ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Grocery food prices are expected to fall in 2024 and 2025

- Thread starter THE_DEVIL

- Start date

Every time I check out at the grocery store

this is also the worst ITYSL by far.Every time I check out at the grocery store

The housing market is getting ready to crash. Grocery store prices will be the least of your worries.

Let the lenders fry this time. Learned nothing from last time.The housing market is getting ready to crash. Grocery store prices will be the least of your worries.

Grocery stores took COVID and ran with it. Prices never came back down. They are making record profits. Time monopolies to be broken up.

Good. Housing prices are insane.The housing market is getting ready to crash. Grocery store prices will be the least of your worries.

Glad we got Biden leading the charge on that. Hopefully it’s between 10 and 4 when it finally goes or we might be in trouble.Let the lenders fry this time. Learned nothing from last time.

Let the lenders fry this time. Learned nothing from last time.

Yeah, what could possibly go wrong?

We're past the halfway point in 2024 and they didn't fall.

yep, companies now own 100s of products, and take profits as high as possible.Grocery stores took COVID and ran with it. Prices never came back down. They are making record profits. Time monopolies to be broken up.

Actual responsibility with no government bailouts? The horror.Yeah, what could possibly go wrong?

Last time gave bailouts to billionaires and tacked on trillions to the debt with nobody learning a damn thing except, “ dont worry, the government will bail you out”

Last edited:

Good. Housing prices are insane.

I have a fixed 2.5% mortgage rate. Don't care what prices do.

of course. Just when I have mastered killing my own food.

How was the racoon tonight?

Tonight was "squirrel brisket"....How was the racoon tonight?

Actual responsibility with no government bailouts? The horror.

Or a recession, which is an actual horror.

coons are for tenderfoot. I feast on Griz, pilgram.How was the racoon tonight?

Reagan stopped enforcement of the Sherman Act, and look where we are after 40 years of that.Grocery stores took COVID and ran with it. Prices never came back down. They are making record profits. Time monopolies to be broken up.

Just sayin'.

Reagan stopped enforcement of the Sherman Act, and look where we are after 40 years of that.

Just sayin'.

Yes. I still think there is enough teeth in the law.

They took the money the government printed in response to COVID.Grocery stores took COVID and ran with it. Prices never came back down. They are making record profits. Time monopolies to be broken up.

You jack up the money supply to pay for things instead of tax it from the public and the consequence is the regressive tax of inflation.

Supply and demand cannot be conned.

I don’t think food consumption and production have changed much since January 2020. Put the money supply back at 2020 levels and you’ll see closer to 2020 prices.

