Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

1929 & Dot Com Charts

- Thread starter West Dundee Hawkeye

- Start date

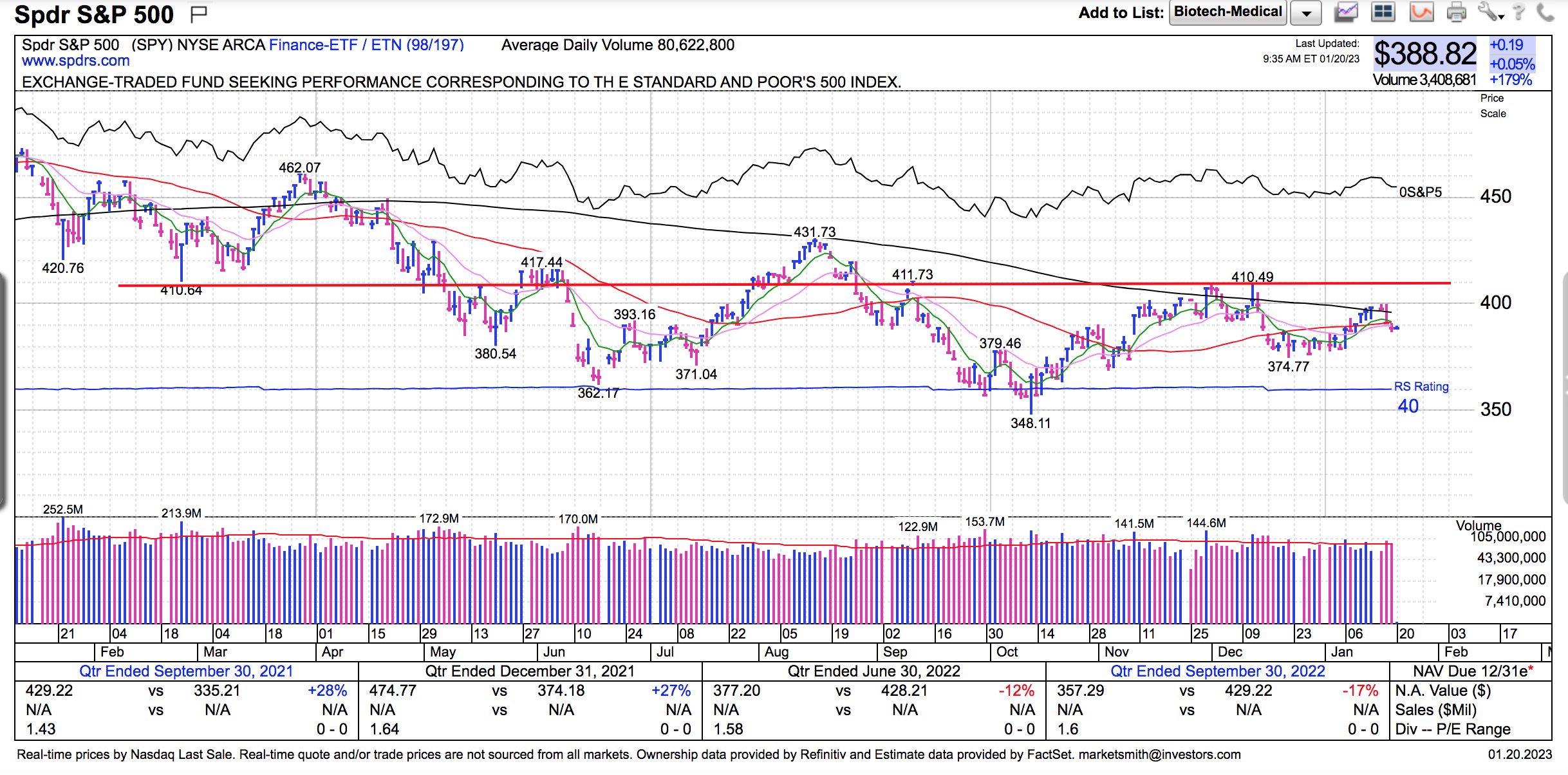

410 on this current SPY chart (solid red horizontal line) or 4100 on the S&P continues to be resistance.

Met with my finanical guy. Some interesting comments:

Trending markets is very difficult now. In 2012, they established age based retirement funds and pensions have been dying. This puts and incredible load of money into the top 5-10 stocks which fuel the SP500. There are no longer people making value based decisions on the profitability and value of those top 10 companies. Every quarter, everyone just passively puts money into those companies. This guarantees increases in stock value without any link to performance.

