Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What Would You Do If You Could Be DICTATOR FOR A DAY?

- Thread starter What Would Jesus Do?

- Start date

Fair points.

Which is also for the record I don't understand why people have such a big income range for middle class.

People will literally say middle class is like 50k to 300k or something like that. But as someone towards the bottom of that range I will tell you someone towards the top of that range doesn't live in the same world as someone at the bottom of that range.

We could probably stand to break it up into more than 3 or 4 economic classes. But the economic classes should be such that if you took someone from the top range of that class and someone from the bottom range of that class and put them in the same car or same house they shouldn't have wildly different opinions of that home to where one thinks it's a dump and the other one thinks it's great.

2 people in the same "economic class" should have more in common financially than "Well neither of us can afford a yacht or a private jet" Because that's like saying two people look a like because the they have similar length toes.

Death to @McLovin32

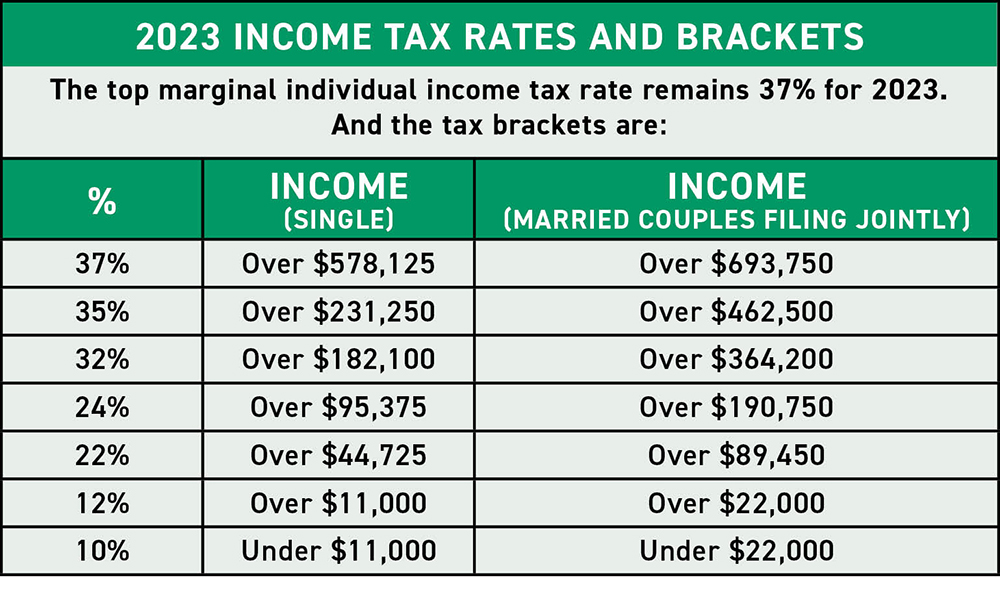

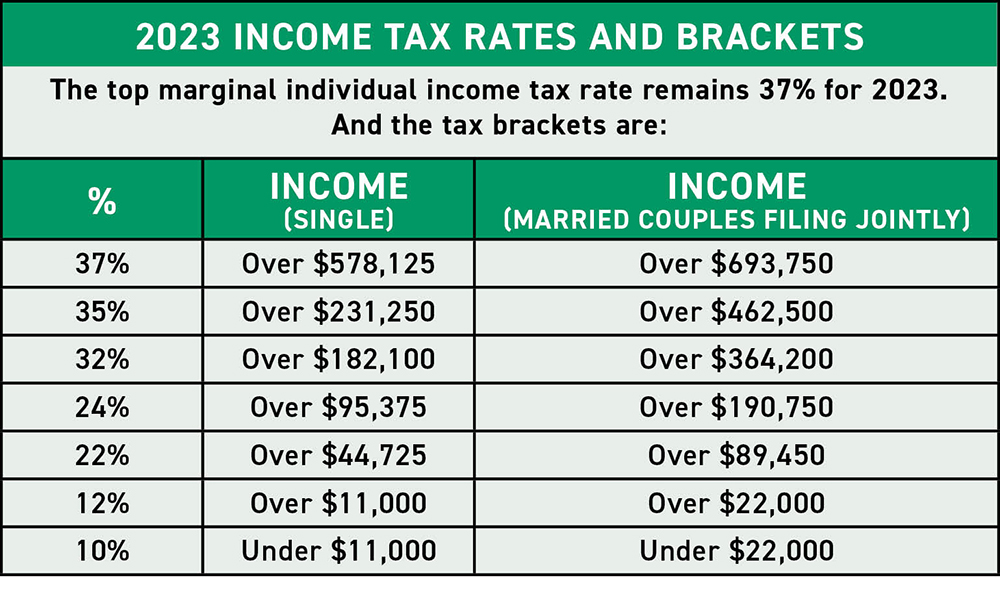

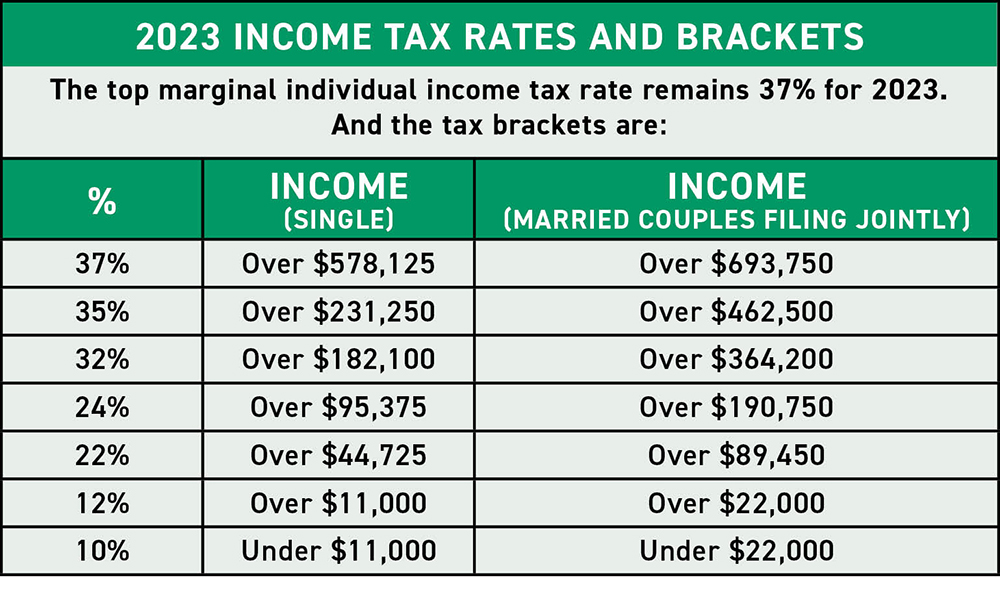

We do break it up more into more classes, although they are called tax brackets:Which is also for the record I don't understand why people have such a big income range for middle class.

People will literally say middle class is like 50k to 300k or something like that. But as someone towards the bottom of that range I will tell you someone towards the top of that range doesn't live in the same world as someone at the bottom of that range.

We could probably stand to break it up into more than 3 or 4 economic classes. But the economic classes should be such that if you took someone from the top range of that class and someone from the bottom range of that class and put them in the same car or same house they shouldn't have wildly different opinions of that home to where one thinks it's a dump and the other one thinks it's great.