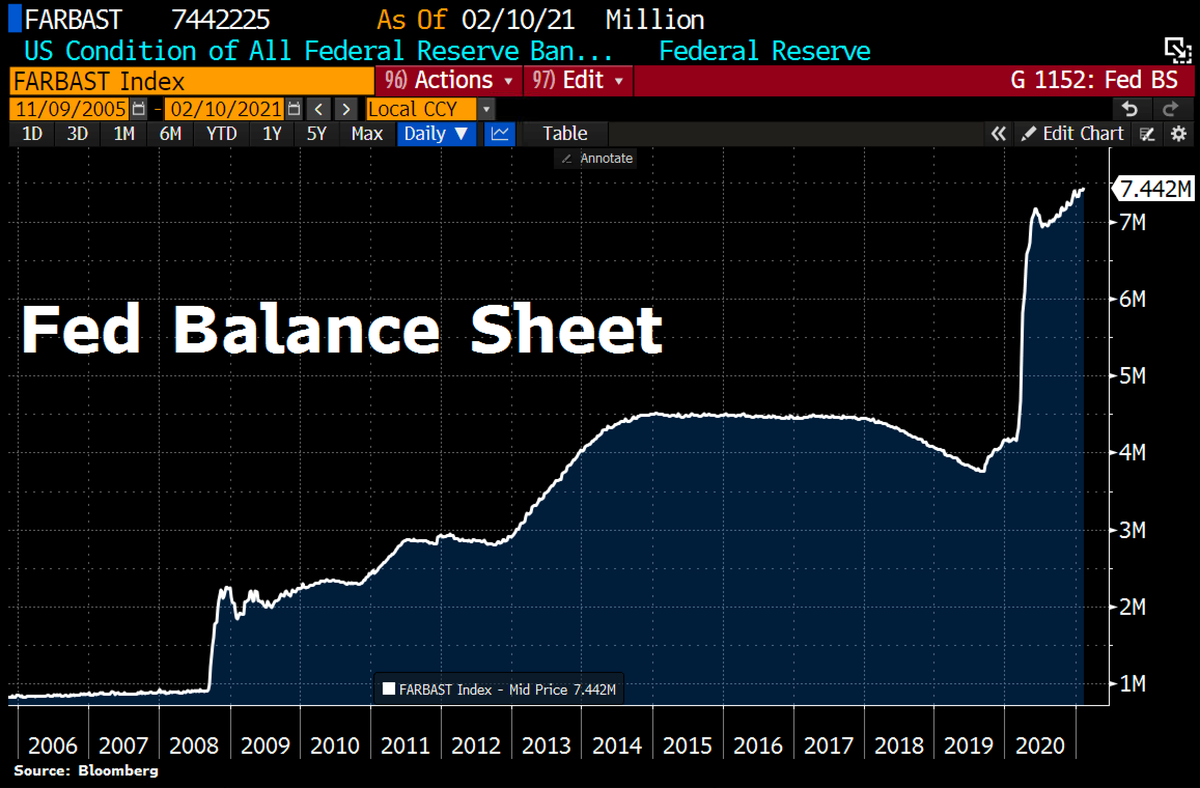

September of 2019 Federal Reserve balance sheet was at 3.7 trillion. By June of 2020 it was over 7 trillion. Price increases inevitably followed. Balance sheet kept growing until it peaked at 8.9 trillion in May 2022. It’s down to 7.2 trillion now.

We’ll see when they stop and start printing money for bailouts again.

So why did other Western countries have higher inflation in response to Covid?They took the money the government printed in response to COVID.

September of 2019 Federal Reserve balance sheet was at 3.7 trillion. By June of 2020 it was over 7 trillion.

#ThanksTrump??

So why did other Western countries have higher inflation in response to Covid?

Because they played the same game, but without the globe using their currency for international trade to the degree of the USD.

