I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is the state of Iowa working on housing at all?

- Thread starter Huey Grey

- Start date

I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

Costs are going way up due to a shortage. I really worry about the next generation being able to purchase homes. Renting is no way to go through life.

Add to that, more affordable housing. Everything they seem to be slinging up around the DSM metro and suburbs is starting around 350k, minimum.I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

is zoning a statewide thing in iowa?I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

in a lot of states, the governor (and the state government in general) has little to no control over zoning

They keep putting up section 8 housing in Ames. Problem is, they are mostly going to people from other states

I bought my house, which is completely remodeled, for 48 grand in a small town in North East Iowa

My boss keeps asking me if my wife and I will eventually be moving to DSM metro as she will also be working down there in the future. I'm perfectly content not having a mortgage payment in Ames. Commute is cheaper.

It has to due to power grid issues. It's all over the US not just Iowa. The new regulations on the transformers have caused projects to be on hold because they can't use the ones, they had stockpiled. So there is a huge shortage of transformers and the ones that were slated for the projects are paper weights. Isn't the Green New Deal awesome.I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

It's so bad. There's a house in my area going for $500k. It's a nice house but nowhere near that price tag. 2,000 sq/ft and the back side faces a couple of apartment buildings. Townhomes in this area are going for $350k.Add to that, more affordable housing. Everything they seem to be slinging up around the DSM metro and suburbs is starting around 350k, minimum.

Reynolds is too busy mobilizing troops to go to the border. And developing her metrics to measure success for charter schools.I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

If there was more affordable housing in Iowa, some of the people who would benefit may be ghey or even trans. Probably best not to risk it.

The total number of housing units in Iowa increased from 1,336,417 in 2010 to 1,412,789 in 2020, which is a 5.71% increase. At the same time, the State population increased from 3,046,355 in 2010 to 3,190,369 in 2020, which is a 4.73% increase.

https://www.legis.iowa.gov/docs/publications/FRB/1294644.pdf

Housing has been growing faster than your population statewide.

People just don't want to live in the sticks as much.

https://www.legis.iowa.gov/docs/publications/FRB/1294644.pdf

Housing has been growing faster than your population statewide.

People just don't want to live in the sticks as much.

Isn’t that wealthy people buying vacation homes?This shit can get out of hand quickly. Look at the housing prices in Montana metros

I only made it a few episodes into Yellowstone…

Having traveled to both Montana and Idaho in the past few years and only going by the "talk" of the locals that I met...it is more related to people moving there permanently, primarily from the west coast/California. Someone say selling their home in LA and then needing to spend that $$ on their next home finds that their dollars go a LONG WAYS in other states...driving up prices in the destination states.Isn’t that wealthy people buying vacation homes?

I only made it a few episodes into Yellowstone…

The KC market is fooked. Our 50's mid-century modern bought seven years ago for $275k could be sold for about $475-$500k tomorrow. That is for just over 1,500 square feet, three bedrooms, two bathrooms. Thank the lord I got wifey (no pic) to cool off on the idea of a larger house.

my coworkers rent is a couple hundred dollars than my mortgage and she has 1/3 the space.Costs are going way up due to a shortage. I really worry about the next generation being able to purchase homes. Renting is no way to go through life.

The total number of housing units in Iowa increased from 1,336,417 in 2010 to 1,412,789 in 2020, which is a 5.71% increase. At the same time, the State population increased from 3,046,355 in 2010 to 3,190,369 in 2020, which is a 4.73% increase.

https://www.legis.iowa.gov/docs/publications/FRB/1294644.pdf

Housing has been growing faster than your population statewide.

People just don't want to live in the sticks as much.

Any kind of acreage in the sticks are highly coveted too. In town, prices are reasonable, but still go for more than they should. (Unless you buy in a really crap community)

my coworkers rent is a couple hundred dollars than my mortgage and she has 1/3 the space.

That just sucks for them. How can you get a head in life if you can't own? I know someone will point out NYC. Fine. This is Iowa. Not NYC or DC or SF or LA.

We locked in our house in '21 under 3%. Free money. Taxes have gone up a lot in those 3 years, but still nothing compared to the skyrocketing rent in the Omaha metro.That just sucks for them. How can you get a head in life if you can't own? I know someone will point out NYC. Fine. This is Iowa. Not NYC or DC or SF or LA.

