Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

House approves bill to take aim at gasoline ‘price gouging’

- Thread starter THE_DEVIL

- Start date

Any insight as to what the determining factor is for “excessive” or "exploitative manner" price hikes? Are they suggesting price fixing a global commodity?

Blame Big Oil for a Lot—But Not for Price Gouging at the Pump

https://www.motherjones.com/politics/2022/03/gas-prices-oil-industry-crude-biden-russia-covid/

The Democrats’ argument goes like this: Crude oil is the raw material that gets refined into gasoline. When crude prices rise, it makes sense for gas prices to rise in proportion. But when crude falls, the oil industry juices its profits by keeping gas prices high, pocketing a windfall at the pump.

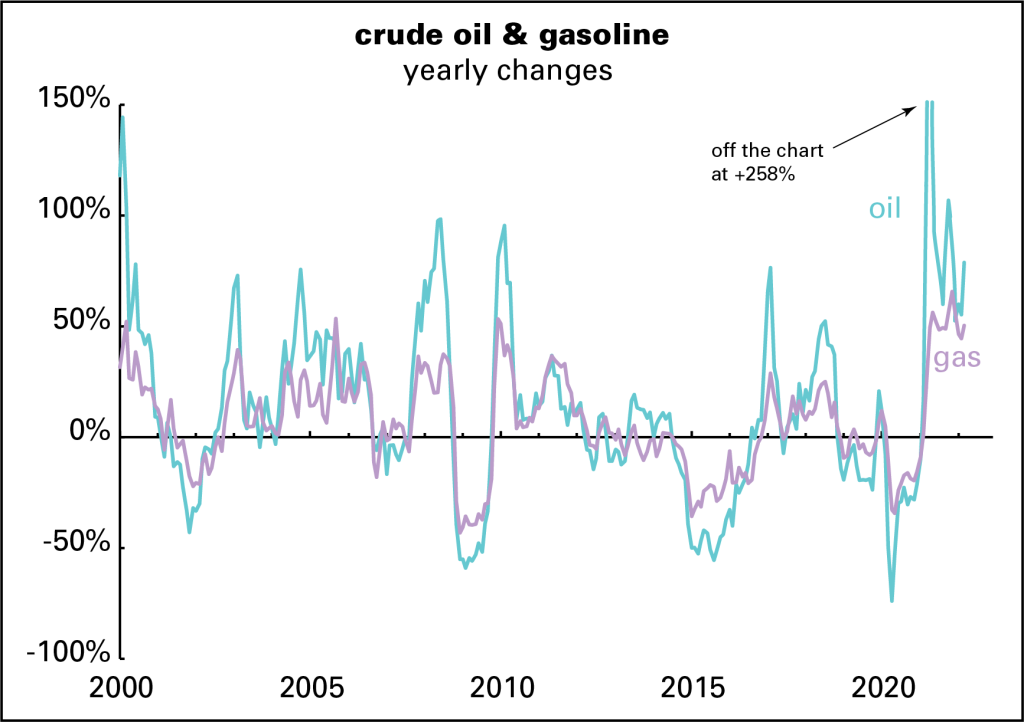

But these politicians have it wrong, too. As socialist economics commentator Doug Henwood showed recently, there’s no historical evidence that the oil industry artificially jacks up gas prices when crude prices fall. According to data stretching all the way back to 2000, Henwood finds, for every 10 percent change in the price of oil over the course of a year, the price of gas moves by just 4.5 percent. The relationship holds in both directions. So when the price of crude oil plunges, don’t expect the price of gas to fall by as much. Henwood adds that it “holds if you take the analysis back to 1975 instead of beginning in 2000.” Here’s his chart—note that gasoline prices fluctuate in tune with those of crude, but within a tighter range:

As for the lag—crude prices dropped last week, while gas prices stayed at heightened levels—that’s normal, says Jamie Webster, partner and associate director of Boston Consulting Group’s Center for Energy Impact. Like many industries, retail gasoline operates on what’s known in business-analysis circles as a “rockets and feathers” pricing model. Prices tend to shoot up fast when input costs rise or demand jumps, but float down slowly in response to the opposite conditions.

Price controls didn't work in the 70's, and they won't work now. Another misguided attempt at fixing what they broke.

0/10Ok we will just stop. Take over old joe.

Bull fvcking shit. You’re a fvcking moron if you believe that.No such thing as price gouging.

Bull fvcking shit. You’re a fvcking moron if you believe that.

The word you're looking for is "collusion" and there are already laws against that.

No, it’s not.The word you're looking for is "collusion" and there are already laws against that.

Bull fvcking shit. You’re a fvcking moron if you believe that.

And you’re a ****ing idiot if you don’t. Mark you down as another blowhard dumb **** on this board with zero economic intelligence.

Gas prices are remarkably consistent right now. $4.47 or $4.49 virtually everywhere in Central Florida.

If that's not price collusion, then I don't know what to tell you.

If that's not price collusion, then I don't know what to tell you.

So they’re in lock step whether prices are high or low.Gas prices are remarkably consistent right now. $4.47 or $4.49 virtually everywhere in Central Florida.

If that's not price collusion, then I don't know what to tell you.

Lol, kAnd you’re a ****ing idiot if you don’t. Mark you down as another blowhard dumb **** on this board with zero economic intelligence.

Republicans are working very hard to make sure the country fails. Constantly voting against cheaper everything. Their voters be like, “Cool.”

Gas is 4.29 on Hwy 90 inside the west loop of capital circle. 4.59 where Buck Lake Rd hits Hwy 90 going out the east side of the loop.Gas prices are remarkably consistent right now. $4.47 or $4.49 virtually everywhere in Central Florida.

Zooming in on a gas buddy map I see it vary as usual - largely with the property value where it’s located.

Gas is 4.29 on Hwy 90 inside the west loop of capital circle. 4.59 where Buck Lake Rd hits Hwy 90 going out the east side of the loop.

Zooming in on a gas buddy map I see it vary as usual - largely with the property value where it’s located.

Tallahassee is not in Central Florida.

"The price-gouging at the pump stuff, the more general price-gouging stuff, is to economic science what President Trump’s remarks about disinfectant-in-your-veins was to medical science". - Larry Summers

Treasury Secretary under Bill Clinton

Treasury Secretary under Bill Clinton

Last edited:

You’re right about that, but not the gas prices.Tallahassee is not in Central Florida.

The gas buddy map for Orlando shows prices ranging from 3.99 to 4.49.

Zoom in until you see prices:

https://www.gasbuddy.com/gaspricemap?lat=28.55884441566047&lng=-81.34352961782517&z=10

Is it really collusion if gas retailers set their retail price to match area competitors? Because that is pretty much how it has always been doneGas prices are remarkably consistent right now. $4.47 or $4.49 virtually everywhere in Central Florida.

If that's not price collusion, then I don't know what to tell you.

I’m not an economist, just a poor lowly paramedic. Help me out here. Who is making more money with higher gas prices? The oil is being pumped out of the ground in the same way as always. Are they making more money? The refiners are using the same plants to make the same gas. Are they making more money? The gas stations are selling the same gas for a lot more. You get the picture.

Someone somewhere is making a bunch more money in a process that has no real apparent need for increased prices, except the raw product.

Someone somewhere is making a bunch more money in a process that has no real apparent need for increased prices, except the raw product.

It’s not the gas stations. I have been told they typically make around the same amount per gallon regardless of retailI’m not an economist, just a poor lowly paramedic. Help me out here. Who is making more money with higher gas prices? The oil is being pumped out of the ground in the same way as always. Are they making more money? The refiners are using the same plants to make the same gas. Are they making more money? The gas stations are selling the same gas for a lot more. You get the picture.

Someone somewhere is making a bunch more money in a process that has no real apparent need for increased prices, except the raw product.

if anything it probably hurts the gas stations as the high prices at pump leaves less money to spend on items inside that they make money on

The most compelling explanation I've heard is that demand on the global market is extremely high, which is what is driving up the gas prices. Since Russian oil is not available that has, of course, driven the price of oil up. Saudi Arabia and OPEC have zero interest in increasing production to try and offset that and they really enjoy these sky high prices.

Since the US opened up domestic oil to the world, our oil companies are in the same boat and want to make as much money as possible so they sell it at the international price, even though demand in the US does not justify $100/barrell. Basically, if we still limited selling domestic oil to the US, gas prices would not be this high. This was off a show on the radio so I don't know if the claim about demand is accurate, but it could explain why the last time this happened was prior to the regulation being enacted and now that the regulation was removed it has happened again.

Of course, it isn't so simple as to just say, "Keep all the oil here" because of the situation in Ukraine. If the US says no to exporting oil, that pretty much leaves Europe to go back to Russian oil. They have no choice.

It would be nice to exert some pressure on the Saudi's though. I guess we think we need those bases in Saudi Arabia are more important than the Saudi's need for us to protect them. I don't know much about the politics of the situation but I'm sure it's slimey.