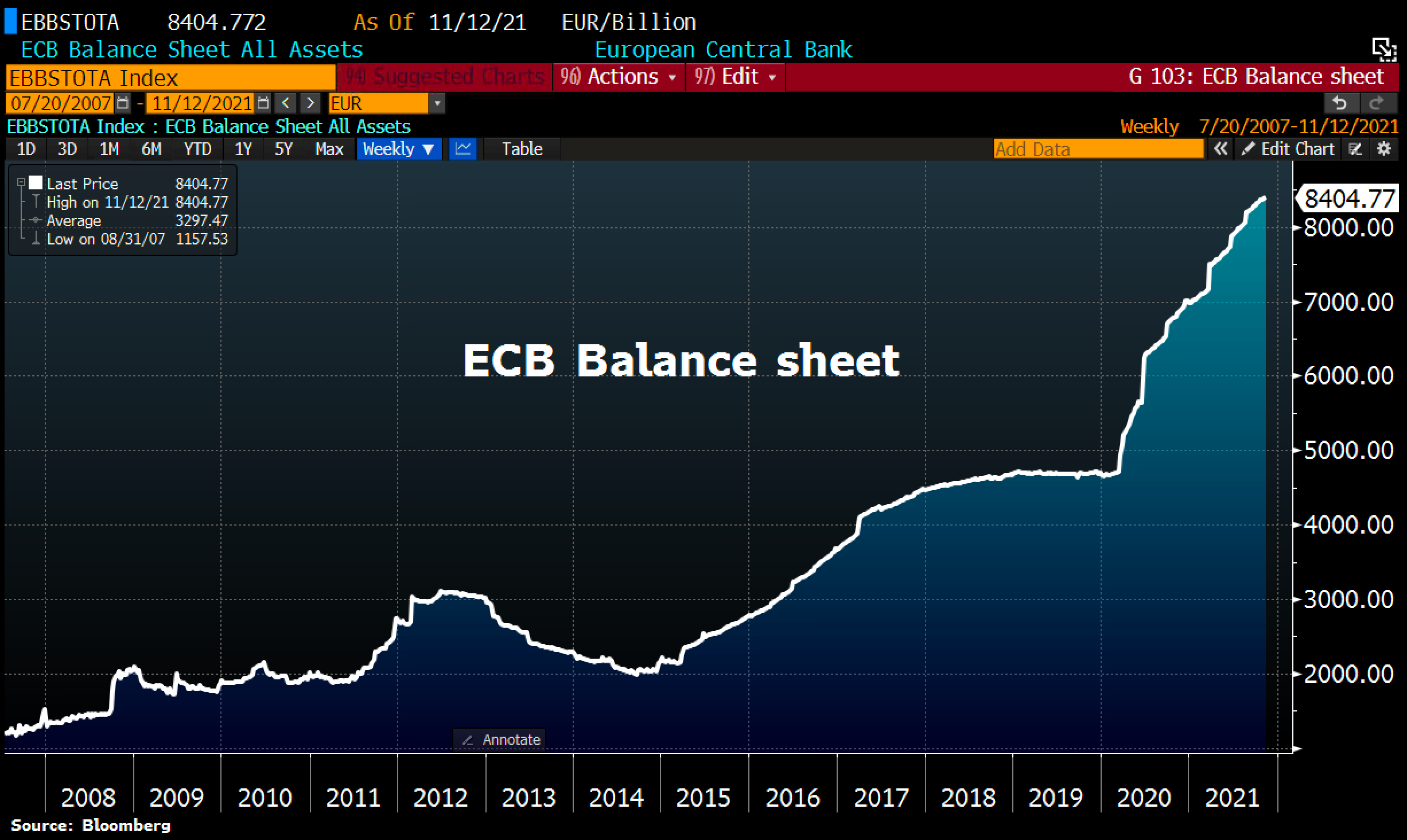

Look at the ECB balance sheet:

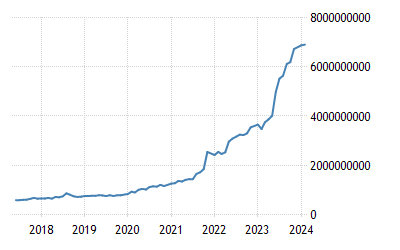

Turkish Central Bank Balance Sheet:

and here is the balance sheet at the Fed, where Biden re-appointed Chairman Powell and has supported every bit and more of the federal spending that has occurred and been monetized by the Fed:

Look up the UK balance sheet, going from 719 billion in 2019 to over 1.3 trillion in 2022.

Without other nations clamoring for Turkish lire, British pounds, or even EU euros with the same level of demand as USD, those countries saw their money printing bring even worse inflation.

Make no mistake, the money printing caused the price increases. It does not do so instantaneously, but through progressive transactions over time.

Draining the monetary pool can have the opposite effect.

In before @FSUTribe76 gives us his preferred methods of preparing squirrel, and the top 20 restaurants he’s had squirrel at.

Similar threads

- Replies

- 0

- Views

- 78

- Replies

- 40

- Views

- 669

- Replies

- 12

- Views

- 341

ADVERTISEMENT

Latest posts

-

-

-

-

HawkCast Ep. 80 OVERREACTION TIME? Iowa Releases Pre-Camp Depth Chart

- Latest: Eliot Clough

ADVERTISEMENT