Why would you or anyone else think it's the States job to provide housing?I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

I always forget you're a Nebraskan.We locked in our house in '21 under 3%. Free money. Taxes have gone up a lot in those 3 years, but still nothing compared to the skyrocketing rent in the Omaha metro.

I wish I wasn't!I always forget you're a Nebraskan.

I wish I wasn't!

I love western Nebraska.

I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

What specifically would you like her to do??

This is by far not just an Iowa thing.I know a lot of states are utilizing measures like rezoning to make it easier to build new housing. What's Reynolds doing? Especially in cities, we have a big need for more housing.

This article is 5 years old, but it shows how cities have zoning laws that require builders to build these big houses. The cities want that big property tax bill. They don’t build the small 1500 square foot ranch houses anymore. There’s no money in that.Add to that, more affordable housing. Everything they seem to be slinging up around the DSM metro and suburbs is starting around 350k, minimum.

With Zoning Changes, Des Moines Says No to Density

In Des Moines, Iowa, zoning rules regulating lot size, housing styles, and building materials will make new homes too expensive, builders warn.

Last edited:

They need people there that can fill up the private schools.Add to that, more affordable housing. Everything they seem to be slinging up around the DSM metro and suburbs is starting around 350k, minimum.

The KC market is fooked. Our 50's mid-century modern bought seven years ago for $275k could be sold for about $475-$500k tomorrow. That is for just over 1,500 square feet, three bedrooms, two bathrooms. Thank the lord I got wifey (no pic) to cool off on the idea of a larger house.

If anything, we'll need to downsize. But wifey will probably mention grandkids.

Problem we are running into is farmers buying up land next to town and then not being willing to sell for a reasonable price which could buy 2-3 times more acres of land. Price out planned growth in town and then complaining about urban unplanned growth in the countryside.

Blaming farmers again.Problem we are running into is farmers buying up land next to town and then not being willing to sell for a reasonable price which could buy 2-3 times more acres of land. Price out planned growth in town and then complaining about urban unplanned growth in the countryside.

Blaming farmers again.

Well, yes. They are the ones getting all the tax breaks. Tell me when you want to subsidize my job, truck, and vacations.

We sold our house today. No inspection and no appraisal worries be cause the buyer has a huge down payment.We locked in our house in '21 under 3%. Free money. Taxes have gone up a lot in those 3 years, but still nothing compared to the skyrocketing rent in the Omaha metro.

It’s 3 beds up and one in the basement. 3.5 baths. Kitchen redone in 2020 and basement finished at the same time. Master bathroom was just redone. It’s nice for what it is but it’s a house in a subdivision with 5 different floor plans and average quality. It was listed yesterday with showings starting today. It went over list and $30k more than our friends with the same floor plan but an extra bedroom upstairs sold for last fall. They also had a walkout basement where ours is daylight instead of walkout. We both put in new kitchens at the same time. I’m guessing it was the Hawkeyes decor that gave us the extra $$$. But I really worry for my kids because I don’t know how they will ever get into the market like this. And that’s just in Omaha.

Agreed that KC is fooked. I’ve been helping my SIL after my sister passed away. They’ve been in the same place for about 12 years. Low interest rate. SIL wants to upgrade and move with her influx of insurance money. I am adamantly telling her over and over that she will never get another house as nice for that price or the interest rate. Housing prices are crazy.The KC market is fooked. Our 50's mid-century modern bought seven years ago for $275k could be sold for about $475-$500k tomorrow. That is for just over 1,500 square feet, three bedrooms, two bathrooms. Thank the lord I got wifey (no pic) to cool off on the idea of a larger house.

But I really worry for my kids because I don’t know how they will ever get into the market like this. And that’s just in Omaha.

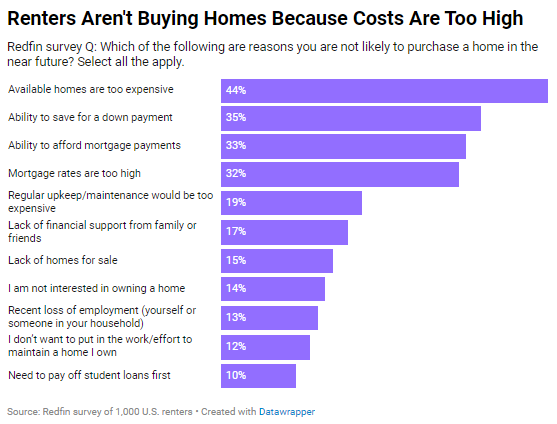

Redfin reports, rising home prices and mortgage rates "are making it harder to believe in the American dream of homeownership. Lack of affordability is the most commonly cited reason renters don’t believe they’ll ever own a home."

