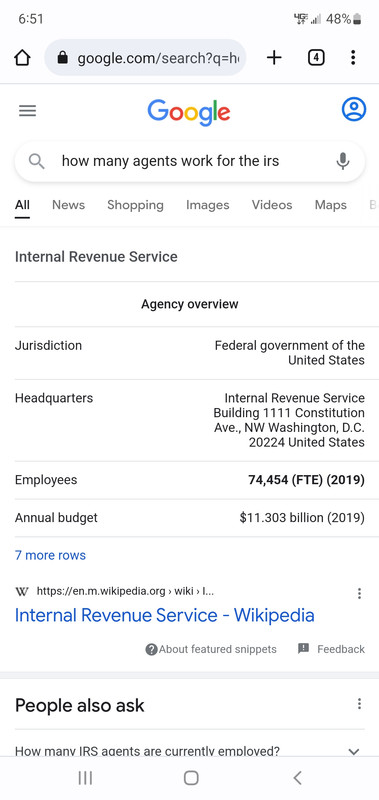

I consider myself a conservative and I am completely in favor of enforcement of our tax law. With that said, I wish they would simplify the tax codes so that less enforcement was needed.

When it comes to individual returns, eliminate all deductions except for the standard deduction, and eliminate all tax credits. Allow the standard deduction for each dependent (i.e. a family of 4 gets the standard deduction x4). All income (i.e. W2, 1099R, interest, cap gains, dividends, etc) should be taxed at either a flat tax or progressive tax (I don't really care which one) should be taxed at the same rate.

When it comes to businesses and corporations, I have no idea how to simplify.