I’d be surprised if it did, but maybe their definition of “around” is different than mine. 😉This is now an electric truck/SUV thread.

Do you think the R2 will come out in 2026 for $45k?

If the last few years have taught us anything about electric vehicles, it's that they're easy to design but hard to manufacture at scale — and even harder to do so profitably.

Why it matters: Rivian revealed three additional new vehicles on Thursday, but like many other EV makers before it, the company is still burning cash at a breathtaking pace.

Reality check: The automaker — which currently sells the premium R1T pickup and R1S SUV — lost about $43,000 per vehicle in its most recent period, Reuters reported.

- The R2, a midsize SUV, would be the automaker's most affordable vehicle yet at around $45,000.

- The surprise unveiling of two additional and even more affordable models to come later — the R3 and R3X crossovers — was reminiscent of a Steve Jobs "one more thing" product introduction at Apple, Axios' Joann Muller reports.

Between the lines: Shortly after the glitzy event Thursday arranged to draw attention to its new, more affordable EVs, Rivian dropped an SEC filing saying that it was suspending plans for a $5 billion factory in Georgia.

- "We think there's a real risk that the R2 may never see the light of day," CFRA analyst Garrett Nelson wrote in a research note, adding that "we see [Rivian's] cash burn accelerating in the coming quarters."

"What we've always said is it's really important for us to make sure we have a strong balance sheet and to make sure that we're not in a position where we're putting the business at risk," Rivian CEO RJ Scaringe told Muller.

- The company said it will instead make the R2 initially more affordably at its current facility in Illinois.

The big picture: Rivian's growing pains are reflective of a broader problem for EV companies — that designing and engineering EVs is a lot easier than making them at a profit.

- "We're tracking towards and focused on both rapidly achieving a scale that ... we're accomplishing, but also doing it in a way that gets us to profitability as fast as possible."

- At this point, only Tesla can plausibly claim that it's figured out a formula for making EVs profitably — and only after a brutal stretch of red ink that nearly tanked the company.

- Others — including established automakers like GM and Ford and startup companies like Fisker and Lordstown — have not yet found a path into the black.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

11/30 Update - Cybertruck Delivery Event (Link)

- Thread starter Phenomenally Frantastic

- Start date

Their website says: "Deliveries expected to begin in the first half of 2026."I’d be surprised if it did, but maybe their definition of “around” is different than mine. 😉

Yep. Was going to add they put themselves in a tighter box than just stating “2026.”Their website says: "Deliveries expected to begin in the first half of 2026."

Off topic: Rivian CEO looks like a cleaned up version of Steve-O.

I can see why people would stop and look at a CyberTruck. I would check it out if I had the opportunity even though I’d never want one.

I kinda like the looks of that new Honda Prologue EV SUV.

I kinda like the looks of that new Honda Prologue EV SUV.

Saw a cybertruck on I10 yesterday. Looked pretty cool in person.

“I’ve never owned a Tesla simply because I’ve never needed one which meant I really didn’t know that much about the company so what I really loved about this project was discovering how insanely passionate Tesla employees and fans are about technology and innovation, like these people genuinely love what they do.

So even if you’re not a fan of electric vehicles or some of Tesla‘s designs, we should all be cheering for this aggressive, innovative, and passionate American company which employees a lot of American people because at the end of the day differences aside, we are all on the same team 🤝 (except for government mandated EV ownership, that is not on our team)”

Saw my third one at my kids soccer practice last night. My 5 yo makes a comment that it looks like something from Minecraft.

Don Lemon demanded the sun, the moon and the stars from the SpaceX boss – before being unceremoniously dumped this week, The Post has learned.

The ex-CNN anchor sent over an astronomical wish list to Elon Musk during contract talks to host a show on the billionaire’s social media platform X – including a free Tesla Cybertruck, a $5 million upfront payment on top of an $8 million salary, an equity stake in the multibillion-dollar company, and the right to approve any changes in X policy as it relates to news content, according to a document reviewed by The Post.