He thinks we will have a technical recession but consumer spending will stay high as unemployment will actually remain low so it won't hit the individual very hard. He thinks the markets priced in a quarter or two with slowing of interest rates by the feds and when they don't do that, it will drive the overall market lower. This dip will effect market performance but he thinks we should hit double digit returns if you're picking the right stocks based on individual company metrics. Market overall will be volatile and generally perform in mid single digits. Then enter 2-3 years of a flat trajectory.

Trending markets is very difficult now. In 2012, they established age based retirement funds and pensions have been dying. This puts and incredible load of money into the top 5-10 stocks which fuel the SP500. There are no longer people making value based decisions on the profitability and value of those top 10 companies. Every quarter, everyone just passively puts money into those companies. This guarantees increases in stock value without any link to performance.

He thinks we will have a technical recession but consumer spending will stay high as unemployment will actually remain low so it won't hit the individual very hard. He thinks the markets priced in a quarter or two with slowing of interest rates by the feds and when they don't do that, it will drive the overall market lower. This dip will effect market performance but he thinks we should hit double digit returns if you're picking the right stocks based on individual company metrics. Market overall will be volatile and generally perform in mid single digits. Then enter 2-3 years of a flat trajectory.

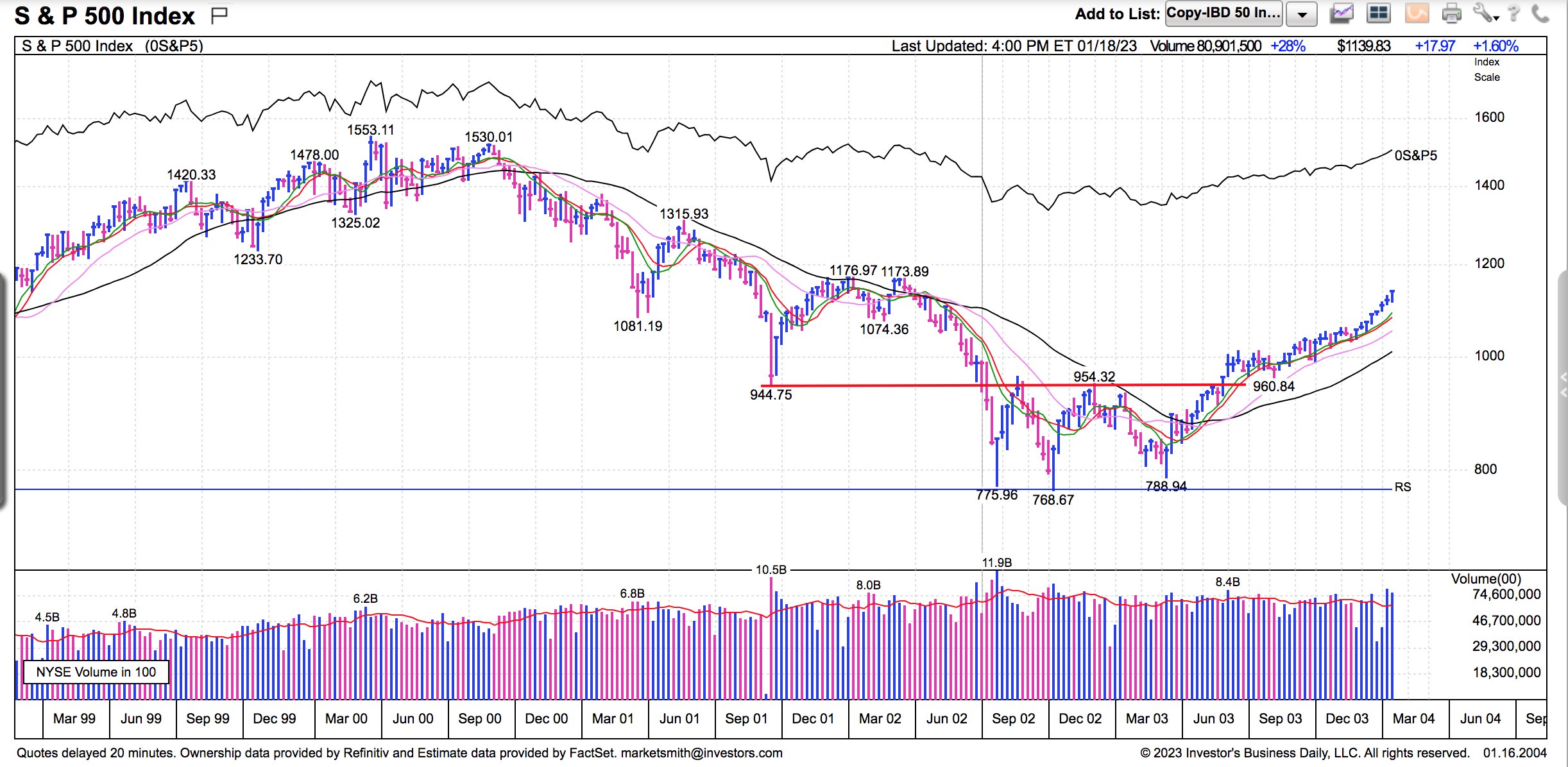

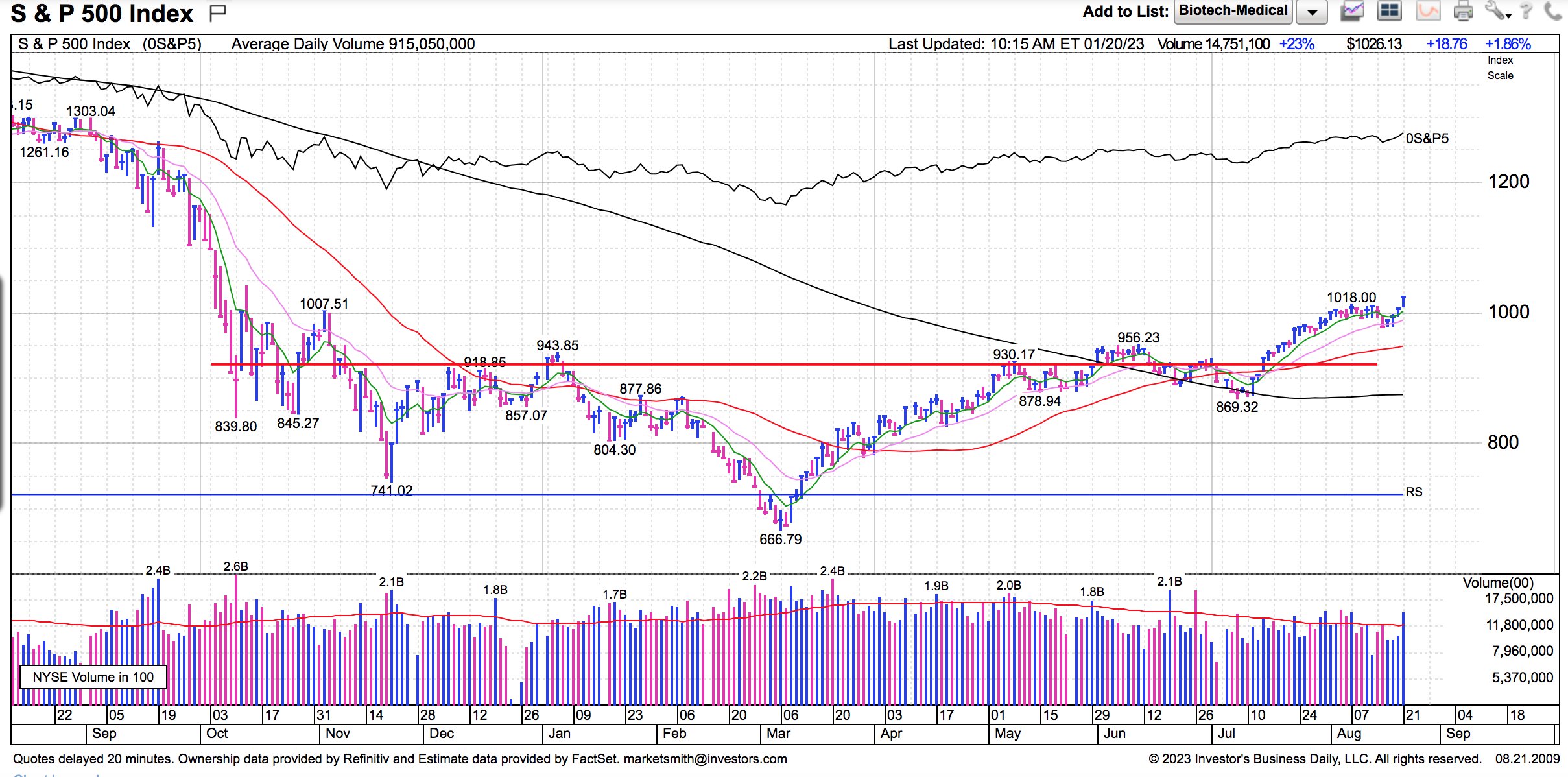

Had our group call with blue horseshoe tuesday. He is as bearish as i remember since 2009 and 9/11.Met with my finanical guy. Some interesting comments:

Trending markets is very difficult now. In 2012, they established age based retirement funds and pensions have been dying. This puts and incredible load of money into the top 5-10 stocks which fuel the SP500. There are no longer people making value based decisions on the profitability and value of those top 10 companies. Every quarter, everyone just passively puts money into those companies. This guarantees increases in stock value without any link to performance.

