Simply because that's two account closed. It should only be a month before it's back up and another month before it's higher. That said, the most important things to get a high score seem to be large lines of credit with low utilization, longevity of accounts and no missed payments.Why does a credit score go down when you pay off your debt? I paid off my car and a small remaining balance on a home equity loan in January. The only debt we have is the remaining balance of our home loan (less than 25% of the value of the home) and my credit card generally shows a balance because we run all expenses through it and pay it off each month. It's our airline miles card and I put an absurd amount of money on it. The credit report shows us using less than 1% of our credit limit. So why would both of our credit scores drop by about 15 points since we paid off the car and heloc? This makes no sense to me.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Can anyone make sense of credit scores?

- Thread starter 3boysmom

- Start date

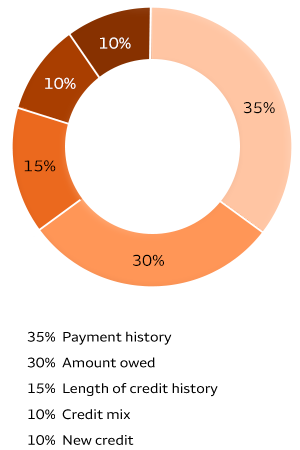

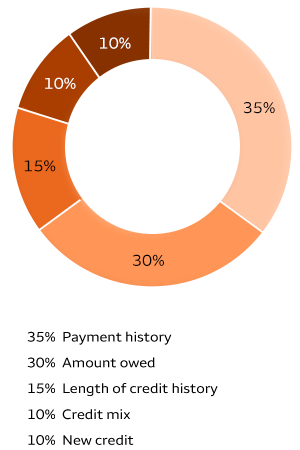

No argument from me. I need to be better informed.This thread proves that many people that don't understand how their credit score is derived. Plenty of misinformation here.

How Your Credit Score is Calculated - Wells Fargo

Learn what your credit score is based on and the many ways you can improve it.

It was off the cuff, for some reason I thought 870 was the max; but I see 850 is the max.. I topped out at 841 a few months ago.860? You sure about that?

Because, supposedly, you no longer have that credit available to you. Rather stupid in my mind, but that's the way it was explained to me,Why does a credit score go down when you pay off your debt? I paid off my car and a small remaining balance on a home equity loan in January. The only debt we have is the remaining balance of our home loan (less than 25% of the value of the home) and my credit card generally shows a balance because we run all expenses through it and pay it off each month. It's our airline miles card and I put an absurd amount of money on it. The credit report shows us using less than 1% of our credit limit. So why would both of our credit scores drop by about 15 points since we paid off the car and heloc? This makes no sense to me.

Damn it. He knows he’s supposed to run everything through the miles card. No miles, no blow.Only reasonable explanation is the hubby took out a loan you don’t know about to pay for the standard hookers and blow and missed a few payments.

Which is crazy because it’s not like you add to a car loan. Clearly it can’t differentiate between a car/home loan and a credit card.Because, supposedly, you no longer have that credit available to you. Rather stupid in my mind, but that's the way it was explained to me,

It's because they heard my avatar isn't really me, isn't it.

Wait... what?

I was told by a banker once, to never completely pay off and close a credit card. I usually pay mine off monthly, but I have things like hrot and Netflix which hit between statement time and when I pay it off, so I always have a balance and never accrue interest.Which is crazy because it’s not like you add to a car loan. Clearly it can’t differentiate between a car/home loan and a credit card.

Because its not a system to show how good you are at finances. Its a system to show how valuable you are to creditors. We've just been pushed to believe that its the former.I never understood why a person gets punished for being financially responsible.

Edit: I never got a credit card in college because I knew I wouldn't be responsible with it. I got punished for it after school.

Well, that's how it works. If you have no debt there's nothing to measure.When our sons graduated college and had no debt and some savings left, one a lot, one very little, and were just starting with jobs that provided good income, etc, their credit scores were puny...because, essentially, they didn't have debt. Huh? As told to us at the time by people in the industry...they want to see that you pay debt off.

OK, alrighty, sure...but shouldn't there be some value assigned to NOT getting into debt first and having paid their way through school, etc? In retrospect, we should have gotten them a credit card in their HS years and had them run a few expenses through the card just to "get on the board". Nuts, if you ask me.

Think of it in the viewpoint of the creditor. Your sons have no way to show they can pay anything back. Sure, they may be financially responsible, but they have no tangible way of showing it. In the view of the creditor, they are a big risk.When our sons graduated college and had no debt and some savings left, one a lot, one very little, and were just starting with jobs that provided good income, etc, their credit scores were puny...because, essentially, they didn't have debt. Huh? As told to us at the time by people in the industry...they want to see that you pay debt off.

OK, alrighty, sure...but shouldn't there be some value assigned to NOT getting into debt first and having paid their way through school, etc? In retrospect, we should have gotten them a credit card in their HS years and had them run a few expenses through the card just to "get on the board". Nuts, if you ask me.

You could also apply it to yourself. You have a friend you have known for 20 years. They've borrowed tools, they've done you favors. If they ask you for something, you know they have a history of being reliable, so you don't view them as a risk.

Then you have a neighbor you've never spoken to that needs a big favor. You hardly know them. They could be financially responsible, they could be reliable, but you don't know. You don't know anything about them. This would be similar to having no credit score at all.

What would be really cool is if you would actually contribute something to the thread.This thread proves that many people that don't understand how their credit score is derived. Plenty of misinformation here.

What I think is ridiculous if simply having a lender check your credit actually hurts your credit. You are penalized for shopping around.

Also we just found out our credit score is taking a hit because, somehow I got off on a car payment for two months In 2021. It wasn’t because I couldn’t make the payment, but somehow missed Jan, paid Feb, thinking it was on time, but was actually paying Jan. No letter from the lender indicating late payment or anything. This lender issues a payment book rather than monthly statements. We caught this in March, but two months of late payments, the damage was done. We’ve since paid that loan off, but there it sits for 7 years. You would think paying off a debt in full would carry more weight than a one time fvck up.

The exact formula behind credit scores should be completely transparent and published for the public to see. There should be no ambiguity.

I’ve been trying to get that last 10pts to 850 for years. It’s freaking impossible.

I’ve been trying to get that last 10pts to 850 for years. It’s freaking impossible.

Have you actually read the thread? I addressed the top three factors that influence a person's score. What kind of contribution were you looking for? I also addressed the notion that a person has to carry balances or actively even use their available credit to have a great score. That's misinformation. What was it that you contributed again?What would be really cool is if you would actually contribute something to the thread

I personally like a well toned silver fox. Doesn’t need to be muscle bound or super pumped up.2nd row, left. Thanks.

Just healthy and uh, capable...🚀

I have several accounts with high limits that I haven’t used in years.Simply because that's two account closed. It should only be a month before it's back up and another month before it's higher. That said, the most important things to get a high score seem to be large lines of credit with low utilization, longevity of accounts and no missed payments.

No late payments and I will have all but one paid off by June. But my score isn’t perfect either. (800 more or less)

It may be because I’m retired and my annual income isn’t what it was on the day I retired?

Not worried about it because I don’t need a bunch of credit anyway.

I did read the thread. I don‘t usually pay too much attention to who the poster is, so I likely read your contributions, but didn’t link them to this particular post. My bad fornthinking you were just being snarky. peace.Have you actually read the thread? I addressed the top three factors that influence a person's score. What kind of contribution were you looking for? I also addressed the notion that a person has to carry balances or actively even use their available credit to have a great score. That's misinformation. What was it that you contributed again?

Your credit age plays a bigger part in this than people realize. When older accounts get paid off and close, your credit age goes down and can affect your overall score.

This might be part of what is going on.

This might be part of what is going on.

No argument, I understand, nowadays, what you are saying is true. But, it seemed quite counterintuitive at the time. Actually, it still does.Think of it in the viewpoint of the creditor. Your sons have no way to show they can pay anything back. Sure, they may be financially responsible, but they have no tangible way of showing it. In the view of the creditor, they are a big risk.

You could also apply it to yourself. You have a friend you have known for 20 years. They've borrowed tools, they've done you favors. If they ask you for something, you know they have a history of being reliable, so you don't view them as a risk.

Then you have a neighbor you've never spoken to that needs a big favor. You hardly know them. They could be financially responsible, they could be reliable, but you don't know. You don't know anything about them. This would be similar to having no credit score at all.

Tinfoil hat time...it's a scam to coax you into owing somebody something with interest. Student loan debt took my credit score from no credit to the 700s right after I graduated. Why? My fiscal habits didn't change just that I graduated. I believe it was increased just because they believed I could afford to make a debt payment because I had a new source of income and stability. Why would you want to incur debt for the payoff of having a high credit score? The best place to be is ZERO debt, period. Owe nothing to nobody. Having no credit will not effect being able to take out a loan for a house or car (the only acceptable debt IMO). Even after a car or house purchase paying it off ASAP is the best way to go. ZERO debt.

Yeh I've read if you pay off an account to leave it open so it shows you have credit available. The one think I don't understand is they don't seem to take income into any calculations. How would they know if you received a substantial raise?Available credit is part of the equation. By paying off and closing accounts, the rating agencies think you're struggling.

Because when those accounts closed you also lost the age of those accounts. Nothing pissed me off more than Discover closing my account because I hadn't used their card in forever. It was my second credit card and had been open since 1995. Lost a 25+ year account and when I called them on it they were like, oh well, you didn't use it.Why does a credit score go down when you pay off your debt? I paid off my car and a small remaining balance on a home equity loan in January. The only debt we have is the remaining balance of our home loan (less than 25% of the value of the home) and my credit card generally shows a balance because we run all expenses through it and pay it off each month. It's our airline miles card and I put an absurd amount of money on it. The credit report shows us using less than 1% of our credit limit. So why would both of our credit scores drop by about 15 points since we paid off the car and heloc? This makes no sense to me.

Also, believe it or not, a lack of open credit hurts your credit score as well. If you don't have 3 open and active trade lines your credit score can be considered invalid too. So what I do is maintain two credit cards that I pay off each month to go with my mortgage so I can have 3 open and active trade lines. I also make a charge every couple of months or so on some other cards just to keep them open so I don't have a repeat of the Discover fiasco and lose one that has been open since 1994.

I agree with this. Seems insane to have a score that can impact your ability to borrow and have a major portion of the population have no idea how it works. The formula should be standard across all creditors and easy to research and understand.The exact formula behind credit scores should be completely transparent and published for the public to see. There should be no ambiguity.

I’ve been trying to get that last 10pts to 850 for years. It’s freaking impossible.

I mostly agree. I 100% agree the best place to be is zero debt. However, if you can responsibly pay off a credit card on time each month, there is no reason not to have that line of credit to earn rewards and build credit. Down the road, having good credit can be the difference of getting a 3.5% interest rate on a car or an 8% rate.Tinfoil hat time...it's a scam to coax you into owing somebody something with interest. Student loan debt took my credit score from no credit to the 700s right after I graduated. Why? My fiscal habits didn't change just that I graduated. I believe it was increased just because they believed I could afford to make a debt payment because I had a new source of income and stability. Why would you want to incur debt for the payoff of having a high credit score? The best place to be is ZERO debt, period. Owe nothing to nobody. Having no credit will not effect being able to take out a loan for a house or car (the only acceptable debt IMO). Even after a car or house purchase paying it off ASAP is the best way to go. ZERO debt.

Now, I think it is ridiculous advice when people suggest taking out small loans and paying them back to build credit. That is just a waste of energy and money.

If you’re looking for car financing and you’re not running it through a business, you’ve already lost.I mostly agree. I 100% agree the best place to be is zero debt. However, if you can responsibly pay off a credit card on time each month, there is no reason not to have that line of credit to earn rewards and build credit. Down the road, having good credit can be the difference of getting a 3.5% interest rate on a car or an 8% rate.

Now, I think it is ridiculous advice when people suggest taking out small loans and paying them back to build credit. That is just a waste of energy and money.

They share plenty of info. The key is to get accounts young and not close them. Average age of accounts is a variable that isn’t easily fixed. I’ve been above 800 for a long time, it bounces randomly but I doubt it matters much.I agree with this. Seems insane to have a score that can impact your ability to borrow and have a major portion of the population have no idea how it works. The formula should be standard across all creditors and easy to research and understand.

I’m in the situation 3BM, two car loans, mortgage payment, my airline card that I use for everything. I pay that every week. Used it on vacation and put a little bit more on than normal. Before end of week it went down 1 pt. Paid it off and didn’t go back up.

Been stuck in the 820's for a long time.The exact formula behind credit scores should be completely transparent and published for the public to see. There should be no ambiguity.

I’ve been trying to get that last 10pts to 850 for years. It’s freaking impossible.

Totally agree. Credit card for road trips and vacays as long as money is there, or will be there is just plain smart. I paid for a 3 day weekend on the Texas Gulf coast for my wife (no pics) and I over a month ago off of points. Living on credit is a horrible idea.I mostly agree. I 100% agree the best place to be is zero debt. However, if you can responsibly pay off a credit card on time each month, there is no reason not to have that line of credit to earn rewards and build credit. Down the road, having good credit can be the difference of getting a 3.5% interest rate on a car or an 8% rate.

Now, I think it is ridiculous advice when people suggest taking out small loans and paying them back to build credit. That is just a waste of energy and money.

My ideal situation would be having 6 months of expenses in savings as back up. Not quite there but working on it. Even taking advantage of no interest credit on large purchases such as appliances and furniture makes some sense. As far as low interest on a car loan a good credit union will give you a great deal if you've been with them long enough and are proven.

Because its not a system to show how good you are at finances. Its a system to show how valuable you are to creditors. We've just been pushed to believe that its the former.

BS.

You should be able to get that off of your credit report with some wheeling and dealing.What would be really cool is if you would actually contribute something to the thread.

What I think is ridiculous if simply having a lender check your credit actually hurts your credit. You are penalized for shopping around.

Also we just found out our credit score is taking a hit because, somehow I got off on a car payment for two months In 2021. It wasn’t because I couldn’t make the payment, but somehow missed Jan, paid Feb, thinking it was on time, but was actually paying Jan. No letter from the lender indicating late payment or anything. This lender issues a payment book rather than monthly statements. We caught this in March, but two months of late payments, the damage was done. We’ve since paid that loan off, but there it sits for 7 years. You would think paying off a debt in full would carry more weight than a one time fvck up.

Well…that’s full of suck 😕It's because they heard my avatar isn't really me, isn't it.

Sorry, I couldn't read all the garbage back and forth...so I scrolled.

The only debt in my name is student loans.

Paying off credit card before it is due helps. Just my humble opinion. Take that for what it is worth. I'm in the 800s

The only debt in my name is student loans.

Paying off credit card before it is due helps. Just my humble opinion. Take that for what it is worth. I'm in the 800s

I bought 2 round trip tickets to Amsterdam and 2 round trip tickets to Jamaica with my airline miles this year. And I’m already back up to 30,000 miles again. Almost to Platinum status almost completely from my credit card. To be fair some of it is bonus from my job. But it’s a heck of a perk.Totally agree. Credit card for road trips and vacays as long as money is there, or will be there is just plain smart. I paid for a 3 day weekend on the Texas Gulf coast for my wife (no pics) and I over a month ago off of points. Living on credit is a horrible idea.

My ideal situation would be having 6 months of expenses in savings as back up. Not quite there but working on it. Even taking advantage of no interest credit on large purchases such as appliances and furniture makes some sense. As far as low interest on a car loan a good credit union will give you a great deal if you've been with them long enough and are proven.

Anybody in this thread sat through a class put on by Trans Union explaining how credit scores work? I have.

We got some bankers on HROT. Plenty of advice here. Pay off each month. Maintain 2-3 cards plus mortgage and or car payment. You'll be high 780 plus easy.

We got some bankers on HROT. Plenty of advice here. Pay off each month. Maintain 2-3 cards plus mortgage and or car payment. You'll be high 780 plus easy.

I believe that once your over 720 they tick the credit score box and move on to your ability to pay.Yeah, we hover right at 800. The only reason I am even remotely concerned is we want to purchase some property in Colorado. Still trying to work out exactly what we want, but I am leaning toward land and then developing it later. Not sure if being above 800 as opposed to right under it will make a difference.

The fact that your only using 1% of your credit probably isn't helping.

I'm told carrying a little credit card debt month to month is good, but like you I've never done it.

Basically, 720 is the line between Very good and excellent. Over that and your good. If your worried about the loan/rate, include your retirement accounts in your loan application.

I pay a lot of my monthly payments in a rewards card and pay the balance every month. I never pay interest and get cash back. I have a couple late payments on my record that from when we had a struggling business several years ago. They will be dropping off soon. My credit union showed a missed payment when I was on disability. The disability insurance was jacking around with the claim. They straightened it right out when I notified them, that dropped my score 60 points or so until it cleared. My score runs about 815 to 820.

It dropped 15 points the month I paid for my Mom's funeral expenses on my card, but it gave us nearly 2 months interest free to get everything settled.

It dropped 15 points the month I paid for my Mom's funeral expenses on my card, but it gave us nearly 2 months interest free to get everything settled.

Your credit history has dropped due to the fact that before you have paid a huge amount of money on the loan, and then used not a large amount for your purchases, so the system could calculate that you are using less than one percent of your credit limit. Perhaps this is a system error, but I would play safe and take advantage of Mortgage Advice Newcastle in your place. All because you need to solve this problem quickly and on time. If you postpone it for later, then it will be difficult to return to this problem in the future. But I assure you that everything will be fine and you will restore your credit history. I wish you good luck and success.

Last edited:

Similar threads

- Replies

- 13

- Views

- 437

- Replies

- 63

- Views

- 2K

- Replies

- 1

- Views

- 107

- Replies

- 22

- Views

- 264

ADVERTISEMENT

ADVERTISEMENT