Since the US opened up domestic oil to the world, our oil companies are in the same boat and want to make as much money as possible so they sell it at the international price, even though demand in the US does not justify $100/barrell. Basically, if we still limited selling domestic oil to the US, gas prices would not be this high. This was off a show on the radio so I don't know if the claim about demand is accurate, but it could explain why the last time this happened was prior to the regulation being enacted and now that the regulation was removed it has happened again.

Of course, it isn't so simple as to just say, "Keep all the oil here" because of the situation in Ukraine. If the US says no to exporting oil, that pretty much leaves Europe to go back to Russian oil. They have no choice.

It would be nice to exert some pressure on the Saudi's though. I guess we think we need those bases in Saudi Arabia are more important than the Saudi's need for us to protect them. I don't know much about the politics of the situation but I'm sure it's slimey.

I think we need to let the Saudis know future weapons shipments may be caught up in paperwork.The most compelling explanation I've heard is that demand on the global market is extremely high, which is what is driving up the gas prices. Since Russian oil is not available that has, of course, driven the price of oil up. Saudi Arabia and OPEC have zero interest in increasing production to try and offset that and they really enjoy these sky high prices.

Since the US opened up domestic oil to the world, our oil companies are in the same boat and want to make as much money as possible so they sell it at the international price, even though demand in the US does not justify $100/barrell. Basically, if we still limited selling domestic oil to the US, gas prices would not be this high. This was off a show on the radio so I don't know if the claim about demand is accurate, but it could explain why the last time this happened was prior to the regulation being enacted and now that the regulation was removed it has happened again.

Of course, it isn't so simple as to just say, "Keep all the oil here" because of the situation in Ukraine. If the US says no to exporting oil, that pretty much leaves Europe to go back to Russian oil. They have no choice.

It would be nice to exert some pressure on the Saudi's though. I guess we think we need those bases in Saudi Arabia are more important than the Saudi's need for us to protect them. I don't know much about the politics of the situation but I'm sure it's slimey.

Pure gold here.Republicans are working very hard to make sure the country fails. Constantly voting against cheaper everything. Their voters be like, “Cool.”

Thanks.

Lol completely ignorant to supply/demand mechanics. It’s sad we have so many unqualified people in position to make these decisions.

We are smart enough to understand the effects of democrat policies like this oneRepublicans are working very hard to make sure the country fails. Constantly voting against cheaper everything. Their voters be like, “Cool.”

fifyGas prices are remarkably consistent right now. $4.47 or $4.49 virtually everywhere in Central Florida.

If that's notprice collusion,a perfect illustration of transparent competition, then I don't know what to tell you.

We need to do something. I'm tired of their BS.I think we need to let the Saudis know future weapons shipments may be caught up in paperwork.

the energy traders & speculators are pushing prices higher than fundamentals.

https://www.theguardian.com/environment/2022/apr/28/gas-prices-why-are-they-so-high-traders

https://www.theguardian.com/environment/2022/apr/28/gas-prices-why-are-they-so-high-traders

Bull fvcking shit. You’re a fvcking moron if you believe that.

Please define it.

I don't know what a free market and price discovery look like.

FIFY.

Someone somewhere is making a bunch more money in a process that has no real apparent need for increased prices, except the raw product.

Other than that, Mrs. Lincoln, how’d you like the play?

@noleclone2 here’s some more of that pesky Russki propaganda!Oil exports from Russia into the global market have not been slowed by either the war or sanctions. Instead, they’re rising and are expected to end April higher than at any time since before the Covid pandemic, according to research firm Kpler.

Everyone is getting in on it!

This is seriously basic economics. It blows my mind how many people have been programmed to think it’s solely the businesses’ causing the issues and not the idiotic policies our elected leaders have put in place over the years.Not directed at anyone in particular, but please don’t be stupid enough to think the big bad businesses are all out to get us.

Artificially dicking with supply and demand will just lead to shortages. Those are much worse.

If Elizabeth Warren thinks it’s a good idea, it’s a very bad idea.This is seriously basic economics. It blows my mind how many people have been programmed to think it’s solely the businesses’ causing the issues and not the idiotic policies our elected leaders have put in place over the years.

What policy?We are smart enough to understand the effects of democrat policies like this one

Similar threads

- Replies

- 14

- Views

- 178

- Replies

- 17

- Views

- 275

- Replies

- 28

- Views

- 600

ADVERTISEMENT

ADVERTISEMENT