The ex-CNN anchor sent over an astronomical wish list to Elon Musk during contract talks to host a show on the billionaire’s social media platform X – including a free Tesla Cybertruck, a $5 million upfront payment on top of an $8 million salary, an equity stake in the multibillion-dollar company, and the right to approve any changes in X policy as it relates to news content, according to a document reviewed by The Post.

Saw my third one at my kids soccer practice last night. My 5 yo makes a comment that it looks like something from Minecraft.

He’s right. 👾 👽

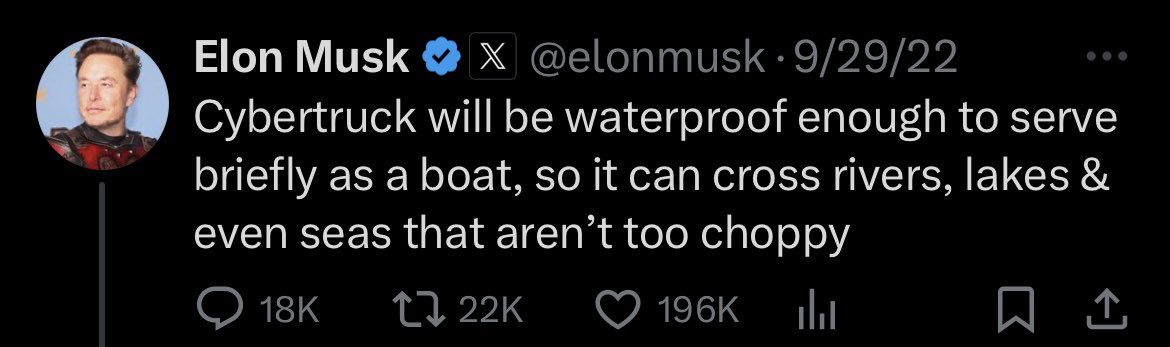

Cool, just avoid puddles!

Cool, just avoid puddles!

puddles, standing water, tomato, tomahtoe

Saw first Cybertruck in the wild today. Noticed the headlights and looked to the oncoming lanes late to see it well, but I think it was in a gloss black wrap.

Anyway, prices cuts coming to Ford Lightnings:

Shares of Rivian Automotive, Lucid Group, and Tesla Motors moved lower during the cash session in the US after Ford Motor announced price cuts for its electric F-150 Lightning pickup truck amid concerns about sliding demand across the EV industry. Meanwhile, an EV price war between the automakers rages on as unprofitable EV startups struggle to survive.

Let's begin with a Bloomberg report that says Ford is reducing the price of its Lightning pickup truck by up to 7.5%. Earlier this year, the company paused production of the truck and is set to resume production later in the month

The largest price cut is on the Flash extended-range model, where customers could expect to save $5,500. The model now starts at around $67,995. Ford told Bloomberg that price cuts will help it "adapt to the market to achieve the optimal mix of sales growth and customer value."

The downshift in EV demand has led Chief Executive Officer Jim Farley to reevaluate Ford's EV strategy by reducing spending on battery-powered vehicles by $12 billion, delaying the launch of various models, and beginning to offer an expanded lineup on gas-electric hybrid propulsion vehicles across North America.

Thousands of auto dealers nationwide recently warned the 'climate change warriors' in the White House: the 2030 EV push is backfiring.

"Currently, there are many excellent battery electric vehicles available for consumers to purchase. These vehicles are ideal for many people, and we believe their appeal will grow over time. The reality, however, is that electric vehicle demand today is not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots," the dealers said.

Many consumers do not embrace the government's and corporate America's forced EV adoption schemes. This is now entirely backfiring, as even Tesla's first-quarter deliveries lagged behind expectations, which may indicate more price cuts are coming.

"Reports of Ford reducing prices for the F-150 Lightning EV are sending shockwaves through the EV market, particularly affecting Rivian and Lucid," Bloomberg Intelligence analyst Steve Man said.

Man said, "Both startups are facing challenges that could be exacerbated by another round of EV price cuts, potentially eroding their profit margins and cash reserves at a time when they need to conserve cash."

Shares of Rivian dropped the most, down 6.5% in early afternoon trade. Shares of Lucid were down around 2.5%, and Tesla was flat on the session.

