Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CNN Estate Tax Op Ed

- Thread starter General Tso

- Start date

This country needs revenue.

Go ahead - find the waste, the pork, the needless spending. I'm a for it, but it's not going to be a trillion dollars.

A National Sales Tax, a Wealth Tax, increasing Corporate and Individual rates and, yes, the Estate Tax all need to be discussed.

But no one in DC cares.

Go ahead - find the waste, the pork, the needless spending. I'm a for it, but it's not going to be a trillion dollars.

A National Sales Tax, a Wealth Tax, increasing Corporate and Individual rates and, yes, the Estate Tax all need to be discussed.

But no one in DC cares.

Yeah. The obvious answer to eliminating our debt are, increasing income, recognizing this is a 50 year process, getting budget to be less than income, decreasing spending (especially military spending-playing world polices since 1946 has been a big part of this debt). We take in about 14% of the debt each years in taxes. So say about 1/7th. So like a family with 200k income with 1.4 million in debt, they are not going to pay that off debt without getting a raise or new job, time, not adding to the debt, and being better with the money. It took us 60 years to get here and going to take time to get out of it.This country needs revenue.

Go ahead - find the waste, the pork, the needless spending. I'm a for it, but it's not going to be a trillion dollars.

A National Sales Tax, a Wealth Tax, increasing Corporate and Individual rates and, yes, the Estate Tax all need to be discussed.

But no one in DC cares.

Last edited:

What percentage of GDP should be spent on defense in your opinion?Yeah. The obvious answer to eliminating our debt are, in order, increasing income, recognizing this is a 50 year process, decreasing spending (especially military spending-playing world polices since 1946 has been a big part of this debt).

In 2023 it was 3.4% fwiw

The United States Spends More on Defense than the Next 10 Countries Combined

Defense spending by the United States accounted for nearly 40 percent of military expenditures by countries around the world in 2022.

www.pgpf.org

www.pgpf.org

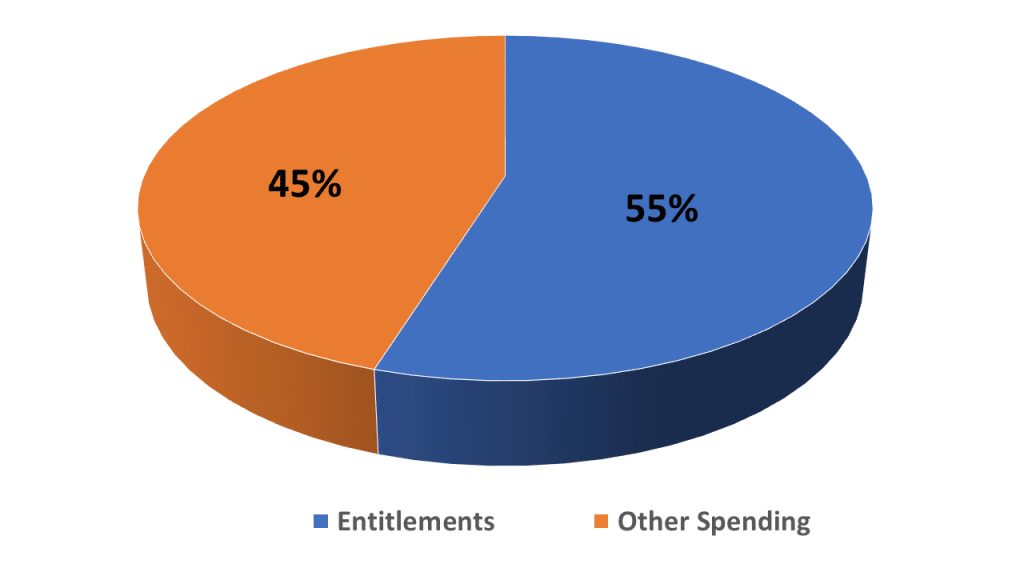

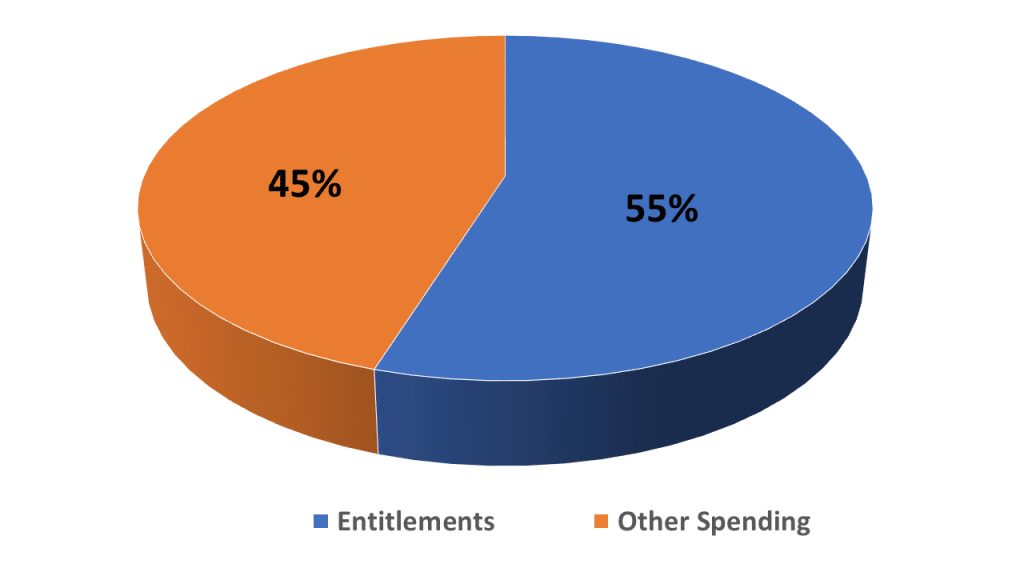

In 2022 52% of GDP went to entitlements..

Entitlement Spending

Here is Entitlement Spending, its portion of the federal budget in total and by program, and the ten-year trend, including per capita costs.

federalsafetynet.com

Last edited:

6.9%What percentage of GDP should be spent on defense in your opinion?

In 2023 it was 3.4% fwiw

In 2022 52% of GDP went to entitlements..

Entitlement Spending

Here is Entitlement Spending, its portion of the federal budget in total and by program, and the ten-year trend, including per capita costs.federalsafetynet.com

GDP makes it sound better because the US has the by far highest GDP in world. We have been spending 12-15 percent of our budget on the military. Almost 800 million this year. Far more by GDP and dollar amount than any other nation. I mean, after 6 months of Ukraine pushing Russia’s dick in the ground after the “three day” invasion, the running joke in West Europe and Ukraine was “this is why the US does not have universal healthcare”What percentage of GDP should be spent on defense in your opinion?

In 2023 it was 3.4% fwiw

The United States Spends More on Defense than the Next 10 Countries Combined

Defense spending by the United States accounted for nearly 40 percent of military expenditures by countries around the world in 2022.www.pgpf.org

In 2022 52% of GDP went to entitlements..

Entitlement Spending

Here is Entitlement Spending, its portion of the federal budget in total and by program, and the ten-year trend, including per capita costs.federalsafetynet.com

And, there you have it. The discretionary spending component is shrinking to a point where is doesn't matter if you cut spending - the problem will remain.What percentage of GDP should be spent on defense in your opinion?

In 2023 it was 3.4% fwiw

The United States Spends More on Defense than the Next 10 Countries Combined

Defense spending by the United States accounted for nearly 40 percent of military expenditures by countries around the world in 2022.www.pgpf.org

In 2022 52% of GDP went to entitlements..

