Biden Budget Will Underscore Divide With Republicans and Trump

The president’s fiscal 2025 budget proposal includes about $3 trillion in deficit reduction over a decade, largely from raising taxes on high earners and corporations.President Biden on Monday will propose a budget packed with tax increases on corporations and high earners, new spending on social programs, and a wide range of efforts to combat high consumer costs like housing and college tuition.

The new spending and tax increases included in the fiscal 2025 budget stand almost no chance of becoming law this year, given that Republicans control the House and roundly oppose Mr. Biden’s fiscal agenda. Last week, House Republicans passed a budget proposal outlining their priorities, which are far afield from what Democrats have called for.

Instead, the document will serve as a draft of Mr. Biden’s policy platform as he seeks re-election in November, along with a series of contrasts intended to draw a distinction with his presumptive Republican opponent, former President Donald J. Trump.

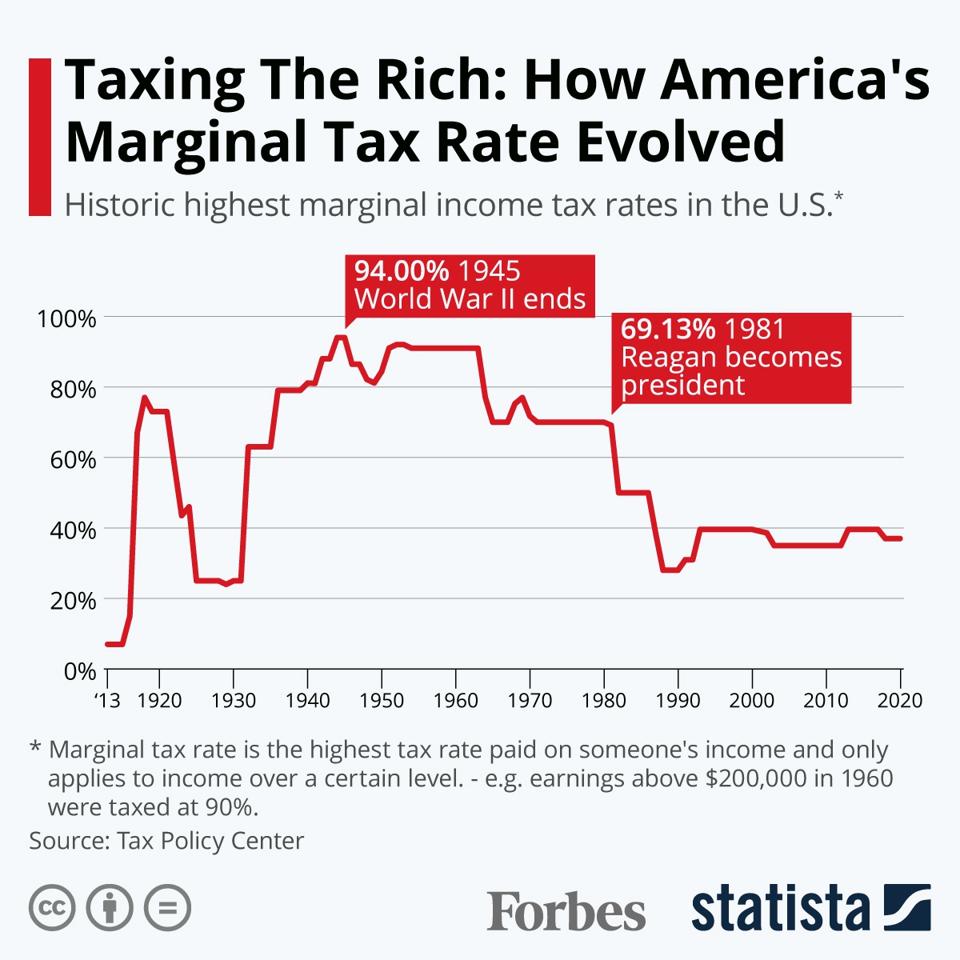

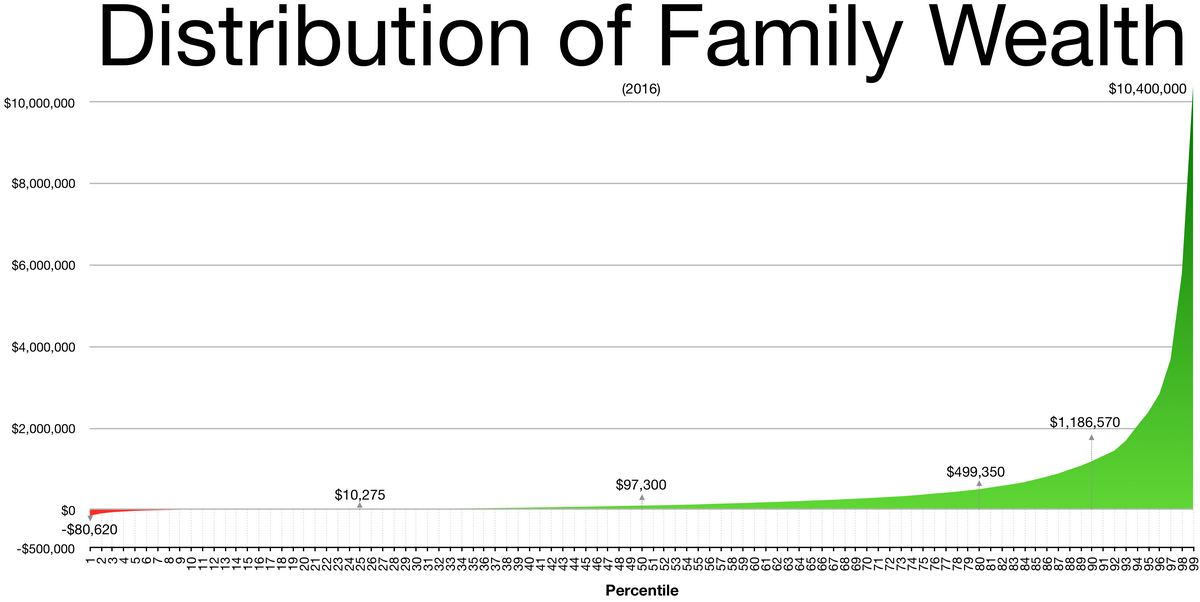

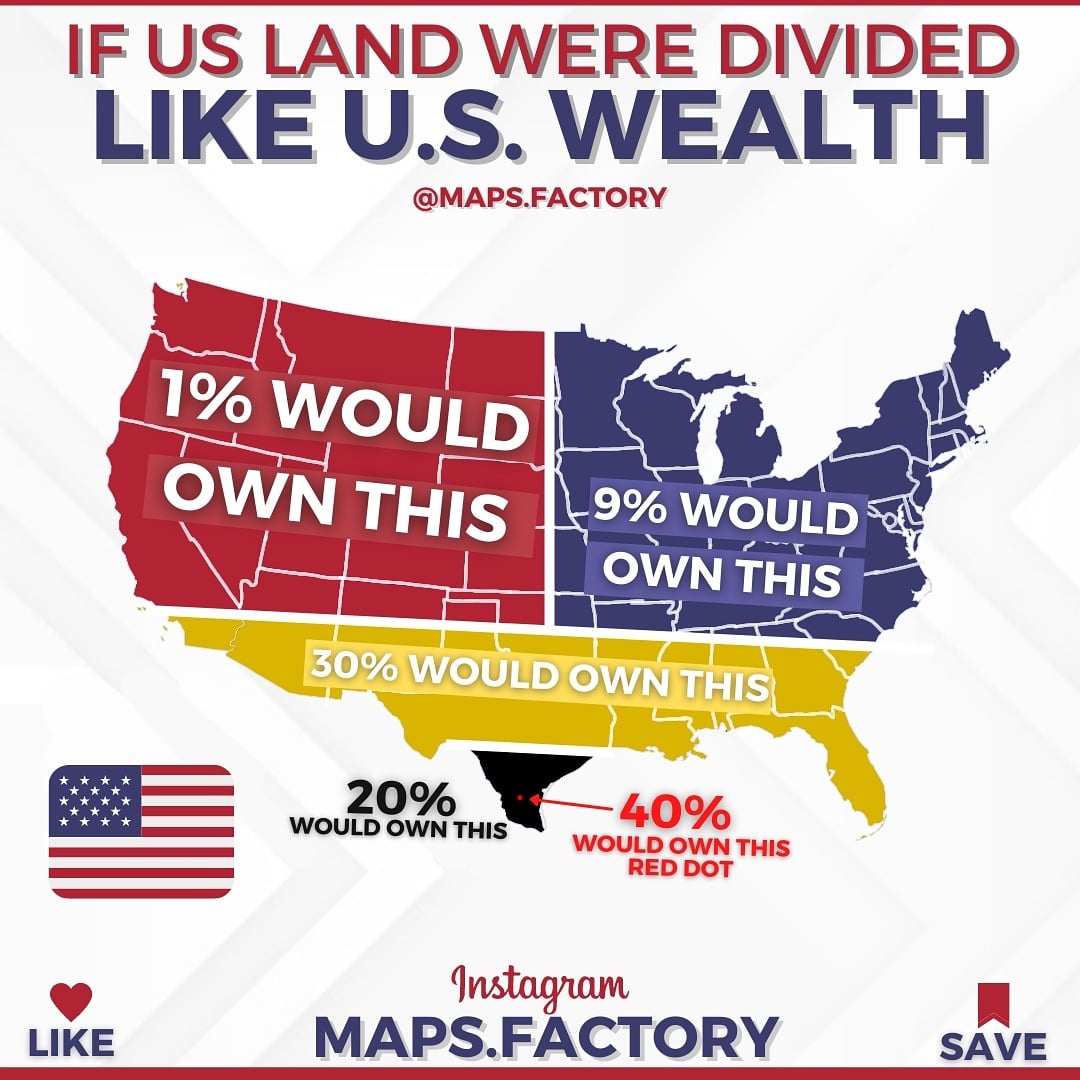

Mr. Biden has sought to reclaim strength on economic issues with voters who have given him low marks amid rapid inflation. This budget aims to portray him as a champion of increased government aid for workers, parents, manufacturers, retirees and students, as well as the fight against climate change. Mr. Biden’s budget proposes to more than offset the cost of those priorities through increased taxes on large companies and the wealthy. The president has already begun trying to portray Mr. Trump as the opposite: a supporter of further tax cuts for corporations.

“A fair tax code is how we invest in things that make this country great: health care, education, defense and so much more,” Mr. Biden said on Thursday during his State of the Union address.

Later in the speech, in a call-and-response with Democrats in the chamber, Mr. Biden added: “Folks at home, does anybody really think the tax code is fair? Do you really think the wealthy and big corporations need another $2 trillion tax break? I sure don’t. I’m going to keep fighting like hell to make it fair.”

Polls show Americans are dissatisfied with Mr. Biden’s handling of the economy and favor Mr. Trump’s approach to economic issues. But Mr. Biden has been unwavering in his core economic-policy strategy, and the budget is not expected to deviate from that plan.

more here: