During jury selection in the ongoing federal fraud trial of the dethroned crypto kingpin Sam Bankman-Fried, one prospective juror worried out loud about his lack of knowledge of cryptocurrencies, despite his son’s efforts to explain them to him. “I still don’t understand how it works,” the would-be juror said. Lewis A. Kaplan, the sharp-tongued U.S. District Court judge overseeing the trial, responded: “You probably have a lot of company in this court.”

Make sense of the news fast with Opinions' daily newsletter

Make sense of the news fast with Opinions' daily newsletter

The confusion is understandable. More than a decade after cryptocurrencies were launched, the promise of these alternative currencies has amounted to little more than broken dreams. Nascent technologies can only remain the next big thing for so long. At some point, regular people need to start using them, which most certainly isn’t happening with crypto. So, while a jury in New York won’t return a verdict on the fate of Bankman-Fried for weeks, the judgment on crypto already is clear: It is a solution in search of a problem.

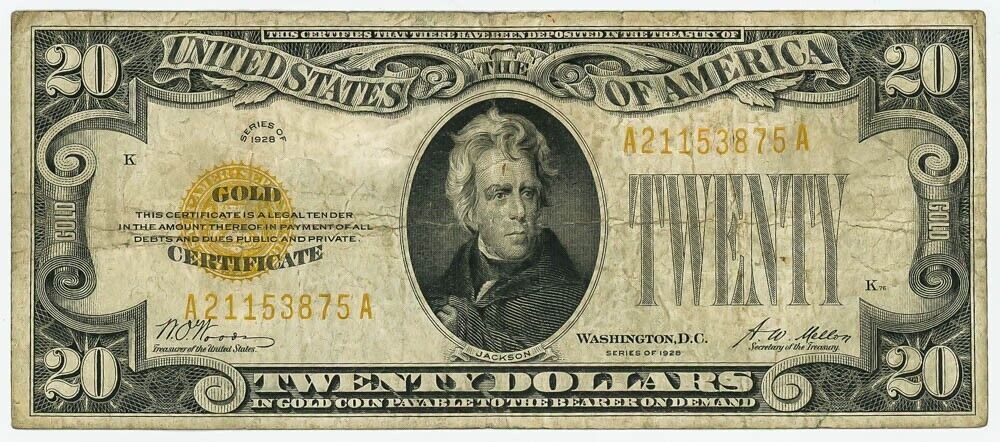

Crypto was supposed to represent nothing less than a paradigmatic shift in the global finance industry. Its backers, led by Silicon Valley venture capitalists bent on divining their next fortunes, envisioned a new, digital form of currency that couldn’t be controlled by any government. They dreamed of a new method of stored value, like gold. And they foresaw a more efficient way for people to move money across borders, given that the global remittance business is stodgy and controlled by a small handful of companies.

Dreams are all good and fine. But cryptocurrencies had two things working against them from the outset. First, they have no inherent value, no matter what their promoters insisted. Second, not being backed by the full faith and credit of a credible government turned out to be a liability rather than a virtue. Most non-dreamers now see these limitations for what they are, and the trial of Bankman-Fried is a painful reminder of how easy it is to run the big con on a lot of folks.

There are a lot of reasons for crypto’s fall. Governments — particularly the U.S. government, which oversees the most important fiat currency in the world — offer better-than-decent protection against the scam artists and other fraudsters who have run roughshod over the largely unregulated crypto industry.

Lesser jurisdictions — from small countries such as El Salvador to large cities such as Miami — that have tried to promote themselves as burgeoning centers for crypto enthusiasts have learned the hard way that most of their citizens simply don’t want or need an alternative currency. According to a 2021 estimate, crypto accounts for about 1 percent of global money transfers. It turns out that workers wanting to send portions of their hard-earned wages back to their home countries would prefer to use a currency they understand: the U.S. dollar.

Mainstream finance companies have been experimenting with crypto, but their forays look to be mostly for show. Venmo, for example, has a button on its app that allows users to trade multiple cryptocurrencies. The small print warns customers of the inherent risk in trading any currency, and the company declined to disclose the trading volume of crypto on its platform. Presumably, if crypto amounted to a significant portion of its business, Venmo, which is owned by the publicly traded PayPal, would say so.

One of the silliest arguments about crypto’s importance — because so many smart people were shifting their careers into crypto-related projects, there must be something to it — also has been unmasked as naive. The Wall Street Journal recently reported that an executive overseeing the crypto investments of prominent hedge fund Third Point had left the firm after it lost a sizable investment in Bankman-Fried’s company. Crypto bros hyping their trades poolside from Miami Beach have become increasingly muted of late. Some even are returning, the horror, to New York City.