Recall analyst Adam Jonas at Morgan Stanley recently suggested consolidation is coming to the industry:

Anyway, prices cuts coming to Ford Lightnings:

Shares of Rivian Automotive, Lucid Group, and Tesla Motors moved lower during the cash session in the US after Ford Motor announced price cuts for its electric F-150 Lightning pickup truck amid concerns about sliding demand across the EV industry. Meanwhile, an EV price war between the automakers rages on as unprofitable EV startups struggle to survive.

Let's begin with a Bloomberg report that says Ford is reducing the price of its Lightning pickup truck by up to 7.5%. Earlier this year, the company paused production of the truck and is set to resume production later in the month

The largest price cut is on the Flash extended-range model, where customers could expect to save $5,500. The model now starts at around $67,995. Ford told Bloomberg that price cuts will help it "adapt to the market to achieve the optimal mix of sales growth and customer value."

The downshift in EV demand has led Chief Executive Officer Jim Farley to reevaluate Ford's EV strategy by reducing spending on battery-powered vehicles by $12 billion, delaying the launch of various models, and beginning to offer an expanded lineup on gas-electric hybrid propulsion vehicles across North America.

Thousands of auto dealers nationwide recently warned the 'climate change warriors' in the White House: the 2030 EV push is backfiring.

"Currently, there are many excellent battery electric vehicles available for consumers to purchase. These vehicles are ideal for many people, and we believe their appeal will grow over time. The reality, however, is that electric vehicle demand today is not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots," the dealers said.

They warned: "Already, electric vehicles are stacking up on our lots which is our best indicator of customer demand in the marketplace."

Many consumers do not embrace the government's and corporate America's forced EV adoption schemes. This is now entirely backfiring, as even Tesla's first-quarter deliveries lagged behind expectations, which may indicate more price cuts are coming.

"Reports of Ford reducing prices for the F-150 Lightning EV are sending shockwaves through the EV market, particularly affecting Rivian and Lucid," Bloomberg Intelligence analyst Steve Man said.

Man said, "Both startups are facing challenges that could be exacerbated by another round of EV price cuts, potentially eroding their profit margins and cash reserves at a time when they need to conserve cash."

Shares of Rivian dropped the most, down 6.5% in early afternoon trade. Shares of Lucid were down around 2.5%, and Tesla was flat on the session.

Recall analyst Adam Jonas at Morgan Stanley recently suggested consolidation is coming to the industry:

First cybertruck spotted on 4/11? Must live around poors. Have seen at least one every single day for 10 days now (not counting the two I see almost everyday at school drop off). Best was seeing a 65+ year young grandmother get out of one.

Can get a good deal on a model y right now with the price cut. Attempting to move more units to get closer to projections, and/or attempting to get rid of stock before spy shots of the model y refresh hit.

Would think the not-so-secret Model 3 plaid will be made available soon. Already having some issues with current/newish model 3 production, so interested to see how new sku factors in.

Can get a good deal on a model y right now with the price cut. Attempting to move more units to get closer to projections, and/or attempting to get rid of stock before spy shots of the model y refresh hit.

Would think the not-so-secret Model 3 plaid will be made available soon. Already having some issues with current/newish model 3 production, so interested to see how new sku factors in.