The details are dire: Nearly two in five (38%) U.S. renters don’t believe they’ll ever own a home, up from roughly one-quarter (27%) less than a year ago.

This is according to a Redfin-commissioned survey of roughly 3,000 U.S. residents conducted by Qualtrics in February 2024. This report focuses on the 1,000 respondents who indicated they are renters. The relevant questions were: “Do you believe that you will ever own your own home in the future?” and “Which of the following are reasons you aren’t likely to purchase a home in the near future?” The 27% comparison is from a Redfin survey conducted in May and June 2023.

Lack of affordability is the prevailing reason renters believe they’re unlikely to become homeowners. Nearly half (44%) of renters who don’t believe they’ll buy a home in the near future said it’s because available homes are too expensive. The next most common obstacles: Ability to save for a down payment (35%), ability to afford mortgage payments (33%) and high mortgage rates (32%). Roughly one in eight (14%) simply aren’t interested in owning a home.

Buying a home has become increasingly out of reach for many Americans due to the one-two punch of high home prices and high mortgage rates. First-time homebuyers must earn roughly $76,000 to afford the typical U.S. starter home, up 8% from a year ago and up nearly 100% from before the pandemic, according to a recent Redfin analysis. Home prices have skyrocketed more than 40% since 2019, due to the pandemic homebuying frenzy and a shortage of homes for sale. And the current average 30-year fixed mortgage rate is 6.82%. While that’s below the 23-year-high of nearly 8% hit in October, it’s still more than double the record low rates dropped to in 2020.

Home prices have risen 7% in the last year alone, and monthly mortgage payments have risen more than 10%, which helps explain why renters today are more likely than they were last year to say they don’t see themselves owning a home anytime soon.

Many renters can’t fathom homeownership because they’re already struggling to afford their monthly housing costs. Nearly one-quarter (24%) of renters say they regularly struggle to afford their housing payments, and an additional 45% say they sometimes struggle to do so.

True statementin a lot of states, the governor (and the state government in general) has little to no control over zoning

It’s greed. Pigs get fed hogs slaughtered.Blaming farmers again.

Yeah, sadly the days of the smaller ranch style homes are a thing of the past. They'll keep saying, "well, people are buying these more expensive homes so we'll keep building them."This article is 5 years old, but it shows how cities have zoning laws that require builders to build these big houses. The cities want that big property tax bill. They don’t build the small 1500 square foot ranch houses anymore. There’s no money in that.

With Zoning Changes, Des Moines Says No to Density

In Des Moines, Iowa, zoning rules regulating lot size, housing styles, and building materials will make new homes too expensive, builders warn.www.bloomberg.com

Well no sh!t, they're buying them because they don't have the "option" to buy smaller, more moderately priced homes, especially around the metro areas.

I am confident so many people are overextendeing themselves on these homes and are living paycheck to paycheck. It's damn near impossible to buy a home without two income earners. It blows my mind to think about how so many large families, in the 50s and 60s, often lived in large homes on one income.

I'm honestly worried the recent housing trends are going to come back and bite our economy in the near future, it just seems so unsustainable.

1950s: The average new home sold for $82,098. It had 983 square feet of floor space and a household size of 3.37 people, or 292 square feet per person.It blows my mind to think about how so many large families, in the 50s and 60s, often lived in large homes on one income.

1960s: The average new-home size grew to 1,200 square feet, giving its 3.33 residents a spacious 360 square feet of room apiece.

The average single-family house in the United States has overall increased in size since 2000. It reached its peak of 2,467 square feet in 2015 before falling to 2,299 square feet by 2022.

Are you sure the farmers are buying up all the land? Post Covid, corporations started buying up homes to get into the rental business.It’s greed. Pigs get fed hogs slaughtered.

Similar threads

- Replies

- 4

- Views

- 198

- Replies

- 56

- Views

- 787

- Replies

- 18

- Views

- 463

- Replies

- 3

- Views

- 127

ADVERTISEMENT

ADVERTISEMENT