He thinks we will have a technical recession but consumer spending will stay high as unemployment will actually remain low so it won't hit the individual very hard. He thinks the markets priced in a quarter or two with slowing of interest rates by the feds and when they don't do that, it will drive the overall market lower. This dip will effect market performance but he thinks we should hit double digit returns if you're picking the right stocks based on individual company metrics. Market overall will be volatile and generally perform in mid single digits. Then enter 2-3 years of a flat trajectory.

Recommending 75 % cash (short term cd’s) and 25% stock with stop losses on all. For those of you who remember him recommending nvs and the oil stocks you’re welcome.

He now recommends stop on nvs at 91.

This is a market where I think most stocks will have some volatility and I don't expect to see large returns of the stock market taking off for the foreseeable future. CD's, short to mid term bonds seem to be good places to get decent return with minimal risk. If you want to look for more return potential, silver, gold, bitcoin and their related stocks appear to me to be good places to be for the next 2 years or so. My MSTR is still doing pretty well, down a bit the past couple days, but I am still up around 30%.

I am getting 5% in 3 month CD's.This is a market where I think most stocks will have some volatility and I don't expect to see large returns of the stock market taking off for the foreseeable future. CD's, short to mid term bonds seem to be good places to get decent return with minimal risk. If you want to look for more return potential, silver, gold, bitcoin and their related stocks appear to me to be good places to be for the next 2 years or so. My MSTR is still doing pretty well, down a bit the past couple days, but I am still up around 30%.

Had our group call with blue horseshoe tuesday. He is as bearish as i remember since 2009 and 9/11.

Recommending 75 % cash (short term cd’s) and 25% stock with stop losses on all. For those of you who remember him recommending nvs and the oil stocks you’re welcome.

He now recommends stop on nvs at 91.

‘Stocks gained 27% in 2009.

Bottom line. No one, and I mean no one knows what the markets are going to do rest of the year.

Where?I am getting 5% in 3 month CD's.

Yes. Do tell. Meaning I can get 20% 1 year returns if bond market/rates stay the same?Where?

Haha, no. That would be ridiculous. I still have not seen a 3 month CD with a rate of 5% APY.Yes. Do tell. Meaning I can get 20% 1 year returns if bond market/rates stay the same?

I’m in SHV. That worth a shit?So you’re looking for a 1.25% return over 3 months then?

March 2009 was the bottom if i remember.‘Stocks gained 27% in 2009.

Bottom line. No one, and I mean no one knows what the markets are going to do rest of the year.

Yes. Park some cash until certain stocks get a little cheaper. I've got it in a high yield on demand savings account that is paying 3.85% APY. If I can get better without having to lock up the money for more than a few months, I'd move most of that.So you’re looking for a 1.25% return over 3 months then?

Why?I’m in SHV. That worth a shit?

Do short term cd’s - 1 or 3 month.

You aren’t likely getting 5% 3 month from traditional banks. Possibly, I guess, but not likely. However, brokered cd’s are paying around 4.8-4.9% right now. Think, broker dealers. Those rates are dropping as we speak.

I have my eye on one certain company and intend to buy a fair amount of it when/if this market has a real hard break...which I don't expect for another 5-6 months. I have done my fair share of speculation in my lifetime and its my opinion that the "stock market" is the worst place to do so.

Money market paying 4.5% right now but will rise and fall depending on rates.

O probably should commit to 6 month CDs but like having flexibility of getting cash out immediately if desired.

Soybean: crystal ball on grain markets please? Maybe spring rally before big crop(rain) hammers it after June?

O probably should commit to 6 month CDs but like having flexibility of getting cash out immediately if desired.

Soybean: crystal ball on grain markets please? Maybe spring rally before big crop(rain) hammers it after June?

Thanks for sharing company. WowI have my eye on one certain company and intend to buy a fair amount of it when/if this market has a real hard break...which I don't expect for another 5-6 months. I have done my fair share of speculation in my lifetime and its my opinion that the "stock market" is the worst place to do so.

I intend to be short Dec Corn before Memorial Day. I already have Sep bean calls on incase the weather turns dry again. In other words - I'm not sure about anything this year.Money market paying 4.5% right now but will rise and fall depending on rates.

O probably should commit to 6 month CDs but like having flexibility of getting cash out immediately if desired.

Soybean: crystal ball on grain markets please? Maybe spring rally before big crop(rain) hammers it after June?

I give you one hint...its an Iowa based company.Thanks for sharing company. Wow

I intend to be short Dec Corn before Memorial Day. I already have Sep bean calls on incase the weather turns dry again. In other words - I'm not sure about anything this year.

I love gambling in the markets. I have traded stock market, oil, gold, silver and foreign currency futures, but never agriculture futures. Would you please explain your short corn reasoning and how those trade (volume and pricing)?

My knowledge of agriculture futures is limited to orange juice futures and reports stolen by Clarence Beeks.

Zombie Burger?I give you one hint...its an Iowa based company.

I have an account at E-Trade and I am buying brokered CD's.Where?

The last one I bought was a few weeks ago.

Sell in May and go away is coming up.

Earnings are going to start coming down.

There is no distributions from the Strategic Petroleum Reserve going on and they may replenish it.

I am now looking for an October low to get back in market. Maybe sooner.

Gee thanks.I give you one hint...its an Iowa based company.

I’ve given free stock advice (actual picks) from blue horseshoe many times. Anyone who took it made bank.

Increased corn acres in the U S and internationally. Slowing economy later this year will likely lead to less driving which means less ethanol use. The domestic cattle and hog herds are decreasing which mean less feed usage. If these acerage increases are realized together with timely rains this summer we could see near a 15B bushel crop which I think means sub $4.00 corn this fall. I'm using options this year to cut my market risk to just the average of 15 cents I spent on the $5.00 Dec puts, which will cover me through the bulk of the U S harvest.I love gambling in the markets. I have traded stock market, oil, gold, silver and foreign currency futures, but never agriculture futures. Would you please explain your short corn reasoning and how those trade (volume and pricing)?

My knowledge of agriculture futures is limited to orange juice futures and reports stolen by Clarence Beeks.

I am also hedging my risk by buying $15.00 Sep soybean calls...I paid an average of 17 cents for these and they will cover me through the August Crop Production report in case normal summer rains do not occur... as a decrease in bean yeilds coupled with already snug inventories could mean significant price gains inspite of the big crop they have in Brazil this year.

This is not a fool-proof strategy as there are many more unkowns than usual this year on both the production and consumption side of things. In fact ,I can see at least a dozen major possible flaws in my plan popping up as we go along. So, I am only about 40% positioned insofar as the risk I'm willing to assume regarding this 2023 season.

For those of you still riding NVS you’re welcome.Had our group call with blue horseshoe tuesday. He is as bearish as i remember since 2009 and 9/11.

Recommending 75 % cash (short term cd’s) and 25% stock with stop losses on all. For those of you who remember him recommending nvs and the oil stocks you’re welcome.

He now recommends stop on nvs at 91.

Move your stop to 97.

My 401k is up 7.5% this year. I have a feeling that may all change come June 2.

This is what my financial guy was talking about. Targeted retirement funds just dumping money into top sp500 on no basis other than timed inputs.

Mine is too. I have not been following this thread. What is the harbinger for 6/2?My 401k is up 7.5% this year. I have a feeling that may all change come June 2.

Mine is too. I have not been following this thread. What is the harbinger for 6/2?

Debt ceiling

There are 2 possible outcomes to the debt ceiling.Debt ceiling

1. No agreement is reached or it takes weeks/months.

Econ & markets will tank

2. Agreement is reached

Gives Fed the green light to raise rates at next meeting.

Treasury will issue at least $1 Trillion in new Treasuries flooding the market and bringing down prices of Treasuries & causing rates to rise.

Today on CNBC Squawk Box @barryknapp (Twitter) was on and explained Scenario #2 where the Debt Ceiling Extension is approved. He was very detailed.There are 2 possible outcomes to the debt ceiling.

1. No agreement is reached or it takes weeks/months.

Econ & markets will tank

2. Agreement is reached

Gives Fed the green light to raise rates at next meeting.

Treasury will issue at least $1 Trillion in new Treasuries flooding the market and bringing down prices of Treasuries & causing rates to rise.

Fed got green light today to raise rates based on inflation #’s.There are 2 possible outcomes to the debt ceiling.

1. No agreement is reached or it takes weeks/months.

Econ & markets will tank

2. Agreement is reached

Gives Fed the green light to raise rates at next meeting.

Treasury will issue at least $1 Trillion in new Treasuries flooding the market and bringing down prices of Treasuries & causing rates to rise.

Similar threads

- Replies

- 36

- Views

- 509

- Replies

- 176

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT