I will believe cryptocurrency is a currency and not just an easy way to get acid in the mail with cash or to scam suckers when crypto "investors" stop talking about how much USD their BTC wallets are worth because the public has started actually viewing it as a currency and not a way to get more USD fast (or get drugs in the mail).

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Not looking good in the Bitcoin world this morning

- Thread starter soybean

- Start date

Gresham’s Law will preclude bitcoin from becoming a common currency in exchange. Everyone who understands how this works realizes the USD pool will continue to inflate, and the inexorable law of supply and demand will shift the USD price of bitcoin accordingly.I will believe cryptocurrency is a currency and not just an easy way to get acid in the mail with cash or to scam suckers when crypto "investors" stop talking about how much USD their BTC wallets are worth because the public has started actually viewing it as a currency and not a way to get more USD fast (or get drugs in the mail).

If you had the opportunity to spend hard money or soft money, you spend the soft money to get it out of your hands before it devalues further.

A couple times over lol. Now I’m just sitting through this current cycle until 2025 sometime. The halving is in April so there will probably be a nice build up and sell the news event in May which I will probably sell some more and diamond hand until the cycle ends.I hope you've realized your gains before talking sh!t.

Also why wouldn’t I talk shit to a couple of these posters? They were trying to make me look like an idiot because of investing in risky assets that have made me and many other individuals money.I hope you've realized your gains before talking sh!t.

A couple times over lol. Now I’m just sitting through this current cycle until 2025 sometime. The halving is in April so there will probably be a nice build up and sell the news event in May which I will probably sell some more and diamond hand until the cycle ends.

Curious about this halving thing. Will bitcoin go down in April due to this and create a buying opportunity?

Curious about this halving thing. Will bitcoin go down in April due to this and create a buying opportunity?

Halving #1

- The first halving occurred on November 28, 2012, and reduced the block reward to 25 BTC from 50 BTC.

- Price at time of halving: $13

- Following year’s peak: $1,152

Halving #2

- The second halving occurred on July 16, 2016, and reduced the block reward to 12.5 BTC.

- Price at time of halving: $664

- Following year’s peak: $17,760

Halving #3

- The third halving occurred on May 11, 2020, and reduced the block reward to 6.25 BTC.

- Price at time of halving: $9,734

- Following year’s peak: $67,549

no bitcoin here but i do have 8.5 (staked) eth, that's on a nice little run also

Gresham’s Law will preclude bitcoin from becoming a common currency in exchange. Everyone who understands how this works realizes the USD pool will continue to inflate, and the inexorable law of supply and demand will shift the USD price of bitcoin accordingly.

If you had the opportunity to spend hard money or soft money, you spend the soft money to get it out of your hands before it devalues further.

Maybe that ends up right, but it works the exact opposite on dark web markets because those people aren't trying to hoard digital gold and need currency people will accept. So in a real life commerce scenario a buyer won't buy any crypto until they are ready to purchase whatever. Usually there's an escrow system in place where the dark web market holds the crypto until delivery of whatever. Vendor usually has tracking on what gets sent out and will often refuse to do another sale to a buyer who did not release the funds soon after tracking says they got their package in the mail because they want the crypto as soon as possible so they can convert to cash which they can actually use before the next dip. So the prices of these items remain relatively consistent in USD (they do inflate alongside USD), but the crypto value in USD fluctuates with barely any connection to fiat inflation (at least from what we've seen the last dozen years) and most people actually using cryptocurrency to do business don't see it as something to "hodl" since the only people who accept it for anything other than a way to skirt the law on transferring cash are basically goldbugs. So you have mainly goldbugs and criminals and El Salvador making this work right now and if you simply want to hedge against inflation, you need to root for the believers and criminals to keep demand up for this digital gold or it won't matter when the fiat inflates. Not unless crypto becomes a more common method of exchange which hasn't happened yet because most people believe a lot more in the USD backed by the full faith and credit of the Pentagon.

"I would like to buy some eggs."

"That will be 0.000067 Bitcoin please."

"Are you going to make me wait hours until this tiny transaction clears the block chain or can I take my eggs home now?"

Maybe that ends up right, but it works the exact opposite on dark web markets because those people aren't trying to hoard digital gold and need currency people will accept. So in a real life commerce scenario a buyer won't buy any crypto until they are ready to purchase whatever. Usually there's an escrow system in place where the dark web market holds the crypto until delivery of whatever. Vendor usually has tracking on what gets sent out and will often refuse to do another sale to a buyer who did not release the funds soon after tracking says they got their package in the mail because they want the crypto as soon as possible so they can convert to cash which they can actually use before the next dip. So the prices of these items remain relatively consistent in USD (they do inflate alongside USD), but the crypto value in USD fluctuates with barely any connection to fiat inflation (at least from what we've seen the last dozen years) and most people actually using cryptocurrency to do business don't see it as something to "hodl" since the only people who accept it for anything other than a way to skirt the law on transferring cash are basically goldbugs. So you have mainly goldbugs and criminals and El Salvador making this work right now and if you simply want to hedge against inflation, you need to root for the believers and criminals to keep demand up for this digital gold or it won't matter when the fiat inflates.

It certainly has utility as a medium of exchange, which Silk Road, etc demonstrated. But there are now bitcoin ETFs. People are going to use this medium as a store of value relative to USD or their shittier local fiat currency.

Not only do claims that crypto is criminals’ preferred tool exaggerate the role of cryptocurrency in funding illegal activity, but they also ignore estimates both that the lion’s share of crypto activity is legitimate and that the legitimate share of crypto use is growing over time. The latest Chainalysis numbers estimate that transactions involving illicit addresses made up only 0.12 percent of the total cryptocurrency transaction volume in 2021 and 0.24 percent in 2022. (Interestingly, Chainalysis’s latest research has revised down 2021’s illicit transaction share number from 0.15 percent of total transaction volume.) Money laundering specifically was estimated to make up only 0.05 percent of total crypto transaction volume in 2021.

Not unless crypto becomes a more common method of exchange which hasn't happened yet because most people believe a lot more in the USD backed by the full faith and credit of the Pentagon.

What does even mean?

Full faith and credit was put on Federal Reserve Notes because they originally specified an amount of gold warehoused at the bank that you could exchange the notes for on demand.

FDR abrogated that and Nixon killed it. The faith was betrayed.

How has the Pentagon maintained the value of the dollar in any sense?

"I would like to buy some eggs."

"That will be 0.000067 Bitcoin please."

"Are you going to make me wait hours until this tiny transaction clears the block chain or can I take my eggs home now?"

Again, Gresham’s Law will prevent bitcoin from becoming the most common medium of exchange. You’re not wrong to point out the transaction time drawbacks. They’re real, but I have to admit that most of my personal transactions, whether it’s with the mortgage company, the utility company, Amazon, the grocer, etc are done online and the situation you describe is really irrelevant to how a lot of money changes hands these days.

Gresham’s Law means the bad (depreciating) money will drive the good (hard) money out of circulation.

How often do you come across <1964 change with real silver content anymore?

It still reminds me of Tulip Mania.So @bhawk24bob has absolutely no clue about anything with crypto. Lol

Just because it's nutty doesn't mean it will crash any time soon. Or ever. Sometimes nutty things transform into something good. Addicts go straight. Criminals go legitimate.

Crypto and AI have made Nvidia rich.

I think you call it ‘nutty’ because you don’t understand it, or its advantages.Just because it's nutty doesn't mean it will crash any time soon. Or ever. Sometimes nutty things transform into something good.

It’s always been good.

Honest money is good for civilization.

Doubling down on this idiocy?It still reminds me of Tulip Mania.

Just because it's nutty doesn't mean it will crash any time soon. Or ever. Sometimes nutty things transform into something good. Addicts go straight. Criminals go legitimate.

Crypto and AI have made Nvidia rich.

"Honest money" is an oxymoron.I think you call it ‘nutty’ because you don’t understand it, or its advantages.

It’s always been good.

Honest money is good for civilization.

You can argue that the US dollar is worse than crypto but at least dollars are backed by something distinct and real: US power.

Crypto is backed by what, exactly? Algorithms and massive energy expenditures. No intrinsic value.

I'm no goldbug, but I appreciate a currency that has more behind it than giddy fanboys.

I am curious about some things, though. Maybe you can weigh in with your expertise....

I wonder how well crypto would hold up under a carbon tax? Or a transaction tax?

Is crypto taxed as income when converted after appreciation? When? At the time of conversion, or when honest traders report it? At regular income rates or something else?

Crypto has notably been used by criminals and terrorists because it's hard to track. What's the solution to those problems?

"Honest money" is an oxymoron.

Wrong.

Honest money means money that thieves can't counterfeit. Money produced by real effort, not government edict.

You wouldn't have civilization without money and the division of labor that it enables.

When politicians corrupt money with inflation it leads to economic chaos and social disorder (e.g. Zimbabwe, Venezuela) because it permits consumption without the requisite production. Instead of society being able to accumulate wealth and improve living standards, consumption swamps production and real wealth declines, along with living standards.

How? What does that mean to you?You can argue that the US dollar is worse than crypto but at least dollars are backed by something distinct and real: US power.

'Backing' in a monetary sense meant the paper notes were simply warehouse receipts for tangible goods (e.g. gold)

Tangible goods that had to be produced by actual effort (mining and refining the gold).

The issue with counterfieting is that we recognize it is theft. The effort to produce a $10 note and a $100 are not different by a factor of 10x

'Intrinsic value' isn't an economic concept.Crypto is backed by what, exactly? Algorithms and massive energy expenditures. No intrinsic value.

Value is personal and subjective.

Crypto is 'backed' back immutable laws of math that prevent counterfeiting, not the malleable laws of greedy politicians.

The value is found primarily in being a medium of exchange that the politicians can't abrogate with the printing presses.

I wonder how well crypto would hold up under a carbon tax?

Or a transaction tax?

Is crypto taxed as income when converted after appreciation? When? At the time of conversion, or when honest traders report it? At regular income rates or something else?

Current U.S. law:

Cryptocurrencies on their own are not taxable—you're not expected to pay taxes for holding one. The IRS treats cryptocurrencies as property for tax purposes, which means:

- You pay taxes on cryptocurrency if you sell or use your crypto in a transaction, and it is worth more than it was when you purchased it. This is because you trigger capital gains or losses if its market value has changed.

- If you receive crypto as payment for business purposes, it is taxed as business income.

- If you successfully mine a cryptocurrency or are awarded it for work done on a blockchain, it is taxed as ordinary income.

I've already pointed out that the criminal complaints are exaggerated, shrinking relative to other uses, and frankly dwarfed by the illicit use of USD.Crypto has notably been used by criminals and terrorists because it's hard to track. What's the solution to those problems?

Maybe you want the government tracking everyone's transactions, and thus see it as a 'problem' if the government can't, but I would view that as a privacy feature. That having been said, I think the blockchain is much less private than people assume.

What is the "real effort" that gives crypto value The chugging away of zillions of power-hungry mining operations may look like real effort, because it consumes so much energy and creates a lot of pollution, but that's not "value." It's just very costly bookkeeping.Honest money means money that thieves can't counterfeit. Money produced by real effort

When you strip away the mantra parts of your argument you are left with the problem of counterfeiting. I agree that's bad.How? What does that mean to you?

'Backing' in a monetary sense meant the paper notes were simply warehouse receipts for tangible goods (e.g. gold)

Tangible goods that had to be produced by actual effort (mining and refining the gold).

The issue with counterfieting is that we recognize it is theft. The effort to produce a $10 note and a $100 are not different by a factor of 10x

You and I (or better hackers) may not be able counterfeit a bitcoin but some crypto is shakier. Moreover, bad actors will find other ways to swindle and con using crypto.

Crypto doesn't eliminate crooked currency transactions, it just alters their nature.

Early money was simply a replacement for and improvement on product-specific IOUs which, in turn, were, an improvement on immediate or short-term direct barter.'Backing' in a monetary sense meant the paper notes were simply warehouse receipts for tangible goods (e.g. gold)

Once we escaped product-specificity, money became both much more useful, and also more vulnerable. It's a tradeoff that most think was overwhelmingly justified by the growth of commerce and prosperity.

I've recommended this book before. Best economics book I've ever read. You'll enjoy it. I have a very conservative grad-school buddy. We agree a lot on science and often on geopolitics, but seldom on domestic politics or economics. Sort of like you and me. He loved this book. Not just for lefties like me.

I like the privacy angle.Maybe you want the government tracking everyone's transactions, and thus see it as a 'problem' if the government can't, but I would view that as a privacy feature. That having been said, I think the blockchain is much less private than people assume.

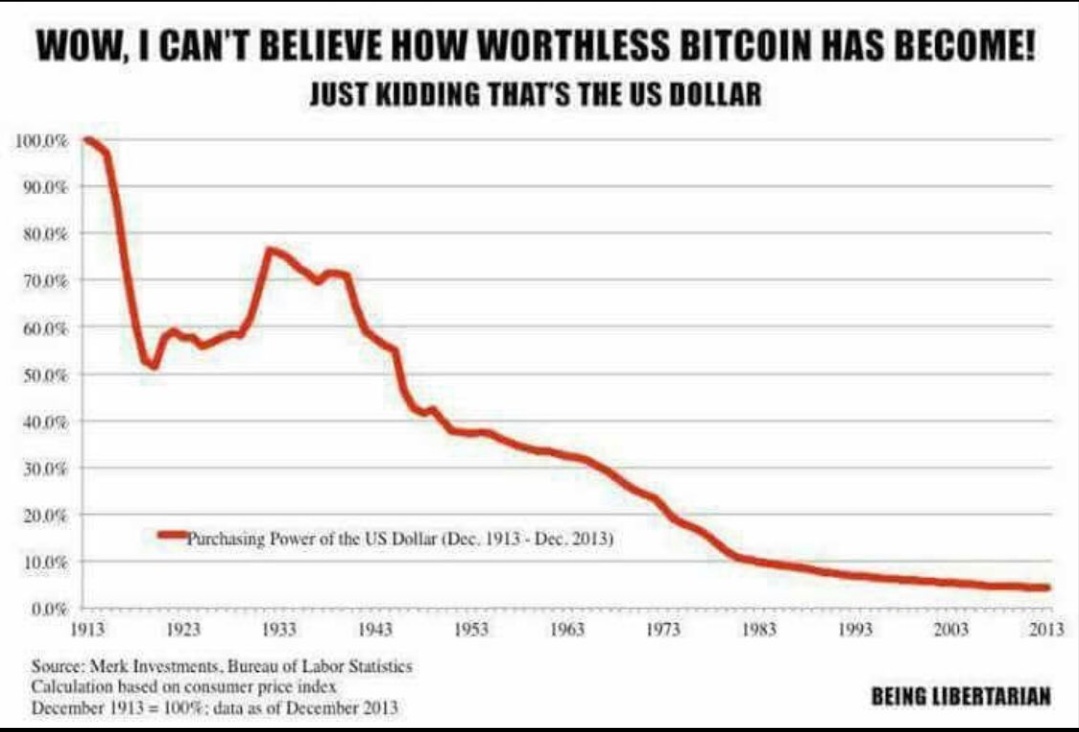

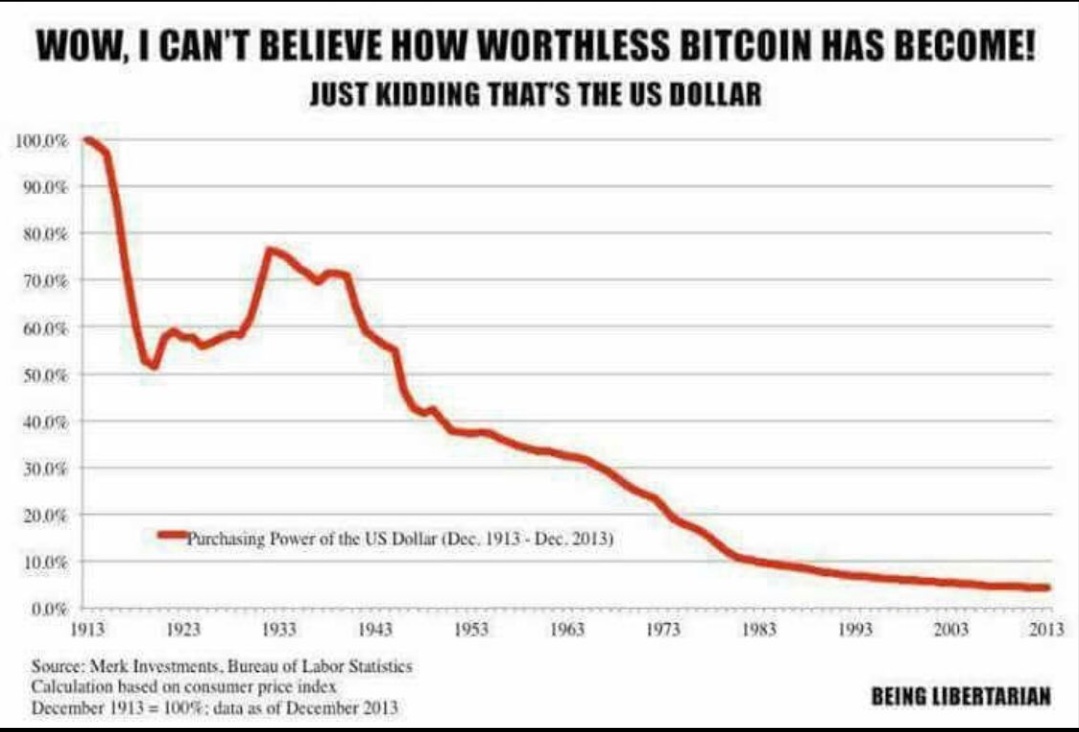

Exhibit AWhat is the "real effort" that gives crypto value The chugging away of zillions of power-hungry mining operations may look like real effort, because it consumes so much energy and creates a lot of pollution, but that's not "value." It's just very costly bookkeeping.

you don’t understand the purpose of a distributed, cryptographically secured ledger.

IT PREVENTS COUNTERFEITING.

Preventing theft via counterfeiting has enormous value, ask anyone stuck using a fast depreciating currency.

Some crypto are programmed to inflate.When you strip away the mantra parts of your argument you are left with the problem of counterfeiting. I agree that's bad.