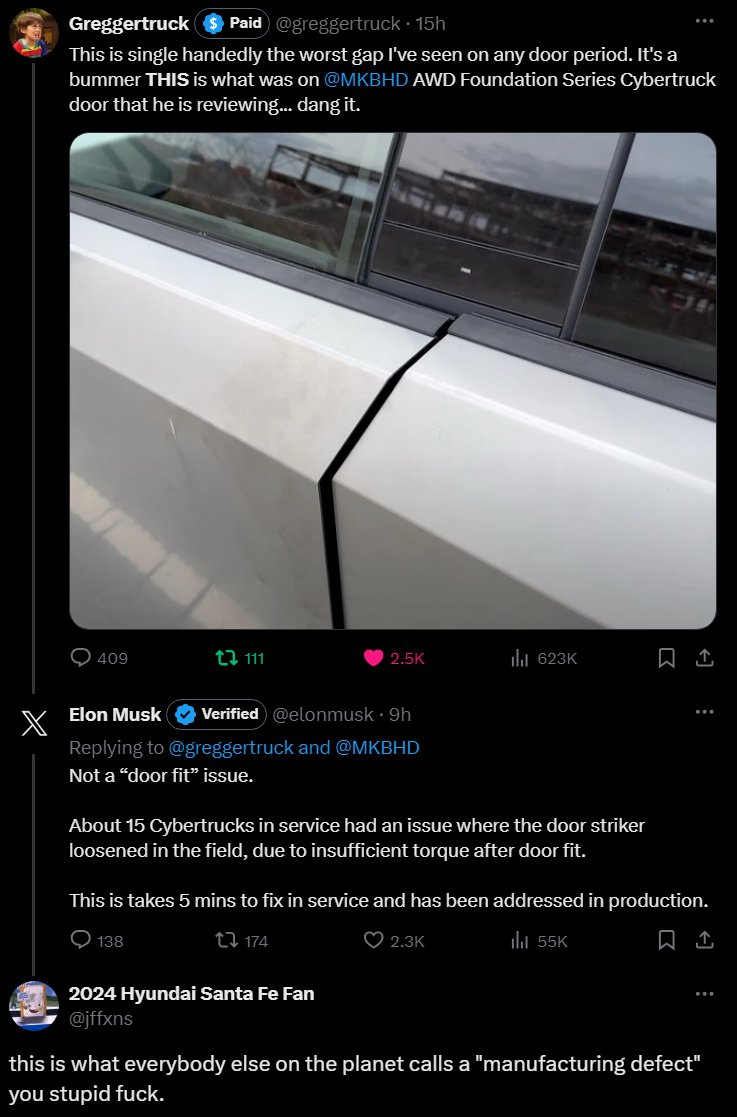

Tesla Cybertruck Owners' Forum Is Already Full Of Tales Of Broken, Malfunctioning Cybertrucks

From brake light malfunctions to full-on failures, if you want to know just how bad things are with the Cybertruck, check the owners forums.

jalopnik.com

jalopnik.com

Saw a few on spring break in Texas. Looked pretty sweet if you ask me.

Shares of Rivian Automotive Inc. fell 4% in the extended session Tuesday after the EV maker posted mixed quarterly results, reporting a wider-than-expected loss but revenue above Wall Street’s expectations.

The results “set a strong foundation to the remainder of the year,” Chief Executive RJ Scaringe said on a call after the results.

Rivian RIVN, -0.77% lost $1.45 billion, or $1.48 a share, in the first quarter, compared with a loss of $1.35 billion, or $1.45 a share, in the year-ago quarter.

…

The company reaffirmed the 2024 guidance it provided earlier this year of producing 57,000 EVs and an Ebitda loss of $2.7 billion. Rivian cut down on its capital-expenditure budget required to launch R2 to $1.2 billion, a reduction of $550 million.

That cash-conservation move won praise from investors, and Rivian also said at the time it was pausing construction of its $5 billion plant in Georgia.

Rivian last week said it got more than $800 million in incentives from Illinois to expand the Normal plant.

The results “set a strong foundation to the remainder of the year,” Chief Executive RJ Scaringe said on a call after the results.

Rivian RIVN, -0.77% lost $1.45 billion, or $1.48 a share, in the first quarter, compared with a loss of $1.35 billion, or $1.45 a share, in the year-ago quarter.

…

The company reaffirmed the 2024 guidance it provided earlier this year of producing 57,000 EVs and an Ebitda loss of $2.7 billion. Rivian cut down on its capital-expenditure budget required to launch R2 to $1.2 billion, a reduction of $550 million.

That cash-conservation move won praise from investors, and Rivian also said at the time it was pausing construction of its $5 billion plant in Georgia.

Rivian last week said it got more than $800 million in incentives from Illinois to expand the Normal plant.

Similar threads

- Replies

- 83

- Views

- 2K

- Replies

- 0

- Views

- 196

- Replies

- 0

- Views

- 545

- Replies

- 2

- Views

- 105

- Replies

- 3

- Views

- 139

ADVERTISEMENT

ADVERTISEMENT