Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Seems legit

- Thread starter Howard Roarkes Ghost

- Start date

Do you think the tens of thousands of new IRS agents will be coving the white areas of the map more thoroughly?

It probably takes 1 audit per county in those less populated areas to up the numbers there...

It's per 1,000 filings....so no.It probably takes 1 audit per county in those less populated areas to up the numbers there...

It's per 1,000 filings....so no.

...and if you have an area with "just" 200 tax filings and 1 audit, it becomes "5 per 1000"

So, if they were to target ONE return per county, that'd inflate the low-population areas quite a lot. It can be a misleading statistic in poorly populated areas where people don't file many returns.

True...and if you have an area with "just" 200 tax filings and 1 audit, it becomes "5 per 1000"

So, if they were to target ONE return per county, that'd inflate the low-population areas quite a lot. It can be a misleading statistic in poorly populated areas where people don't file many returns.

That was the point I was making - I understand how the rate-per-1000 SHOULD eliminate that bias, but may not.True

You would eliminate that bias by excluding areas that have <2000 or <5000 returns and running sub-analysis on the remaining data. Then looking separately at the low-population/low-return regions.

When you do not account for that, you're going to skew your results, badly for the low-population areas.

Kind of weird no Iowa counties pop up though.....we have some low population ones.That was the point I was making - I understand how the rate-per-1000 SHOULD eliminate that bias, but may not.

You would eliminate that bias by excluding areas that have <2000 or <5000 returns and running sub-analysis on the remaining data. Then looking separately at the low-population/low-return regions.

When you do not account for that, you're going to skew your results, badly for the low-population areas.

Almost seems like some regional offices are getting after it and some aren't...

Y'all really need to get a grip on this "87,000 agents" thing. There ain't gonna be 87,000 new agents. Most of the hiring will probably be for jobs that have nothing to do with audits. This money will go towards continuing operations because the IRS fails at modernization over and over. Some would say it's a good thing though because it is less likely to get hacked not having all that data in the cloud.

federalnewsnetwork.com

federalnewsnetwork.com

IRS plans ‘significant hiring’ to stay ahead of 52K employees expected to leave in coming years

While President Joe Biden has proposed increased IRS spending by $80 billion over the next 10 years, the long-term nature of workforce planning and IT modernization requires a commitment to steady budget increases.