Entitlement Spending

Here is Entitlement Spending, its portion of the federal budget in total and by program, and the ten-year trend, including per capita costs.federalsafetynet.com

GDP makes it sound better because the US has the by far highest GDP in world. We have been spending 12-15 percent of our budget on the military. Almost 800 million this year. Far more by GDP and dollar amount than any other nation. I mean, after 6 months of Ukraine pushing Russia’s dick in the ground after the “three day” invasion, the running joke in West Europe and Ukraine was “this is why the US does not have universal healthcare”

Billion

I’ve never been a fan of estate taxes. The money’s already been taxed along the way, and the government gets another cut when you kick the bucket? Doesn’t sit well with me. At the very least keep sizable exemptions.

Raise the rates along the way instead.

Raise the rates along the way instead.

Defense spend could have been ZERO last year and the deficit would still have been around $900B.And, there you have it. The discretionary spending component is shrinking to a point where is doesn't matter if you cut spending - the problem will remain.

Tax corparations at the 1950 rates, cut individual taxes, reestablish 80% estate tax,make it so no corparation or individual can obtain enough wealth to control a country.

Not until and unless spending stops. Without serious spending cuts, no more taxes.This country needs revenue.

Go ahead - find the waste, the pork, the needless spending. I'm a for it, but it's not going to be a trillion dollars.

A National Sales Tax, a Wealth Tax, increasing Corporate and Individual rates and, yes, the Estate Tax all need to be discussed.

But no one in DC cares.

Lots of estate income is not taxed during one's lifetime. It's because there was an effective estate tax that you get the foundations that you get. Of course not all foundations are used for the betterment of society.I’ve never been a fan of estate taxes. The money’s already been taxed along the way, and the government gets another cut when you kick the bucket? Doesn’t sit well with me. At the very least keep sizable exemptions.

Raise the rates along the way instead.

Like what? Genuinely asking, I’m not aware what that would be.Lots of estate income is not taxed during one's lifetime. It's because there was an effective estate tax that you get the foundations that you get. Of course not all foundations are used for the betterment of society.

The estate tax should be repealed completely. Inequality? It's not inequality to be able to pass on what's been earned and built. Taxes have already been paid on income. If assets are sold, then pay capital gains taxes, but taxing estates is just government greed and wealth envy.

An estate tax will not effect 99% of the in iowa. Estate taxe was put in place to keep people and familles from becoming so filthy rich and powerful that they controlled the masses..

Ummmm....I am pretty sure you can find TRILLIONS of dollars in waste within the military alone.This country needs revenue.

Go ahead - find the waste, the pork, the needless spending. I'm a for it, but it's not going to be a trillion dollars.

A National Sales Tax, a Wealth Tax, increasing Corporate and Individual rates and, yes, the Estate Tax all need to be discussed.

But no one in DC cares.

Well, the Budget is "only" $800 billion. Cutting the military budget would be a good start, but it's going to take a lot more.Ummmm....I am pretty sure you can find TRILLIONS of dollars in waste within the military alone.

Trillions, huh? Where did you learn math? The US military budget isn't even 1 trillion, the total gdp is just over 20 trillion. You proposing we go Costa Rica style and have zero military?Ummmm....I am pretty sure you can find TRILLIONS of dollars in waste within the military alone.

Eff that garbage and anyone trying to justify it.

No matter what revisions are done to the tax code and additional revenue, our politicians will exceed it with spending. No one with a functional brain and a job should ever support higher federal taxes in any form.

No matter what revisions are done to the tax code and additional revenue, our politicians will exceed it with spending. No one with a functional brain and a job should ever support higher federal taxes in any form.

I’ve never been a fan of estate taxes. The money’s already been taxed along the way, and the government gets another cut when you kick the bucket? Doesn’t sit well with me. At the very least keep sizable exemptions.

Raise the rates along the way instead.

That's not really accurate; very few become highly wealthy from saving their earned income (which is taxed), or simply from dividend & interest income (which is taxed). It typically comes from appreciated value of investments - whether that be from founding a company that does well, or purchasing an interest in such a company, or purchasing real estate that appreciates significantly in value. That appreciation does not get taxed as income - it doesn't get taxed until the asset is sold.