As for Bankman-Fried himself, his fraud trial simultaneously has everything and little to do with cryptocurrencies. On the one hand, the empire he founded, which lasted all of three years and at its peak was valued at $32 billion, never would have existed but for the crypto craze on which it was built. And some of the allegations against him involve manipulation of esoteric digital tokens. But Bankman-Fried mostly stands accused of plain, old-fashioned fraud, such as providing false information to lenders, living grandly on money that belonged to depositors and violating campaign finance laws by raiding customer accounts for contributions to politicians. It’s an old story, not a new one. (Bankman-Fried has pleaded not guilty to all charges.)

Like any gold rush, the crypto craze has created vast wealth for a few — and a trail of misery for many. Actual gold rushes featured fights over a precious metal that looks pretty even when financial parties disagree over its value. Crypto, which exists only in the digital ether, was a made-up concept from its inception. After you switch off your computer or phone, you can’t even look at it.

Make sense of the news fast with Opinions' daily newsletter

Make sense of the news fast with Opinions' daily newsletterThe confusion is understandable. More than a decade after cryptocurrencies were launched, the promise of these alternative currencies has amounted to little more than broken dreams. Nascent technologies can only remain the next big thing for so long. At some point, regular people need to start using them, which most certainly isn’t happening with crypto. So, while a jury in New York won’t return a verdict on the fate of Bankman-Fried for weeks, the judgment on crypto already is clear: It is a solution in search of a problem.

Crypto was supposed to represent nothing less than a paradigmatic shift in the global finance industry. Its backers, led by Silicon Valley venture capitalists bent on divining their next fortunes, envisioned a new, digital form of currency that couldn’t be controlled by any government. They dreamed of a new method of stored value, like gold. And they foresaw a more efficient way for people to move money across borders, given that the global remittance business is stodgy and controlled by a small handful of companies.

Dreams are all good and fine. But cryptocurrencies had two things working against them from the outset. First, they have no inherent value, no matter what their promoters insisted. Second, not being backed by the full faith and credit of a credible government turned out to be a liability rather than a virtue. Most non-dreamers now see these limitations for what they are, and the trial of Bankman-Fried is a painful reminder of how easy it is to run the big con on a lot of folks.

There are a lot of reasons for crypto’s fall. Governments — particularly the U.S. government, which oversees the most important fiat currency in the world — offer better-than-decent protection against the scam artists and other fraudsters who have run roughshod over the largely unregulated crypto industry.

Lesser jurisdictions — from small countries such as El Salvador to large cities such as Miami — that have tried to promote themselves as burgeoning centers for crypto enthusiasts have learned the hard way that most of their citizens simply don’t want or need an alternative currency. According to a 2021 estimate, crypto accounts for about 1 percent of global money transfers. It turns out that workers wanting to send portions of their hard-earned wages back to their home countries would prefer to use a currency they understand: the U.S. dollar.

Mainstream finance companies have been experimenting with crypto, but their forays look to be mostly for show. Venmo, for example, has a button on its app that allows users to trade multiple cryptocurrencies. The small print warns customers of the inherent risk in trading any currency, and the company declined to disclose the trading volume of crypto on its platform. Presumably, if crypto amounted to a significant portion of its business, Venmo, which is owned by the publicly traded PayPal, would say so.

One of the silliest arguments about crypto’s importance — because so many smart people were shifting their careers into crypto-related projects, there must be something to it — also has been unmasked as naive. The Wall Street Journal recently reported that an executive overseeing the crypto investments of prominent hedge fund Third Point had left the firm after it lost a sizable investment in Bankman-Fried’s company. Crypto bros hyping their trades poolside from Miami Beach have become increasingly muted of late. Some even are returning, the horror, to New York City.

As for Bankman-Fried himself, his fraud trial simultaneously has everything and little to do with cryptocurrencies. On the one hand, the empire he founded, which lasted all of three years and at its peak was valued at $32 billion, never would have existed but for the crypto craze on which it was built. And some of the allegations against him involve manipulation of esoteric digital tokens. But Bankman-Fried mostly stands accused of plain, old-fashioned fraud, such as providing false information to lenders, living grandly on money that belonged to depositors and violating campaign finance laws by raiding customer accounts for contributions to politicians. It’s an old story, not a new one. (Bankman-Fried has pleaded not guilty to all charges.)

Like any gold rush, the crypto craze has created vast wealth for a few — and a trail of misery for many. Actual gold rushes featured fights over a precious metal that looks pretty even when financial parties disagree over its value. Crypto, which exists only in the digital ether, was a made-up concept from its inception. After you switch off your computer or phone, you can’t even look at it.