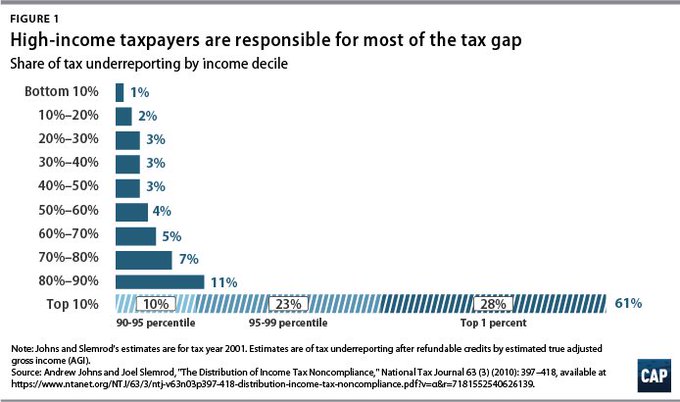

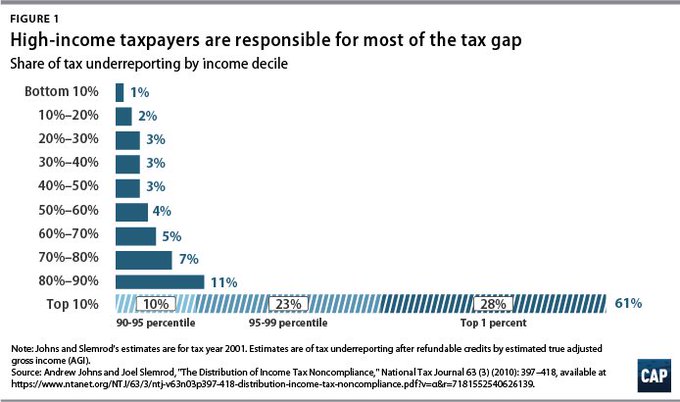

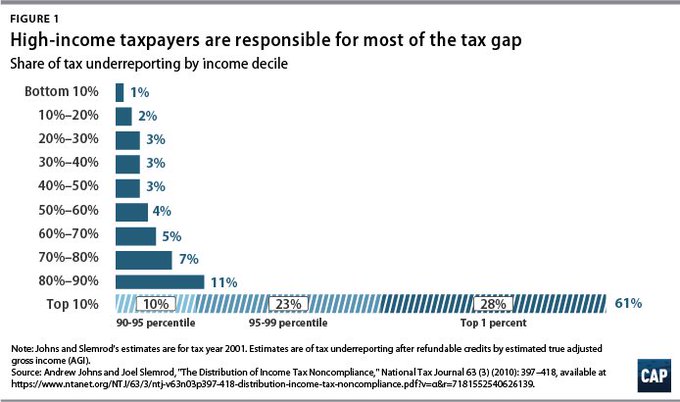

...and who's under-reporting the most?

The highest earners.

For reference:

80th Percentile = $141k/yr

90th Percentile = $201k/yr

(11% of under-reported income between these reported levels)

95th Percentile = $274k/yr

(10% of under-reported income for those earners at $200-274k)

99th Percentile = $504k/yr

(23% of under-reported income for those earning $274-504k)

Nearly ONE THIRD of under-reported income is from those >$504k/yr

For reference:

If you make 100k, you're in the 67th percentile

So, let's not get too freaked out about "audit rates" and recognize who the folks are that are cheating on income taxes. They're making 10x more than you are, most likely, and do not "live like you" at all. You pay WAY more tax than they do when we're referring to "tax rates", AINEC.

dqydj.com

dqydj.com

The highest earners.

For reference:

80th Percentile = $141k/yr

90th Percentile = $201k/yr

(11% of under-reported income between these reported levels)

95th Percentile = $274k/yr

(10% of under-reported income for those earners at $200-274k)

99th Percentile = $504k/yr

(23% of under-reported income for those earning $274-504k)

Nearly ONE THIRD of under-reported income is from those >$504k/yr

For reference:

If you make 100k, you're in the 67th percentile

So, let's not get too freaked out about "audit rates" and recognize who the folks are that are cheating on income taxes. They're making 10x more than you are, most likely, and do not "live like you" at all. You pay WAY more tax than they do when we're referring to "tax rates", AINEC.

Household Income Percentile Calculator, US - DQYDJ

Check your household income percentile vs. 2023's United States income distribution in this calculator. How does it rank: top 1%, median, or other?

dqydj.com

dqydj.com

I'm sure that's who the IRS will be going after. Rev. Al's place is their first stop as soon as they're sworn in....and who's under-reporting the most?

The highest earners.

For reference:

80th Percentile = $141k/yr

90th Percentile = $201k/yr

(11% of under-reported income between these reported levels)

95th Percentile = $274k/yr

(10% of under-reported income for those earners at $200-274k)

99th Percentile = $504k/yr

(23% of under-reported income for those earning $274-504k)

Nearly ONE THIRD of under-reported income is from those >$504k/yr

For reference:

If you make 100k, you're in the 67th percentile

So, let's not get too freaked out about "audit rates" and recognize who the folks are that are cheating on income taxes. They're making 10x more than you are, most likely, and do not "live like you" at all. You pay WAY more tax than they do when we're referring to "tax rates", AINEC.

Household Income Percentile Calculator, US - DQYDJ

Check your household income percentile vs. 2023's United States income distribution in this calculator. How does it rank: top 1%, median, or other?dqydj.com

I hope they will all be targeting plutocrats, corporations, churches, and so-called non-profits.Do you think the tens of thousands of new IRS agents will be coving the white areas of the map more thoroughly?

Yeah, yeah, but a guy can hope, can't he?

Do you think the tens of thousands of new IRS agents will be coving the white areas of the map more thoroughly?

No... clearly auditing the white parts of the map is not part of the evil democrat agenda. Conservative media must be harping on this because I keep seeing this topic mentioned from my conservative friends on social media. There is usually very little delay between Tucker telling them to think something and them spouting off about it.

Tucker probably under-reports more than most of his viewers earn.No... clearly auditing the white parts of the map is not part of the evil democrat agenda. Conservative media must be harping on this because I keep seeing this topic mentioned from my conservative friends on social media. There is usually very little delay between Tucker telling them to think something and them spouting off about it.

I'm a big fan of bias in this context.That was the point I was making - I understand how the rate-per-1000 SHOULD eliminate that bias, but may not.

You would eliminate that bias by excluding areas that have <2000 or <5000 returns and running sub-analysis on the remaining data. Then looking separately at the low-population/low-return regions.

When you do not account for that, you're going to skew your results, badly for the low-population areas.

Auditing should absolutely be biased toward cracking down on those most likely to be playing games or outright cheating at the highest levels.

LOL... I just searched for Tucker Carlson IRS 87000 agents and of course he went off on this subject a few days ago. Apparently he is pushing the belief that the IRS is being weaponized and they will be kicking in the doors of innocent middle class families. I love how he plays on the hot topics with the "Guns.. that kill people, remember?". He knows his audience.

"In 2018, the Government Accountability Office reported that more than 2,000 IRS enforcement agents have more than 4,000 weapons. Guns -- that kill people, remember?” Carlson added. “The IRS is also stockpiling more than 5 million rounds of ammunition.”

Carlson’s guest that night, Rep. Matt Gaetz (R-FL), argued that the Biden administration is “raising taxes and disarming Americans. So, of course, they are arming up the IRS like they’re preparing to take Fallujah.” Gaetz was on the show to talk about a bill he introduced called the Disarm the IRS Act in July; the bill is co-sponsored by Reps. Marjorie Taylor Greene (R-GA) and Paul Gosar (R-AZ), two of the most extreme members of the House Republican caucus.

The following night, Fox News’ Will Cain, sitting in for Carlson, returned to the topic. “The agency stands to gain $80 billion from this legislation,” Cain said. “Now, that will allow the agency to hire more than 80,000 new agents.”

“Keep in mind, the IRS is already wonderfully, mysteriously, heavily militarized,” he continued. “They've stockpiled thousands of firearms and millions of rounds of ammunition. Why does the IRS need all that weaponry?”

“It won't be Goldman Sachs doors being kicked in with IRS agents with those guns,” Cain added, suggesting that the real targets will be working- and middle-class families.

"In 2018, the Government Accountability Office reported that more than 2,000 IRS enforcement agents have more than 4,000 weapons. Guns -- that kill people, remember?” Carlson added. “The IRS is also stockpiling more than 5 million rounds of ammunition.”

Carlson’s guest that night, Rep. Matt Gaetz (R-FL), argued that the Biden administration is “raising taxes and disarming Americans. So, of course, they are arming up the IRS like they’re preparing to take Fallujah.” Gaetz was on the show to talk about a bill he introduced called the Disarm the IRS Act in July; the bill is co-sponsored by Reps. Marjorie Taylor Greene (R-GA) and Paul Gosar (R-AZ), two of the most extreme members of the House Republican caucus.

The following night, Fox News’ Will Cain, sitting in for Carlson, returned to the topic. “The agency stands to gain $80 billion from this legislation,” Cain said. “Now, that will allow the agency to hire more than 80,000 new agents.”

“Keep in mind, the IRS is already wonderfully, mysteriously, heavily militarized,” he continued. “They've stockpiled thousands of firearms and millions of rounds of ammunition. Why does the IRS need all that weaponry?”

“It won't be Goldman Sachs doors being kicked in with IRS agents with those guns,” Cain added, suggesting that the real targets will be working- and middle-class families.

LOL... I just searched for Tucker Carlson IRS 87000 agents and of course he went off on this subject a few days ago. Apparently he is pushing the belief that the IRS is being weaponized and they will be kicking in the doors of innocent middle class families. I love how he plays on the hot topics with the "Guns.. that kill people, remember?". He knows his audience.

"In 2018, the Government Accountability Office reported that more than 2,000 IRS enforcement agents have more than 4,000 weapons. Guns -- that kill people, remember?” Carlson added. “The IRS is also stockpiling more than 5 million rounds of ammunition.”

Carlson’s guest that night, Rep. Matt Gaetz (R-FL), argued that the Biden administration is “raising taxes and disarming Americans. So, of course, they are arming up the IRS like they’re preparing to take Fallujah.” Gaetz was on the show to talk about a bill he introduced called the Disarm the IRS Act in July; the bill is co-sponsored by Reps. Marjorie Taylor Greene (R-GA) and Paul Gosar (R-AZ), two of the most extreme members of the House Republican caucus.

The following night, Fox News’ Will Cain, sitting in for Carlson, returned to the topic. “The agency stands to gain $80 billion from this legislation,” Cain said. “Now, that will allow the agency to hire more than 80,000 new agents.”

“Keep in mind, the IRS is already wonderfully, mysteriously, heavily militarized,” he continued. “They've stockpiled thousands of firearms and millions of rounds of ammunition. Why does the IRS need all that weaponry?”

“It won't be Goldman Sachs doors being kicked in with IRS agents with those guns,” Cain added, suggesting that the real targets will be working- and middle-class families.

Right or wrong, the IRS audits lower income brackets at a much higher rate than upper income brackets, which seems consistent with this map. The equity issue falls squarely on income (and, by correlation, race), not politics.

It defini

I didn't realize that a million dollars an agent was the going rate.The following night, Fox News’ Will Cain, sitting in for Carlson, returned to the topic. “The agency stands to gain $80 billion from this legislation,” Cain said. “Now, that will allow the agency to hire more than 80,000 new agents.”

I guess I can't afford my own.

I'll have to wait until women are returned to chattel status.

lol

I'll have to wait until women are returned to chattel status.

Is it just an accident that "chattel" is so similar to "cattle"?

As long as she does exactly what I tell her like the good Christian chattel she is, everything is fine.

Several people here have blamed liberals for this.

Speaking as a liberal, I initially took offense at that. But having mulled it over, you're welcome.

If this was a win for liberals, what was the previous meat market show other than a win for conservatives who think of women as chattel?

Darn. I was thinking your answer would either be that all pro-choice women are sluts or that since all women are chattel who should do what men tell them to do, men will just have sex even if the women don't want to.

I thought women were chattel - or, at a minimum, totally subordinate to their husbands.

Clearly husbands should vote for wives, if they are allowed a vote at all.

That's different. Women (and children) are chattel.

Once we have finished stripping women of their rights and have returned them to chattel status, you will get to own 3 from this list.

Which would you pick?

THE BEST ACTRESSES - Born 1980s and 1990s - IMDb

THE BEST ACTRESSES - Born 1980s and 1990swww.imdb.com

That is not true at all.Right or wrong, the IRS audits lower income brackets at a much higher rate than upper income brackets, which seems consistent with this map. The equity issue falls squarely on income (and, by correlation, race), not politics.

It defini

Higher-income taxpayers face greater chance of audit

Despite common misperceptions about IRS examination rates, the reality is that the likelihood of an audit significantly increases as income grows.Taxpayers with incomes of $10 million and above had substantially higher audit rates than taxpayers in every other income category for each calendar year from 2010 through 2015. Those with incomes above $1 million also had higher exam rates than all other groups earning less.

Tax Year 2015 provides a good historical overview of where IRS compliance priorities are focused. The exam coverage rate of taxpayers with incomes of $10 million or more is 8.16%. The rate for those between $1 million and $10 million is 2.53%. And other income categories are far below that – generally less than 1%.

Tax Year 2015 is the last year for which we know the actual audit rates, because the IRS can still open audits for more recent years, so the data for more recent years is not yet complete.

| Total positive income | Total returns filed in TY2015 | Returns examined* | Percent covered |

|---|---|---|---|

| No total positive income** | 701,594 | 31,329 | 4.47 |

| $1 under $25,000 | 54,135,898 | 357,410 | 0.66 |

| $25,000 under $50,000 | 35,589,401 | 141,727 | 0.40 |

| $50,000 under $75,000 | 20,312,858 | 108,219 | 0.53 |

| $75,000 under $100,000 | 13,063,770 | 64,324 | 0.49 |

| $100,000 under $200,000 | 19,459,846 | 92,124 | 0.47 |

| $200,000 under $500,000 | 5,788,644 | 31,804 | 0.55 |

| $500,000 under $1,000,000 | 962,481 | 10,898 | 1.13 |

| $1,000,000 under $5,000,000 | 428,082 | 10,244 | 2.39 |

| $5,000,000 under $10,000,000 | 31,159 | 1,367 | 4.39 |

| $10,000,000 and above | 19,531 | 1,593 | 8.16 |

There are almost 55 million households with an income of $25K or less that were audited at a higher rate than the almost 90 million households with an income of between $25K and $500K.That is not true at all.

Higher-income taxpayers face greater chance of audit

Despite common misperceptions about IRS examination rates, the reality is that the likelihood of an audit significantly increases as income grows.

Taxpayers with incomes of $10 million and above had substantially higher audit rates than taxpayers in every other income category for each calendar year from 2010 through 2015. Those with incomes above $1 million also had higher exam rates than all other groups earning less.

Tax Year 2015 provides a good historical overview of where IRS compliance priorities are focused. The exam coverage rate of taxpayers with incomes of $10 million or more is 8.16%. The rate for those between $1 million and $10 million is 2.53%. And other income categories are far below that – generally less than 1%.

Tax Year 2015 is the last year for which we know the actual audit rates, because the IRS can still open audits for more recent years, so the data for more recent years is not yet complete.

Total positive income Total returns filed in TY2015 Returns examined* Percent covered No total positive income** 701,594 31,329 4.47 $1 under $25,000 54,135,898 357,410 0.66 $25,000 under $50,000 35,589,401 141,727 0.40 $50,000 under $75,000 20,312,858 108,219 0.53 $75,000 under $100,000 13,063,770 64,324 0.49 $100,000 under $200,000 19,459,846 92,124 0.47 $200,000 under $500,000 5,788,644 31,804 0.55 $500,000 under $1,000,000 962,481 10,898 1.13 $1,000,000 under $5,000,000 428,082 10,244 2.39 $5,000,000 under $10,000,000 31,159 1,367 4.39 $10,000,000 and above 19,531 1,593 8.16

The < 2 million households with more than $500K in income aren't really germane to the discussion.

Lol - these are returns examined and it makes perfect sense that those under $25K would be examined at slightly more than others because they are more likely to have mistakes. People not able to afford a professional to do their taxes make more mistakes. Not to mention the difference in the rate of examination is negligible at the lower levels.There are almost 55 million households with an income of $25K or less that were audited at a higher rate than the almost 90 million households with an income of between $25K and $500K.

The < 2 million households with more than $500K in income aren't really germane to the discussion.

And they are all examined at a much LOWER rate than those at the highest income levels.

What you posted previously is completely wrong.

Hey, I didn't invent the notion that women are chattel.

That's straight from Christian America's favorite book.

Similar threads

- Replies

- 163

- Views

- 4K

- Replies

- 132

- Views

- 3K

ADVERTISEMENT

ADVERTISEMENT