Bill Gates & Paul Allen didn't become among the world's wealthiest men from salary that they drew from Microsoft; they grew fabulously wealthy by owning it.

And heirs get the benefit of a stepped-up basis...so, for many assets they do not have to pay any capital gains when they sell the property.That's not really accurate; very few become highly wealthy from saving their earned income (which is taxed), or simply from dividend & interest income (which is taxed). It typically comes from appreciated value of investments - whether that be from founding a company that does well, or purchasing an interest in such a company, or purchasing real estate that appreciates significantly in value. That appreciation does not get taxed as income - it doesn't get taxed until the asset is sold.

Bill Gates & Paul Allen didn't become among the world's wealthiest men from salary that they drew from Microsoft; they grew fabulously wealthy by owning it.

Your stock portfolio appreciation isn't taxed until you sell it. Your property appreciation isn't taxed until you sell it. The appreciation of valuable works of art isn't taxed until sale. Under current law, when your heir takes possession, they get it at its current value...they can sell it immediately and owe 0 taxes no matter how much it has appreciated in value previously.Like what? Genuinely asking, I’m not aware what that would be.

It was the wealthy who pushed for the estate tax and the step-up in basis. Previously, they had to track the value of all of their assets and their heirs had to keep up with all that until they were sold. It was a book-keeping nightmare. They had to keep records on everything of value that they owned that could have its appreciation taxed when it was finally sold...no matter how many generations it had passed through.

With the estate tax, they paid a percentage upon their death of their total wealth which captured the taxes they would have owed had they sold the day before they died. Now they want to KEEP the step-up in basis AND do away with the estate tax or raise it until it becomes meaningless...and they're pretty much there.

What percentage of GDP should be spent on defense in your opinion?

In 2023 it was 3.4% fwiw

The United States Spends More on Defense than the Next 10 Countries Combined

Defense spending by the United States accounted for nearly 40 percent of military expenditures by countries around the world in 2022.www.pgpf.org

In 2022 52% of GDP went to entitlements..

Entitlement Spending

Here is Entitlement Spending, its portion of the federal budget in total and by program, and the ten-year trend, including per capita costs.federalsafetynet.com

Except the entitlement money is mostly pass through. Social Security and Medicare monies in; Social Security and Medicare money out.

Let’s up the estate tax, up the tax on those over 400k, pay for more IRS enforcement agents, automatic audits for anyone making over a set amount, and cut spending 10% across the board except for Social Security and Medicare; raise all fees for other government services to the estimated cost per person or entity expenses incurred by the government (patent filing fees, national park fees, etc.)

Continue until balanced.

....as long as it's over what I makeExcept the entitlement money is mostly pass through. Social Security and Medicare monies in; Social Security and Medicare money out.

Let’s up the estate tax, up the tax on those over 400k, pay for more IRS enforcement agents, automatic audits for anyone making over a set amount, and cut spending 10% across the board except for Social Security and Medicare; raise all fees for other government services to the estimated cost per person or entity expenses incurred by the government (patent filing fees, national park fees, etc.)

Continue until balanced.

Estate taxes, except on gains are double taxation. That's a no go.

Cut spending then let's talk about raising taxes. Until we do that, raising taxes will always be the answer to fund whatever the latest magical campaign promise is.

Cut spending then let's talk about raising taxes. Until we do that, raising taxes will always be the answer to fund whatever the latest magical campaign promise is.

I think I've decided I'm OK with a flat tax on everybody. I don't care if you made 4 dollars this year, pay your taxes.

It’s always comical to see how people think it’s fair to want to tax the shit out of someone when it doesn’t apply to them whatsoever.

With ZERO deductions. The problem with our tax code is there are too many loopholes and things to write off. I would be okay with a consumption tax as well.I think I've decided I'm OK with a flat tax on everybody. I don't care if you made 4 dollars this year, pay your taxes.

