I appreciate your perspective and what you’re saying makes a lot of sense to me.The only thing that is non-negotiable is actually the debt expense (14th amendment).

So you have to cut back the military empire, and you have to roll back government transfer payments insofar as they are financed by increasing debt.

I'm sorry I was misunderstood.

FDR gave America the middle finger with this stupid ponzi scheme. That's done.

Baby Boomers are still getting 100% of promised benefits (22 tax increases later), but in time the IOUs at the Treasury will be burned through, and the payroll taxes will cover ~77% of benefits for the tail end of the Boomers and those who follow.

Ponzis can't work. The government didn't 'screw it up', aside from convincing the public to support it in the first place.

None of the debt is dated beyond 30 years, most of much shorter.

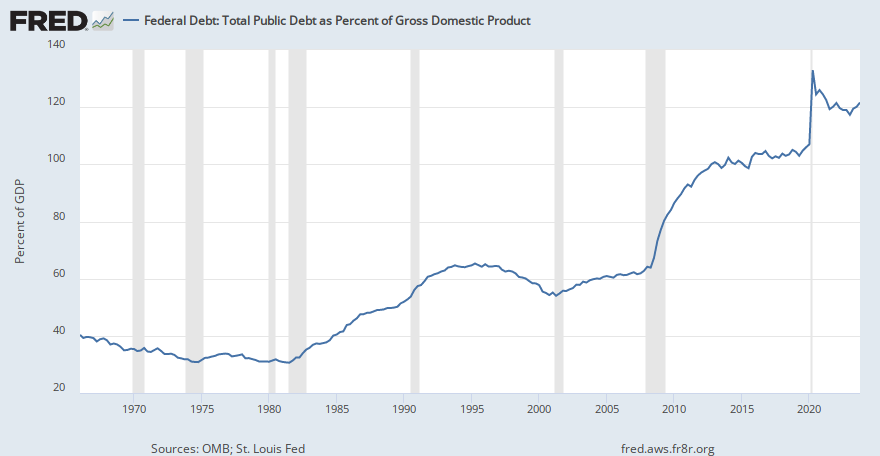

The decision to run deficits is wholly political, and the inflation that results is wholly the negative aspect of a deliberate and ultimately regressive policy choice to spend more than the country taxes.

When look back to the 1950s, or whatever decade with a different income tax rate structure the Progressives demand, I see less than 20% of GDP captured in taxes.

So we need to find a way to spend under that reality, and not let the Left throw a tantrum about a return to Clinton era spending levels.

It was not 'End Times' for crissakes.

With that said, you believe government would not have to increase taxes at all? That there are enough spending cuts to make getting out of the red possible without it?