Federal Reserve Chairman Powell Warns of Unsustainable Fiscal Path as U.S. Debt Approaches $34 Trillion

Federal Reserve Chairman Jerome Powell has taken the unusual step of addressing the growing concern over the United States’ national debt, which is nearing $34.2 trillion.

Powell’s comments came during a recent interview on CBS’ 60 Minutes, where he expressed his apprehension about the nation’s fiscal trajectory, labeling it as unsustainable.

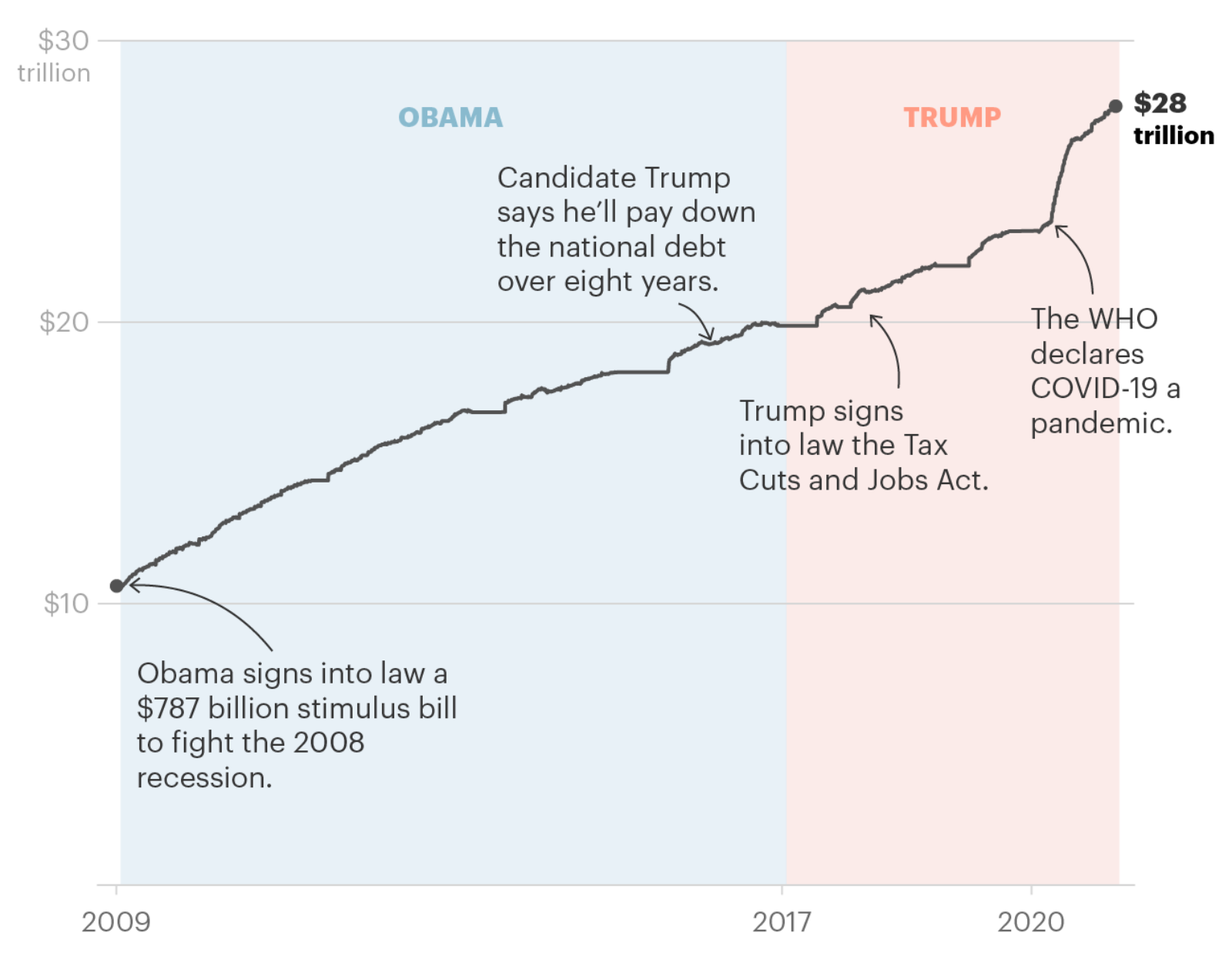

All Time High Debt

Despite the avoidance of a predicted recession in 2023, increased government spending and reduced tax revenue have propelled the national debt to an all-time high.

The debt-to-GDP ratio, a measure of total public debt relative to economic growth, has risen from just over 100% in 2019 to over 120%.

Unsustainable Fiscal Path

Federal Reserve Chairman Jerome Powell has voiced concerns about the United States’ long-term fiscal stability.

He has highlighted the unsustainable fiscal path that the nation is currently on, with the national debt rapidly approaching $34.2 trillion.

Debt to GDP

While the debt-to-GDP ratio has slightly decreased from its COVID-era peak of 133%, it remains at over 120%.

Fiscal Responsibility

Powell emphasized that the government’s debt is still growing at a rate surpassing economic growth, making it “past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”.

Delicate Balance

In his recent interview on CBS’ 60 Minutes, Federal Reserve Chairman Jerome Powell navigated the delicate balance between the central bank’s non-partisan stance and his concerns about the nation’s fiscal policies.

Borrowing from Future Generations

Powell acknowledged that it is unusual for a Fed official to comment on fiscal policy but proceeded to criticize certain aspects of the government’s financial decisions.

He pointed out that lawmakers have essentially been “borrowing from future generations” due to the unsustainable nature of current policies.

