Yep. I think people forget the Fed isn't meeting until Sept. Which means they will have this data from July and then August data to digest. Very positive news lately but need to keep it up. Fed should increase interest rates but it's just a matter of how much imo.Market forecasts for the fed have almost been as volatile as the markets themselves this year. Lots of data will come out between now and and the next meeting. If we continue to see a downward trend, .50 bps would probably be ok. This, imo, will be the trickiest stretch for the fed.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation going down…..maybe?

- Thread starter BrunoMars420

- Start date

Is that a live look at you?

‘Political hacks just can’t resist.

Another thing to keep in mind is that this is the fourth straight month that Core CPI went down. That is a good sign as well. Like I have said in the past, I suspect we will see a general trend of a slow decline over the rest of the year. Don't expect huge decreases though. It will take some time.

Except it's difficult to discern which end is the head and which end is the ass?Is that a live look at you?

Good discussion. I'm not sure the Fed is primary. It's a major piece, but energy prices, labor supply, supply chain issues, fiscal policy, and other supply side concerns outweigh the Fed in aggregate, imo. Some may even outweigh the Fed individually, although Fed policy may also impact these. Non-interest setting monetary policy is also pretty important, imo.I was mostly being facetious. But for normal fed forecast movement, it has been all over the place. Just 3 days ago, after the employment number on Friday, it was at a 67% chance for a .75 bps hike. And he’s f course we need to see a few more months, heck, the rest of the year needs to see more of this. That is why I said continue to see a downward trend.

And the fed, while not the only moving part, is most definitely the primary catalyst. Has been all year.

Thanks for an actual discussion minus the politics and bickering.

You are ahead of me in that prediction, but you have good reason for it. I'm still holding out for a little more data.Another thing to keep in mind is that this is the fourth straight month that Core CPI went down. That is a good sign as well. Like I have said in the past, I suspect we will see a general trend of a slow decline over the rest of the year. Don't expect huge decreases though. It will take some time.

Yikes, looks like the algorithm already rotted your brain. #godspeed PepsiYou and CNN

Also the summer travel season is ending which will help slowly bring down prices in certain sectors of the economy.Good discussion. I'm not sure the Fed is primary. It's a major piece, but energy prices, labor supply, supply chain issues, fiscal policy, and other supply side concerns outweigh the Fed in aggregate, imo. Some may even outweigh the Fed individually, although Fed policy may also impact these. Non-interest setting monetary policy is also pretty important, imo.

Thanks for an actual discussion minus the politics and bickering.

Um, no. Dem spending and Biden energy policy has been a major driver of inflation.Oddly enough, just like inflation going up, Biden has little to nothing to do with this.

What are you looking at - gas or something else? I can see it might shift consumption patterns, but I'm struggling to think of where it might affect demand outside of gasoline and possibly jet fuel.Also the summer travel season is ending which will help slowly bring down prices in certain sectors of the economy.

Still sticking with energy policy huh? What energy policy did Biden change recently to make prices go down?Um, no. Dem spending and Biden energy policy has been a major driver of inflation.

Hotels and airfare I would assume go downWhat are you looking at - gas or something else? I can see it might shift consumption patterns, but I'm struggling to think of where it might affect demand outside of gasoline and possibly jet fuel.