You and I (or better hackers) may not be able counterfeit a bitcoin but some crypto is shakier.

Not all crypto is equal.

Let’s keep the discussion on bitcoin.

Exhibit A

you don’t understand the purpose of a distributed, cryptographically secured ledger.

IT PREVENTS COUNTERFEITING.

Preventing theft via counterfeiting has enormous value, ask anyone stuck using a fast depreciating currency.

It's estimated that there is 70 million in counterfeit money floating around in the US. That's a vanishing small number considering the money supply.

Unless you're just talking standard inflation which has been part of our monetary policy for generations.

As far as Bitcoin goes, first off, I do hold some bitcoin. There are still two things I just don't understand, which is why they require banks to monitor for fraud and laundering, but they haven't placed any restrictions on Bitcoin in this way. It's a HUGE advantage to Bitcoin because banks pay a pretty penny to comply there.

‘Standard inflation’ is a regressive government policy to take purchasing power from the public by deliberately depreciating the currency.It's estimated that there is 70 million in counterfeit money floating around in the US. That's a vanishing small number considering the money supply.

Unless you're just talking standard inflation which has been part of our monetary policy for generations.

The government can’t inflate bitcoin.

“Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.

Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government's promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.”

- Alan Greenspan

Similar threads

- Replies

- 1

- Views

- 111

- Replies

- 0

- Views

- 118

ADVERTISEMENT

ADVERTISEMENT