantial inflation," Buffett said at the annual meeting of Berkshire Hathaway. "We are raising prices. People are raising prices to us, and it's being accepted."

Buffett’s private sector experience is reinforced by former Secretary of the Treasury and Ph.D in economics Larry Summers (Obama's Director of National Economic Council, former President of Harvard), who warned during a forum that inflation indicators were "flashing red alarm" and that "all the signs are for inflation starting to break out.

"We were providing demand well in excess over the next couple of years of any plausible estimate of the economy’s potential to produce, and that meant substantial price increases," Summers said.

Warren Buffett is widely regarded as the best long-term investor in America. He clearly has moved from concerns about unemployment to concerns about inflation.

"We are seeing substantial inflation," Buffett said at the annual meeting of Berkshire Hathaway. "We are raising prices. People are raising prices to us, and it's being accepted."

Buffett’s private sector experience is reinforced by former Secretary of the Treasury and Ph.D in economics Larry Summers (Obama's Director of National Economic Council, former President of Harvard), who warned during a forum that inflation indicators were "flashing red alarm" and that "all the signs are for inflation starting to break out.

"We were providing demand well in excess over the next couple of years of any plausible estimate of the economy’s potential to produce, and that meant substantial price increases," Summers said.