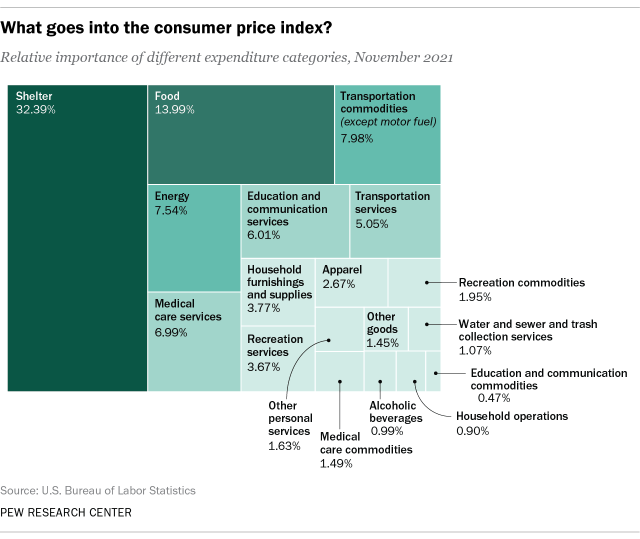

Hotels are less than 1% weight in CPI, iirc, and airfare is part of transportation services. One of the big headwinds we are facing is shelter costs, because those are delayed entries in many cases (around 6 months for some parts, I think). Here's a chart that provides some breakdown of how CPI-U is calculated.Hotels and airfare I would assume go down

Last edited:

Good discussion. I'm not sure the Fed is primary. It's a major piece, but energy prices, labor supply, supply chain issues, fiscal policy, and other supply side concerns outweigh the Fed in aggregate, imo. Some may even outweigh the Fed individually, although Fed policy may also impact these. Non-interest setting monetary policy is also pretty important, imo.

Thanks for an actual discussion minus the politics and bickering.

My pleasure. I love talking this stuff, but hate the political discourse and bickering that normally ensues. And yes, I realize politics does play some roll in it. I just believe it is much smaller than most apparently do.

I can probably agree that as an aggregate, those outweigh the fed, I just happen to be one that believe the fed and their loose policy for far too long has amplified all of those issues. We can go back and play coulda, shoulda woulda all we want but I said it as early as last April/May last year that the fed better start backing off their asset purchasing by the end of last summer. Which brings me to your next point and one I wholeheartedly agree with. I have never really had a problem with their interest rate portion of their monetary policy. It has always been about the quantitative easing imo. You simply cannot inject the amount of cash the fed has done in the last 2 years and not expect this kind of inflation. My hope is that sooner rather than later, the fed can get to a more neutral rate policy so they can focus on unwinding the balance sheet.

Um, no. Dem spending and Biden energy policy has been a major driver of inflation.

To be fair, I did include "little" in my post.

I have been steadfast in my blame all along that Biden and Trump each get about 5-10% of the blame while the federal reserve gets the rest. Inflation started well before the gas prices shot up. That is a fact.

We agree wholeheartedly about QE being a bigger issue. I think the MBS purchases played a substantial role in driving housing prices up, which is a large chunk of what we're seeing. It will just take quite a while for that to unwind, imo.My pleasure. I love talking this stuff, but hate the political discourse and bickering that normally ensues. And yes, I realize politics does play some roll in it. I just believe it is much smaller than most apparently do.

I can probably agree that as an aggregate, those outweigh the fed, I just happen to be one that believe the fed and their loose policy for far too long has amplified all of those issues. We can go back and play coulda, shoulda woulda all we want but I said it as early as last April/May last year that the fed better start backing off their asset purchasing by the end of last summer. Which brings me to your next point and one I wholeheartedly agree with. I have never really had a problem with their interest rate portion of their monetary policy. It has always been about the quantitative easing imo. You simply cannot inject the amount of cash the fed has done in the last 2 years and not expect this kind of inflation. My hope is that sooner rather than later, the fed can get to a more neutral rate policy so they can focus on unwinding the balance sheet.

I also think the pandemic itself had A LOT to do with inflation. You can't have major supply chain issues and shortages and not expect some inflation. That, coupled with delayed demand and there you go along with the Fed issues you mentioned.To be fair, I did include "little" in my post.

I have been steadfast in my blame all along that Biden and Trump each get about 5-10% of the blame while the federal reserve gets the rest. Inflation started well before the gas prices shot up. That is a fact.

I mean classic supply and demand laws here. Supply goes down and demand goes up.

Anxiously awaiting the mental gymnastics on the response to this post...Still sticking with energy policy huh? What energy policy did Biden change recently to make prices go down?