Concerns Echoed by Financial Leaders

The concerns raised by Federal Reserve Chairman Jerome Powell are not isolated in the world of finance.

Prominent figures like JPMorgan Chase CEO Jamie Dimon have also sounded the alarm regarding the United States’ growing national debt.

Dimon recently warned that the nation is hurtling toward an economic “cliff” unless significant measures are taken to address the excessive debt burden.

He cautioned that failure to control the national debt could lead to a “rebellion” among foreign holders of U.S. government bonds.

Additionally, other influential figures on Wall Street, such as Mark Spitznagel and Ray Dalio, have long criticized the escalating federal deficits.

Spitznagel described the current situation as “the greatest credit bubble in human history,” emphasizing the inevitable consequences of such a financial environment.

Additionally, other influential figures on Wall Street, such as Mark Spitznagel and Ray Dalio, have long criticized the escalating federal deficits.

Spitznagel described the current situation as “the greatest credit bubble in human history,” emphasizing the inevitable consequences of such a financial environment.

Dalio, founder of the hedge fund giant Bridgewater Associates, has consistently warned of an impending debt crisis, particularly when the government resorts to borrowing to cover its annual debt servicing payments.

Amid the mounting concerns over the United States’ national debt, Federal Reserve Chairman Jerome Powell offered a glimmer of hope.

Powell acknowledged the inherent strengths of the U.S. economy, describing it as dynamic, innovative, flexible, and adaptable.

He noted that these qualities have contributed to the nation’s outperformance compared to its global peers. Despite the challenges posed by the growing debt, Powell suggested that the United States has the capacity to rectify the situation, provided it acts promptly.

But he also added, “sooner is better than later.”

While concerns about the escalating national debt have resonated in financial circles, Treasury Secretary Janet Yellen has maintained a different perspective.

Yellen has downplayed worries about the rising debt, asserting that the key metric she focuses on is net interest payments as a share of GDP.

According to Yellen, this metric remains “at a very reasonable level.” She defended the current state of the nation’s debt during a CNBC interview, emphasizing her view that the situation remains manageable.

Federal Reserve Chairman Jerome Powell has taken the unusual step of addressing the growing concern over the United States’ national debt, which is nearing $34.2 trillion.

Powell’s comments came during a recent interview on CBS’ 60 Minutes, where he expressed his apprehension about the nation’s fiscal trajectory, labeling it as unsustainable.

All Time High Debt

Despite the avoidance of a predicted recession in 2023, increased government spending and reduced tax revenue have propelled the national debt to an all-time high.

The debt-to-GDP ratio, a measure of total public debt relative to economic growth, has risen from just over 100% in 2019 to over 120%.

Unsustainable Fiscal Path

Federal Reserve Chairman Jerome Powell has voiced concerns about the United States’ long-term fiscal stability.

He has highlighted the unsustainable fiscal path that the nation is currently on, with the national debt rapidly approaching $34.2 trillion.

Debt to GDP

While the debt-to-GDP ratio has slightly decreased from its COVID-era peak of 133%, it remains at over 120%.

Fiscal Responsibility

Powell emphasized that the government’s debt is still growing at a rate surpassing economic growth, making it “past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”.

Delicate Balance

In his recent interview on CBS’ 60 Minutes, Federal Reserve Chairman Jerome Powell navigated the delicate balance between the central bank’s non-partisan stance and his concerns about the nation’s fiscal policies.

Borrowing from Future Generations

Powell acknowledged that it is unusual for a Fed official to comment on fiscal policy but proceeded to criticize certain aspects of the government’s financial decisions.

He pointed out that lawmakers have essentially been “borrowing from future generations” due to the unsustainable nature of current policies.

Concerns Echoed by Financial Leaders

The concerns raised by Federal Reserve Chairman Jerome Powell are not isolated in the world of finance.

Prominent figures like JPMorgan Chase CEO Jamie Dimon have also sounded the alarm regarding the United States’ growing national debt.

Dimon recently warned that the nation is hurtling toward an economic “cliff” unless significant measures are taken to address the excessive debt burden.

He cautioned that failure to control the national debt could lead to a “rebellion” among foreign holders of U.S. government bonds.

Additionally, other influential figures on Wall Street, such as Mark Spitznagel and Ray Dalio, have long criticized the escalating federal deficits.

Spitznagel described the current situation as “the greatest credit bubble in human history,” emphasizing the inevitable consequences of such a financial environment.

Additionally, other influential figures on Wall Street, such as Mark Spitznagel and Ray Dalio, have long criticized the escalating federal deficits.

Spitznagel described the current situation as “the greatest credit bubble in human history,” emphasizing the inevitable consequences of such a financial environment.

Dalio, founder of the hedge fund giant Bridgewater Associates, has consistently warned of an impending debt crisis, particularly when the government resorts to borrowing to cover its annual debt servicing payments.

Amid the mounting concerns over the United States’ national debt, Federal Reserve Chairman Jerome Powell offered a glimmer of hope.

Powell acknowledged the inherent strengths of the U.S. economy, describing it as dynamic, innovative, flexible, and adaptable.

He noted that these qualities have contributed to the nation’s outperformance compared to its global peers. Despite the challenges posed by the growing debt, Powell suggested that the United States has the capacity to rectify the situation, provided it acts promptly.

But he also added, “sooner is better than later.”

While concerns about the escalating national debt have resonated in financial circles, Treasury Secretary Janet Yellen has maintained a different perspective.

Yellen has downplayed worries about the rising debt, asserting that the key metric she focuses on is net interest payments as a share of GDP.

According to Yellen, this metric remains “at a very reasonable level.” She defended the current state of the nation’s debt during a CNBC interview, emphasizing her view that the situation remains manageable.