2 people in the same "economic class" should have more in common financially than "Well neither of us can afford a yacht or a private jet" Because that's like saying two people look a like because the they have similar length toes.

Last edited:

This is why details are important. Damn.Playing djinni game where you technically get what you asked for but not what you intended, she's ready to rock your world:

My favorite quote from the movies my kids watched when they were young:This is why details are important. Damn.

Edit:I'd rewrite the qualifications to be president from day two and going foreword:

1. Natural born citizen 35 -65. Mandatory retirement at 65 or when term expires if elected before 65.

2. Advanced degree with majors in economics, finance, political science or real science. Minor in world history.

3. At minimum two years of military service or education.

4. One 6 year term in office.

5. 6 week election window for campaigning and advertising.

6. The Government funds all candidates equally with no private or outside monies allowed.

7. All candidates have to take both SAT and ACT tests and their test scores posted along with their GPAs...

Can you throw in some term limits for Congress and an independent ethics board to investigate all claims if congressional wrongdoing?I'd rewrite the qualifications to be president from day two and going foreword:

1. Natural born citizen 35 -65. Mandatory retirement at 65 or when term expires if elected before 65.

2. Advanced degree with majors in economics, finance, political science or real science. Minor in world history.

3. At minimum two years of military service or education.

4. One 6 year term in office.

5. 6 week election window for campaigning and advertising.

If you're feeling generous, do away with qualified immunity too.

I know it would be a little much to break it down more but going from $89,450 - $190,750 with a joint income is a huge difference. You’re going from struggling to scrape by to living pretty comfortably.We do break it up more into more classes, although they are called tax brackets.:

You won't draw an argument from me. There is a massive difference in the standard of living going from $90K to $190k.I know it would be a little much to break it down more but going from $89,450 - $190,750 with a joint income is a huge difference. You’re going from struggling to scrape by to living pretty comfortably.

We do break it up more into more classes, although they are called tax brackets.:

I know, although those top end tax brackets should be higher. I would say drop the bottom tax bracket entirely.

Start the bottom off at like 10 for singles and 20 for married at like 10%. At 20 for singles and 40 for married make it 15%. At 30 for singles and 60 for married make it 20% . . . Keep going like that adding 5% starting at every 10k for singles and 20k for married until you get up to about 50% and make 50% your max tax bracket.

I would also say outside of retirement funds, investment income needs to be taxed at the same way everything else is.

We also needs some taxes on inheritances over 5 Mil.

Jesus just move to a socialist country already. Under your tax structure, someone making $90K would be taxed at 50%.I know, although those top end tax brackets should be higher. I would say drop the bottom tax bracket entirely.

Start the bottom off at like 10 for singles and 20 for married at like 10%. At 20 for singles and 40 for married make it 15%. At 30 for singles and 60 for married make it 20% . . . Keep going like that adding 5% starting at every 10k for singles and 20k for married until you get up to about 50% and make 50% your max tax bracket.

I would also say outside of retirement funds, investment income needs to be taxed at the same way everything else is.

We also needs some taxes on inheritances over 5 Mil.

| $ 10,000.00 | 10% |

| $ 20,000.00 | 15% |

| $ 30,000.00 | 20% |

| $ 40,000.00 | 25% |

| $ 50,000.00 | 30% |

| $ 60,000.00 | 35% |

| $ 70,000.00 | 40% |

| $ 80,000.00 | 45% |

| $ 90,000.00 | 50% |

I'm not going to get too into this tax fight.....But there truly are some fundamental changes that need to be made to the system. Eisenhower/Kennedy tax rates were much, much more fair and the economy still boomed.

The top tax rate in 1963 was 91%. I am not saying adjustments should not be made to the current system, but that is insane.I'm not going to get too into this tax fight.....But there truly are some fundamental changes that need to be made to the system. Eisenhower/Kennedy tax rates were much, much more fair and the economy still boomed.

The top tax rate in 1963 was 91%. I am not saying adjustments should not be made to the current system, but that is insane.

Still worked though, didn't it?

We can't continue to fund the military industrial complex without higher taxes. We can't fix deteriorating roads and bridges without higher taxes. We can't educate our children without higher taxes.

Those that benefit the most by our tax system are those those that don't want to pay

Those that benefit the most by our tax system are those those that don't want to pay

And I understand those without IPERS or a military pension have to save. I get it. But generational wealth passed on by tens of millions/billions is not healthy for a civilized society

I don't know. Not my area, but I suppose I would need to see what the deductions, credits, safe havens, shelters, etc. were. In any event, Congress saw fit to pass the Revenue Act of 1964 to reform it. This article suggests that through tax avoidance (not evasion), the top earners only paid about 45%.Still worked though, didn't it?

How a 91% rate sparked the golden age of tax avoidance in 1950s Hollywood

After Rep.

Last edited:

No one making $150K to $400K per year is socking away tens of millions/billions, at least not without getting extremely lucky investing.And I understand those without IPERS or a military pension have to save. I get it. But generational wealth passed on by tens of millions/billions is not healthy for a civilized society

I'll push back. I am not saying the current tax rates are where they should be, but how does someone making $300K benefit more from the system than someone making $30k? .We can't continue to fund the military industrial complex without higher taxes. We can't fix deteriorating roads and bridges without higher taxes. We can't educate our children without higher taxes.

Those that benefit the most by our tax system are those those that don't want to pay

No one making $150K to $400K per year is socking away tens of millions/billions, at least not without getting extremely lucky investing.

Agreed. Your family range of income is not what I'm talking about.

I'll push back. I am not saying the current tax rates are where they should be, but how does someone making $300K benefit more from the system than someone making $30k? .

Consumption based taxes are always going to hurt the 30k more than 300k

Got it. It was hard to tell whose, if anyone's, banner you were carrying. Hoosier was advocating a 50% tax rate for those making 90K. I am mixing apples and oranges.Agreed. Your family range of income is not what I'm talking about.

I don't know. Not my area, but I suppose I would need to see what the deductions, credits, safe havens, shelters, etc. were. In any event, Congress saw fit to pass the Revenue Act of 1964 to reform it. This article suggests that through tax avoidance (not evasion), the top earners only paid about 45%.