2 weeks

2 weeksTook time to get here, it will take time to get it back to normal

Another positive sign actually came out yesterday prior to the CPI report.

- Online retail prices fell 1% year-over-year in July, snapping nearly two years of persistent increases. The shift is even more pronounced on a month-over-month basis, in which online prices dropped by 2% in July.

We agree wholeheartedly about QE being a bigger issue. I think the MBS purchases played a substantial role in driving housing prices up, which is a large chunk of what we're seeing. It will just take quite a while for that to unwind, imo.

Precisely. I cannot agree more with this comment. I was just about to post your chart a couple posts up about shelter and it's impact on inflation. If you understand the money multiplier effect and what the federal reserve was doing with the mortgage backed securities, it really is a no brainer that the inflated real estate market is probably the biggest culprit of this inflation we are seeing.

I posted this in another thread a couple weeks ago, but take this into consideration. A couple wants to sell their house. They think they can get 400k for the home. They find out they can likely list and get 450 for it. They end in a bidding war due to excessive demand and get 500k for it. Where do most put that extra 100k? Sure, some are going to save some, invest, etc... but a good chunk of that money gets spent and driven right back into the economy. Multiply that by millions of home being sold throughout the country and voila.

This is actually what makes me the most optimistic though. We are seeing a slowdown in the real estate markets which bodes well for the inflation numbers moving forward. We have a long way to go though.

Yep and quite simply, housing prices could not continue to go up by 10% + on an annual basis. It's just not sustainable. A slowdown in this sector is good for the economy overall.Precisely. I cannot agree more with this comment. I was just about to post your chart a couple posts up about shelter and it's impact on inflation. If you understand the money multiplier effect and what the federal reserve was doing with the mortgage backed securities, it really is a no brainer that the inflated real estate market is probably the biggest culprit of this inflation we are seeing.

I posted this in another thread a couple weeks ago, but take this into consideration. A couple wants to sell their house. They think they can get 400k for the home. They find out they can likely list and get 450 for it. They end in a bidding war due to excessive demand and get 500k for it. Where do most put that extra 100k? Sure, some are going to save some, invest, etc... but a good chunk of that money gets spent and driven right back into the economy. Multiply that by millions of home being sold throughout the country and voila.

This is actually what makes me the most optimistic though. We are seeing a slowdown in the real estate markets which bodes well for the inflation numbers moving forward. We have a long way to go though.

Stock market and Crypto still bouncing against resistance. The charts I saw said the absolute top before breaking resistance would be 4300 for the S&P. 24,000 for bitcoin. There has been a jump up, but not breaking any of these thresholds to be able to go higher. Basically stating this is bear market rally. The only thing is this would have been the longest bear market rally that I am aware of. Not many things matching up right now.

LMAO @ the Fed has the tools to slow this train down.Jeeeebus Bruno! What do you expect? It took time to get here, too! 15 years or so...A couple of tax cuts, a couple of “quantitative easings” won’t be overcome overnight. Life and economies just don’t work that way. The Fed has the tools to slow this train down...do “we” have the patience? But, this news is good news for most Americans.

Technically true. And Jeffrey Dahmer had the tools to slow down the killing train in Milwaukee.

In prior inflationary times the Fed was able to have more of a role and effect. This time around has seen unprecedented government spending, along with energy issues that are only rivaled by the late 70's.Good discussion. I'm not sure the Fed is primary. It's a major piece, but energy prices, labor supply, supply chain issues, fiscal policy, and other supply side concerns outweigh the Fed in aggregate, imo. Some may even outweigh the Fed individually, although Fed policy may also impact these. Non-interest setting monetary policy is also pretty important, imo.

Thanks for an actual discussion minus the politics and bickering.

In summary, I agree with you.

I had this 4200 area for the S&P as significant resistance. I have unloaded some longs,Stock market and Crypto still bouncing against resistance. The charts I saw said the absolute top before breaking resistance would be 4300 for the S&P. 24,000 for bitcoin. There has been a jump up, but not breaking any of these thresholds to be able to go higher. Basically stating this is bear market rally. The only thing is this would have been the longest bear market rally that I am aware of. Not many things matching up right now.

just in case.

I am torn. I have trading friends that are darn bearish and a couple that are still friendly to the market.

Bitcoin: my wife trades that a little. She has done decently with it. Not perfect by any means. I stay away from it.

LOL. Nothing really public at least. Sometimes, letting other people do their jobs is doing something. Trump would have had a few successes if he understood how to do that.Oddly enough, just like inflation going up, Biden has little to nothing to do with this.

Ppi dropped .5% in July. Very good news on inflation. Should see a nice little rally today.

US inflation rises more than expected in September

Efforts to tame inflation in the US have pushed up the dollar and global borrowing costs.

www.bbc.com

Consumer prices in the US rose more than expected last month in a sign that the inflation fight in the world's largest economy is far from over.

Inflation, the rate at which prices rise, was 8.2% in the 12 months to September, down from 8.3% in August.

Despite the fall, the figure was still higher than forecast.

Inflation in the US is being closely watched as the US central bank's efforts to tame the problem push up the dollar and global borrowing costs.

The rate is well above the central bank's 2% target and means the Federal Reserve is likely to continue to keep raising interest rates in an attempt to cool rising prices.

"The Fed needs to react at the next meeting and continue to keep policy tight until there is some sign that inflation is under control," said Neil Birrell, chief investment officer at Premier Miton Investors.

"This print raises the level of uncertainty and is bad news for the economy overall, but for consumers in particular. The peak in interest rates will, in all probability, be higher now. It's difficult to find any positives in this for the economy or markets."

ARK is up 58% since late June. Nasdaq is up 20% off lows in June.

If this is a dead cat bounce that cat has hops.

- Sep 13, 2002

- 93,934

- 189,843

- 113

Interesting outcome today, that can be spun by either doom-casters or sunshine-shovers.

US inflation rises more than expected in September

Efforts to tame inflation in the US have pushed up the dollar and global borrowing costs.www.bbc.com

Consumer prices in the US rose more than expected last month in a sign that the inflation fight in the world's largest economy is far from over.

Inflation, the rate at which prices rise, was 8.2% in the 12 months to September, down from 8.3% in August.

Despite the fall, the figure was still higher than forecast.

Inflation in the US is being closely watched as the US central bank's efforts to tame the problem push up the dollar and global borrowing costs.

The rate is well above the central bank's 2% target and means the Federal Reserve is likely to continue to keep raising interest rates in an attempt to cool rising prices.

"The Fed needs to react at the next meeting and continue to keep policy tight until there is some sign that inflation is under control," said Neil Birrell, chief investment officer at Premier Miton Investors.

"This print raises the level of uncertainty and is bad news for the economy overall, but for consumers in particular. The peak in interest rates will, in all probability, be higher now. It's difficult to find any positives in this for the economy or markets."

On the one hand, at least the continued upward trajectory has been stopped, and indeed, very slightly reversed.

On the other, it was still worse than expected and shows that the "fixes" to date have not done much to reverse the trend.

Trajectory remains, rate has changed.Interesting outcome today, that can be spun by either doom-casters or sunshine-shovers.

On the one hand, at least the continued upward trajectory has been stopped, and indeed, very slightly reversed.

On the other, it was still worse than expected and shows that the "fixes" to date have not done much to reverse the trend.

If you were going down the road at 83 mph and now you're going 82 mph you didn't stop, and you haven't reversed.

edited to add: Fed thinks we should be going 20 mph...

Similar threads

- Replies

- 7

- Views

- 177

- Replies

- 2

- Views

- 62

- Replies

- 3

- Views

- 96

- Replies

- 7

- Views

- 235

ADVERTISEMENT

Latest posts

-

-

Hawkeyes Host Fast-Rising 2025 Three-Star DB, Graceson Littleton

- Latest: Eliot Clough

-

-

-

ADVERTISEMENT