Trump said it himself. Hilary wants to talk about how the rich use tax codes to their advantage, she doesn't want to actually change anything because her donors and her were taking advantage of the same codes he was.With ZERO deductions. The problem with our tax code is there are too many loopholes and things to write off. I would be okay with a consumption tax as well.

Taxing the rich is great pillow talk though.

With ZERO deductions. The problem with our tax code is there are too many loopholes and things to write off. I would be okay with a consumption tax as well.

Two deductions: charity and mortgage interest.

I didn’t think step up in basis applied to things like inherited IRAs, for example?Your stock portfolio appreciation isn't taxed until you sell it. Your property appreciation isn't taxed until you sell it. The appreciation of valuable works of art isn't taxed until sale. Under current law, when your heir takes possession, they get it at its current value...they can sell it immediately and owe 0 taxes no matter how much it has appreciated in value previously.

It was the wealthy who pushed for the estate tax and the step-up in basis. Previously, they had to track the value of all of their assets and their heirs had to keep up with all that until they were sold. It was a book-keeping nightmare. They had to keep records on everything of value that they owned that could have its appreciation taxed when it was finally sold...no matter how many generations it had passed through.

With the estate tax, they paid a percentage upon their death of their total wealth which captured the taxes they would have owed had they sold the day before they died. Now they want to KEEP the step-up in basis AND do away with the estate tax or raise it until it becomes meaningless...and they're pretty much there.

Last edited:

Why? Giving to charity is a personal choice and mortgage interest is simply part of your loan. Neither should be a means to lower your tax burden IMO.Two deductions: charity and mortgage interest.

Good point.That's not really accurate; very few become highly wealthy from saving their earned income (which is taxed), or simply from dividend & interest income (which is taxed). It typically comes from appreciated value of investments - whether that be from founding a company that does well, or purchasing an interest in such a company, or purchasing real estate that appreciates significantly in value. That appreciation does not get taxed as income - it doesn't get taxed until the asset is sold.

Bill Gates & Paul Allen didn't become among the world's wealthiest men from salary that they drew from Microsoft; they grew fabulously wealthy by owning it.

I guess my position is I’m ok with the Bill Gates and Paul Allens of the world passing on tremendous wealth to their heirs. They built some great companies.

I didn’t think step up on basis applied to things like inherited IRAs, for example?

It does not - if you inherited an IRA/401k, or other qualified plan, you'll pay tax on it when you withdraw it. But a nonqualified investment account gets the stepped up basis, as do rental houses & other real estate investments.

I have no real problem with the estate tax going away. If you have a trillion dollars in cash you should be able to pass that along to your second cousin tax free.Good point.

I guess my position is I’m ok with the Bill Gates and Paul Allens of the world passing on tremendous wealth to their heirs. They built some great companies.

But if your estate includes unrealized capital gains your heirs should only get a continued deferral, not a step up. My mother owns about 200k of stock. The gains have never been taxed. When I inherit them I won’t pay any tax on them either. That is what should be eliminated.

🤡💩Tax corparations at the 1950 rates, cut individual taxes, reestablish 80% estate tax,make it so no corparation or individual can obtain enough wealth to control a country.

Both have said they intend to give away billions instead of giving it all to heirs. Good for them.Good point.

I guess my position is I’m ok with the Bill Gates and Paul Allens of the world passing on tremendous wealth to their heirs. They built some great companies.

My dad died in 2020. My brother and I inherited the farm without paying a single cent of estate tax. The most expensive part were the lawyer fees. My brother died of a heart attack in September. I am in the process of inheriting his half of the farm. This time because I'm not a direct descendant I will pay 6% inheritance tax.I have farmers who do everything in their power to not pay a single cent. I think there should be something there, but how to fix it not sure. They are asset and land rich. However, immense debt. The debt may overtake at the end not sure.

Similar threads

- Replies

- 0

- Views

- 182

ADVERTISEMENT

ADVERTISEMENT