How a 91% rate sparked the golden age of tax avoidance in 1950s Hollywood

After Rep.www.latimes.com

Deferring realized gains until the right person is in the white house strongly hurts the base of people that need those taxes to pay for schools, roads, sewer systems, etc.

Got it. It was hard to tell whose, if anyone's, banner you were carrying. Hoosier was advocating a 50% tax rate for those making 90K. I am mixing apples and oranges.

A family of 5 should not be paying a similar tax rate to a marriage of 2 that makes 10 times more money.

It's not about being fair. Its about being equitable and helping the country as a whole (starting to sound like commie Northern will say)

Yeah, I get the concepts of marginal utility and how consumption/flat taxes hurt more the less you make. I was more interested in how the person making $300K was benefiting from the government more than the person making $30K.Consumption based taxes are always going to hurt the 30k more than 300k

And they don't.A family of 5 should not be paying a similar tax rate to a marriage of 2 that makes 10 times more money.

It's not about being fair. Its about being equitable and helping the country as a whole (starting to sound like commie Northern will say)

And they don't.

With write offs, tax shelters and consumption taxes....the % is pretty damn close

Again, I used to be stubborn on paying less taxes. I was reformed by the practice of law and seeing how poor people struggle to get by. Many of them are lazy. But most of them want to be in a better place. Landlords, inability to pay for transportation, a criminal justice system that has increasingly become a debtors court, and the day to day expenses makes it extremely difficult. Forgot to add on access to medical care.

Those that can afford to pay, should.

Those that can afford to pay, should.

Certainly a healthy debate for all of us to continue to look at and not put our heads in the sand from the left, middle, or right.

I am sure there are those who do a great job of minimizing their tax burden - like farmers - but for the vast majority of people out there I have a hard time believing that. If you link something to support your claim, I would read it.With write offs, tax shelters and consumption taxes....the % is pretty damn close

I am sure there are those who do a great job of minimizing their tax burden - like farmers - but for the vast majority of people out there I have a hard time believing that. If you link something to support your claim, I would read it.

I'll see what I can find for you (I"m not as helpful as @cigaretteman ) when it comes to citing articles. I have read plenty of articles, but will have to find them. Fair question.

To me, this is an interesting article. It is only like the top 0.1% of the wealthy that generate enough capital gains to really avoid income tax.I'll see what I can find for you (I"m not as helpful as @cigaretteman ) when it comes to citing articles. I have read plenty of articles, but will have to find them. Fair question.

The difference in how the wealthy make money—and pay taxes | Brookings

Jesus just move to a socialist country already. Under your tax structure, someone making $90K would be taxed at 50%.

$ 10,000.00 10% $ 20,000.00 15% $ 30,000.00 20% $ 40,000.00 25% $ 50,000.00 30% $ 60,000.00 35% $ 70,000.00 40% $ 80,000.00 45% $ 90,000.00 50%

90k plus deductions as a single person with no kids.

And remember they are only taxed 50 percent on what they make over 90k plus deductions.

I'd have Selma Hayek do my bidding for a day.

I think if you were not dictator for the day, but a legislator introducing a bill, 99% of congress, if not 100%, would tell you to GTFO.90k plus deductions as a single person with no kids.

And remember they are only taxed 50 percent on what they make over 90k plus deductions.

Not reading though this thread but I assume I'm at least the tenth person to say hookers and blow.

Install the best pooper money can buy and ensure a lifetime of unlimited usage for me and me only.

I think if you were not dictator for the day, but a legislator introducing a bill, 99% of congress, if not 100%, would tell you to GTFO.

Yeah sure are all rich, most are multi millionares. None of them think they are rich yet almost none of them have any clue about the struggles of a large number of the people they represent.

Rich people don't tend to like to make sacrifices for the betterment of society, that is the job for poor people who are the ones who not only often do the hardest labor but when the rich people start wars the poor people go to die in them.

But figure someone makes 103500 just to make it easy. By my calculations after federal taxes, social security and Medicare they are still left with a take home pay of 68,500 or about $5700 a month.

That probably horrified you but most of the country lives on less than that now in terms of take home pay.

Last edited:

Similar threads

- Replies

- 9

- Views

- 208

- Replies

- 7

- Views

- 186

- Replies

- 0

- Views

- 77

- Replies

- 0

- Views

- 80

- Replies

- 56

- Views

- 882

ADVERTISEMENT

ADVERTISEMENT