Dr Parik Patel is my favorite follow on Twitter. He’s hilarious.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gamestop

- Thread starter Bonerfarts

- Start date

Dr Parik Patel is my favorite follow on Twitter. He’s hilarious.

Facts

I wanted to jump into GME when it was $40. Instead, I watched about 6 hours of videos on YouTube and read countless hours about it before committing to put some money in it.These are the kind of comments that typically denote market tops.

I had stocks in apple, corsair, weed etfs, TSM, and others and this whole thing has taught me one major lesson. The market is literally a casino with what these assbags are doing. Technical analysis, fundamentals, earnings reports, etc is all bullshit. There is no rhyme or reason to this. It's all rigged and any gains are more due to luck than anything else.

So naturally, I sold all the other stocks and put it in GME.

YOLO

I wanted to jump into GME when it was $40. Instead, I watched about 6 hours of videos on YouTube and read countless hours about it before committing to put some money in it.

I had stocks in apple, corsair, weed etfs, TSM, and others and this whole thing has taught me one major lesson. The market is literally a casino with what these assbags are doing. Technical analysis, fundamentals, earnings reports, etc is all bullshit. There is no rhyme or reason to this. It's all rigged and any gains are more due to luck than anything else.

So naturally, I sold all the other stocks and put it in GME.

YOLO

Nothing to see here. Just CNBC doctoring Congressional Hearings. Probably nothing.

CNBC Posts Edited Video from House Financial Services’ GameStop Hearing, Deleting Dennis Kelleher’s Key Testimony Criticizing Citadel

CNBC Posts Edited Video from House Financial Services’ GameStop Hearing, Deleting Dennis Kelleher’s Key Testimony Criticizing Citadel | Better Markets

FOR IMMEDIATE RELEASE Tuesday, March 23, 2021 Contact: Pamela Russell at 202-618-6433 or prussell@bettermarkets.com CNBC Posts Edited Video from House Financial Services’ GameStop Hearing, Deleting Dennis Kelleher’s Key Testimony Criticizing Citadel Washington, D.C. – Dennis M. Kelleher...

bettermarkets.com

bettermarkets.com

“To hear Kelleher’s concerns about Citadel’s substantial presence in the financial markets without the regulatory oversight necessary to protect investors and markets, visit this link. However, Kelleher’s following comments, directly responding to a Republican witness’s unqualified defense of Citadel, during the hearing capture the essence of his concerns:

“If Citadel shut down today, even for a day, that means 26 percent of all U.S. equities’ volume in 8,900 listed securities would stop. It executes 47 percent of all U.S. listed retail volume. It represents 99 percent of the traded volume of 3,000 listed options. To say that the system would work perfectly fine if all that evaporated today and competitors would come into the market—that may ultimately happen—but until it ultimately happens, you're going to have a systemic event. And to deny that is to deny reality.”

Off market activity tracker. Interesting to see the top names.

This is the way.I wanted to jump into GME when it was $40. Instead, I watched about 6 hours of videos on YouTube and read countless hours about it before committing to put some money in it.

I had stocks in apple, corsair, weed etfs, TSM, and others and this whole thing has taught me one major lesson. The market is literally a casino with what these assbags are doing. Technical analysis, fundamentals, earnings reports, etc is all bullshit. There is no rhyme or reason to this. It's all rigged and any gains are more due to luck than anything else.

So naturally, I sold all the other stocks and put it in GME.

YOLO

Close. I bought 50 shares yesterday at 140 and exited today at 216. Set a sell limit and got lucky on the sell the second peak in the morning today.Who bought at $120 and made 50% returns in a day, raise your hand.

Off market activity tracker. Interesting to see the top names.

This is exactly why I own GameStop stock partially as a hedge. Look what happened to Discovery and Viacom because a hedge fund had to liquidate positions in those stocks because of a margin call. With GME, the margin depth is significantly greater and more widespread. If the squeeze happens and hedge funds get margin called, the rest of the market will crater. GME’s beta supports that theory as well.

Buy and hold, apes.

i haven’t seen any evidence of huge block trades.

Link

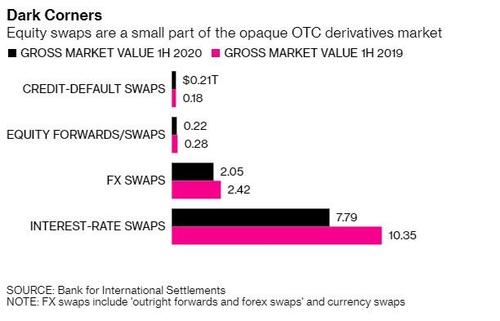

Stop us if you've heard this one before - Wall Street prime brokers allowed hedge funds to dance while the music was playing with ever greater leverage in off-exchange and unregulated derivatives... until the first sign of trouble and the whole house of cards comes crashing down in a potentially systemic manner.

The bloodbath in various media stocks on Friday has brought light back to one of the dark corners of the equity trading business - so-called contracts-for-differences (CFDs).

As Bloomberg reports, much of the leverage used by Hwang’s Archegos Capital was provided by banks including Nomura and Credit Suisse - who have most recently admitted huge losses - as CFDs, which are made off exchanges, allow managers like Hwang to amass stakes in publicly traded companies without having to declare their holdings (far in excess of the 5% stakes that require regulatory reporting).

Crucially, as Bloomberg notes, this means Archegos may never actually have owned most of the underlying securities - if any at all - as the CFD is akin to a privately-arranged (i.e. off exchange and bespoke) futures contract where the differences in the settlement between the open and closing trade prices are cash-settled (there is no delivery of physical goods or securities with CFDs).

What makes the situation worse is that Archegos reportedly took positions in these CFDs with various prime brokers - and because these positions are by their nature not centrally cleared or aggregated, this left prime broker X unaware of their client's exposures with prime broker Y... which in this case was huge.

The leverage Hwang was given made him look like a trading genius as the various positions he took were pumped and pumped (and helped by gamma-squeezers) but now look like a reckless gambling fool as the bets collapsed.

CFDs linked to stocks (with a gross market value of around $282 billion at end June 2020) are among bespoke derivatives that investors trade privately between themselves, or over-the-counter, instead of through public exchanges. This is exactly the kind of hidden risk that amplified the losses during the 2008 financial crisis.

As Bloomberg notes, regulators have begun clamping down on CFDs in recent years because they’re concerned the derivatives are too complex and too risky for retail investors, with the European Securities and Markets Authority in 2018 restricting the distribution to individuals and capping leverage. In the U.S., CFDs are largely banned for amateur traders... but not for hedge fund managers who are "sophisticated"?

But, banks still favor them because they can make a large profit without needing to set aside as much capital versus trading actual securities (driven to this opaque market as an unintended consequence of heavy regulation following the 2008 financial crisis).

In the case of Archegos, there is very little transparency about Hwang’s trades, but market participants suggest his assets had grown to anywhere from $5 billion to $10 billion in recent years with total exposure topping $50 billion. And bear in mind, this is not 'leverage' in the old-fashioned sense (i.e. banks allow you buy X-times the amount of stocks relative to your capital); this is purely synthetic - the firm has no actual underlying asset to fall back on, but is linearly exposed to losses (and gains) on a margined basis.

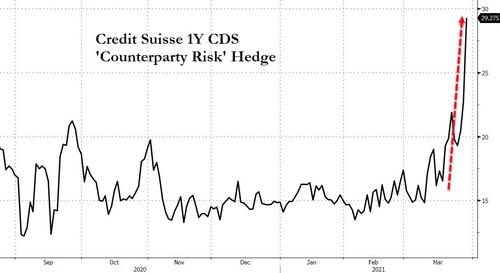

And as we noted at the beginning, this has the potential to be much more systemic as the losses created by Archegos' margin calls trigger more margin calls and more potential losses for the prime brokers. Think we are exaggerating, then explain why the costs of counterparty risk hedging for Credit Suisse for example, has exploded in the last few days...

Mohammed El-Erian told CNBC this morning that "It seems to be a one-off ... for now, it looks contained. And that's a good thing." But added "what we don't want is a pile-up."

We look forward to the Congressional hearings on this.

I haven't been following terribly closely and am not wise in the stock market ...can someone explain how covering the over-shorted stocks works?

If GME, for example, is shorted over 100% of the float, how can those be covered? Do shorts have to buy back "virtual" shares to return to lenders until they get down under the actual float #? Do real shares have to be bought to cover shorts at some point, or can it all be done with virtual shares? Or do you have to buy real shares, return them to the lender, then buy them again just to return them right back to cover when it's over-shorted? The absurdity of naked shorting confuses me.

If GME, for example, is shorted over 100% of the float, how can those be covered? Do shorts have to buy back "virtual" shares to return to lenders until they get down under the actual float #? Do real shares have to be bought to cover shorts at some point, or can it all be done with virtual shares? Or do you have to buy real shares, return them to the lender, then buy them again just to return them right back to cover when it's over-shorted? The absurdity of naked shorting confuses me.

That’s the big issue - supply and demand. If there’s any sort of catalyst like a margin call or some sort of share recall, these shares need to be accounted for and purchased, possibly several times over. So retail investors who hold out when the hedge funds need to purchase are going to see the price shoot up significantly.I haven't been following terribly closely and am not wise in the stock market ...can someone explain how covering the over-shorted stocks works?

If GME, for example, is shorted over 100% of the float, how can those be covered? Do shorts have to buy back "virtual" shares to return to lenders until they get down under the actual float #? Do real shares have to be bought to cover shorts at some point, or can it all be done with virtual shares? Or do you have to buy real shares, return them to the lender, then buy them again just to return them right back to cover when it's over-shorted? The absurdity of naked shorting confuses me.

That’s the big issue - supply and demand. If there’s any sort of catalyst like a margin call or some sort of share recall, these shares need to be accounted for and purchased, possibly several times over. So retail investors who hold out when the hedge funds need to purchase are going to see the price shoot up significantly.

My buddy is telling me that the big boys will have to "re-balance" at the end of the quarter (tomorrow). Anyone have insight on how that works?

The rebalance has been happening for a couple weeks now. A lot of riskier companies have seen their price decrease dramatically (see Tesla over the last 2 weeks), with money flowing into bonds with rising yields. I don't expect to see a last minute change in portfolios tomorrow.My buddy is telling me that the big boys will have to "re-balance" at the end of the quarter (tomorrow). Anyone have insight on how that works?

Last edited:

Say Public Retirement Fund X has an internal strategy to hold 50% equities. If stocks have a great quarter, their percentage might run up to say 53%, so they would sell enough stock to get back down to 50%.My buddy is telling me that the big boys will have to "re-balance" at the end of the quarter (tomorrow). Anyone have insight on how that works?

Gamestop names Amazon guy as Chief Growth Officer Link thingy

Just bought 3 more tickets to the moon @ $185, then it shot straight up to $198.

I haven't been following terribly closely and am not wise in the stock market ...can someone explain how covering the over-shorted stocks works?

If GME, for example, is shorted over 100% of the float, how can those be covered? Do shorts have to buy back "virtual" shares to return to lenders until they get down under the actual float #? Do real shares have to be bought to cover shorts at some point, or can it all be done with virtual shares? Or do you have to buy real shares, return them to the lender, then buy them again just to return them right back to cover when it's over-shorted? The absurdity of naked shorting confuses me.

just an FYI but the short interest isn’t anywhere near 100%. It’s reported at 18%.

I'll cut my balls off if the short interest is actually 18%.just an FYI but the short interest isn’t anywhere near 100%. It’s reported at 18%.

I'm also convinced that retail owns around 100 percent of the float.

I'm also convinced that retail owns around 100 percent of the float.

Me too. There are only 70 million shares total. Insiders own ~10 million. Institutions own ~15 million. that leaves what 45 million available? What are the chances that 4.5 million people own avg of 10 shares? It has to be high. Or 450K people own 100 shares. you all gotta remember that people were taking huge positions when this was at $5/share. individuals could easily procure tens of thousands of shares. $5 x 30,000 shares was only $150K. plenty of the OG GME investors took such positions. that brings down the average or total number of retail required to own the float down much further.

GameStop Corp. (GME) Valuation Measures & Financial Statistics

Find out all the key statistics for GameStop Corp. (GME), including valuation measures, fiscal year financial statistics, trading record, share statistics and more.

"

| Shares Outstanding 5 | 69.94M |

| Float | 45.34M |

| % Held by Insiders 1 | 22.29% |

| % Held by Institutions 1 | 110.63% |

This thing went worldwide. I saw a graph back in early Feb that GME was the #1 most purchased stock in nearly every European country. Nearly every time this stock was shorted into oblivion, brokers were reporting buy to sell ratio of 65, 75, 85%. On days the price was plummeting.

I think the chance retail owns less than 100% of the float is something near 0%. Retail must own naked short sold positions. they just keep rolling over the FTD and or hiding the naked short obligations in some manner. there is no other logical explanation to me.

Again, there are only 70 million shares total outstanding!!!

Top 10 Owners of GameStop Corp

| Stockholder | Stake | Shares owned | Total value ($) | Shares bought / sold | Total change |

|---|---|---|---|---|---|

| Fidelity Management & Research Co... | 13.30% | 9,276,087 | 943,749,091 | -258,003 | -2.71% |

| BlackRock Fund Advisors | 12.17% | 8,489,953 | 863,767,818 | +592,046 | +7.50% |

| The Vanguard Group, Inc. | 7.25% | 5,053,431 | 514,136,070 | -131,681 | -2.54% |

| Senvest Management LLC | 7.24% | 5,050,915 | 513,880,092 | +1,825,175 | +56.58% |

| Maverick Capital Ltd. | 6.68% | 4,658,607 | 473,966,676 | +2,894,757 | +164.12% |

| Dimensional Fund Advisors LP | 5.64% | 3,934,919 | 400,338,659 | -13,195 | -0.33% |

| Morgan Stanley Investment Managem... | 4.54% | 3,168,279 | 322,340,705 | +2,050,191 | +183.37% |

| D. E. Shaw & Co. LP | 4.07% | 2,841,563 | 289,100,620 | +2,306,866 | +431.43% |

| SSgA Funds Management, Inc. | 3.51% | 2,445,216 | 248,776,276 | -164,271 | -6.30% |

| Susquehanna Financial Group LLLP | 3.50% | 2,444,172 | 248,670,059 | -1,931,873 | -44.15% |

Top 10 Mutual Funds Holding GameStop Corp

| Mutual fund | Stake | Shares owned | Total value ($) | Shares bought / sold | Total change |

|---|---|---|---|---|---|

| Fidelity Series Intrinsic Opportu... | 9.75% | 6,801,757 | 692,010,757 | -176,510 | -2.53% |

| iShares Core S&P Small Cap ETF | 5.28% | 3,679,007 | 374,302,172 | +7,911 | +0.22% |

| Fidelity Low Priced Stock Fund | 2.87% | 2,000,679 | 203,549,081 | -40,742 | -2.00% |

| Vanguard Total Stock Market Index... | 2.11% | 1,471,585 | 149,719,058 | -507 | -0.03% |

| Morgan Stanley Instl. Fund Tr. - ... | 2.03% | 1,415,967 | 144,060,483 | +1,069,024 | +308.13% |

| iShares Russell 2000 ETF | 2.03% | 1,415,331 | 143,995,776 | +20,114 | +1.44% |

| DFA US Small Cap Value Portfolio | 1.61% | 1,121,503 | 114,101,715 | 0 | 0.00% |

| Vanguard Extended Market Index Fu... | 1.11% | 771,765 | 78,519,371 | +6,267 | +0.82% |

| iShares Russell 2000 Value ETF | 0.90% | 629,067 | 64,001,277 | +9,222 | +1.49% |

| Vanguard Small Cap Index Fund | 0.90% | 628,361 | 63,929,448 | +4,768 | +0.76% |

Last edited:

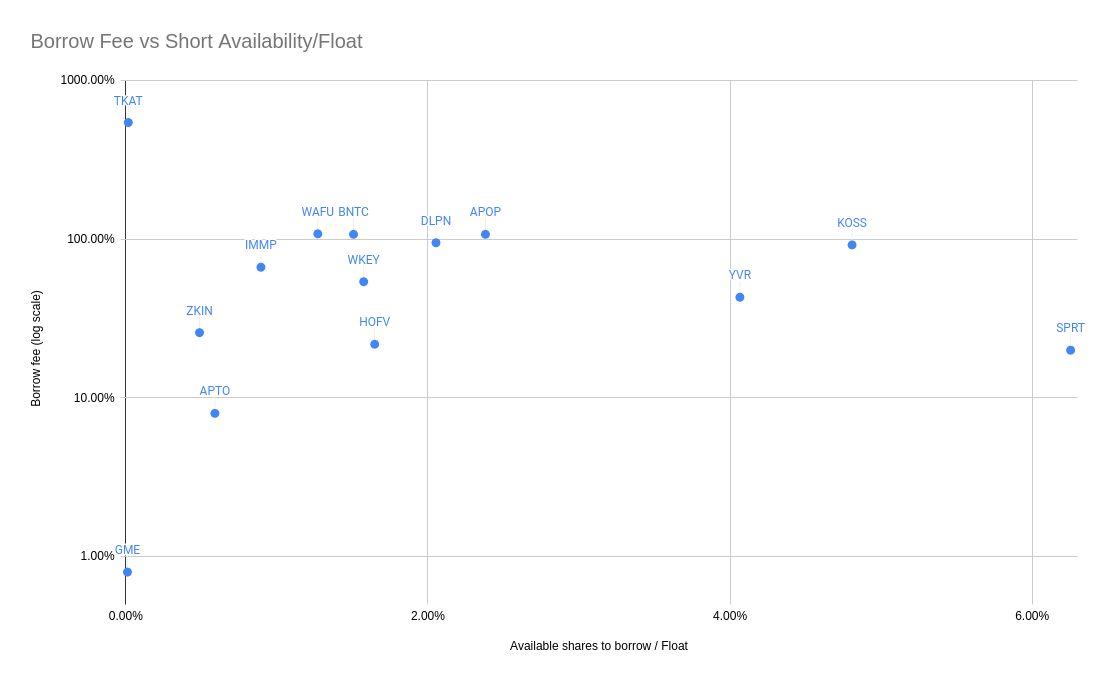

Nothing to see here...Just an absurdly low borrowing rate on the third most difficult to source shares in the market. Why?????

www.tradersinsight.news

www.tradersinsight.news

Could anyone explain this even with a rationalization?

Securities Lending Report: 3/22/21 – 3/26/21

Securities Lending Report March 22-26 2021: Sector vs Short Positions, Largest Short Values, Highest Borrow Fees, Hardest to Borrow, ETF Shorts vs Non-Shorts

Could anyone explain this even with a rationalization?

Oops!!!

Read page 14!

@TennNole17 rest easy, my diamondhanded friend.

@Bonerfarts you too

This explains why the price has ended EXACTLY on a whole number, no cents. Time and time again, most recently, Friday March 26 - $181.00. From the comments:

"Wingardienleviosah 2 days ago·edited 2 days ago

I have been following this line of thought since February and am more convinced than ever that it is a good thesis. Basically, I think the shorts figured out a few weeks back that they couldn't go blow for blow given their weak hand (costs money and interest on a losing position) and that this is why we started to see INSANE open interest on way OTM calls all along the chain. On the one hand the shorts want to drive the price down and use massive put walls to create a downward spiral (this is how they typically short stocks and create a 'virtuous cycle' of profit for themselves fyi). On the other hand, they saw a possible war of attrition and the inevitable MOASS, and took out massive otm call positions as insurance to secure shares relatively cheaply at those prices. The thinking was, 'these idiots writing the options are using models that are underpricing the underlying, and we know this because we are the ones sitting on the price!) So it suddenly becomes in their interest to either, 1. Drive the price to as close to $0 as possible and cover, or 2. Drive the price as high as possible, exercise their now substantial itm calls, and cover. The maximum pain, then, is this middling sideways but consistent upwards movement. Exactly what we've been seeing apart from last week's coordinated post earnings desperate attack. The long whales know all this. They know Citadel et al want to either crush the stock (New board and co means this is out of the question at this point) or to have the MOASS to kick off ASAP in order pass the buck onto the naked option sellers in Chicago. The long whales, also having access to the public options chains as well as information we aren't privy too, are choosing a slow burn in order to prevent the shorts from covering, but also the shorts from using their OTM calls to shift the liability for securing shares to the options writers and their brokers/clearing houses.

What does this mean for you and I? As a theta driven options trader myself, I am using both shares and leaps to play this trade but will convert my long July calls to shares ASAP. The leverage is not that good due to IV (avg 2:1 leverage for ATM calls) and the theta decay and IV crush could take a toll on the calls as price action continues a slow but steady ascent to squeeze out the shorts. I made good money on covered calls these past few weeks and may continue one or two but certainly not with my full position. The MOASS could be triggered at any time, but I suspect we'll see more of the same in the short term and that it will only be triggered when the true margin calls are made by the DTCC and the longs have thoroughly vanquished Citadel and co and put them in a place that the MOASS won't save them and put the brokers or clearing houses at risk."

@Bonerfarts you too

This explains why the price has ended EXACTLY on a whole number, no cents. Time and time again, most recently, Friday March 26 - $181.00. From the comments:

"Wingardienleviosah 2 days ago·edited 2 days ago

I have been following this line of thought since February and am more convinced than ever that it is a good thesis. Basically, I think the shorts figured out a few weeks back that they couldn't go blow for blow given their weak hand (costs money and interest on a losing position) and that this is why we started to see INSANE open interest on way OTM calls all along the chain. On the one hand the shorts want to drive the price down and use massive put walls to create a downward spiral (this is how they typically short stocks and create a 'virtuous cycle' of profit for themselves fyi). On the other hand, they saw a possible war of attrition and the inevitable MOASS, and took out massive otm call positions as insurance to secure shares relatively cheaply at those prices. The thinking was, 'these idiots writing the options are using models that are underpricing the underlying, and we know this because we are the ones sitting on the price!) So it suddenly becomes in their interest to either, 1. Drive the price to as close to $0 as possible and cover, or 2. Drive the price as high as possible, exercise their now substantial itm calls, and cover. The maximum pain, then, is this middling sideways but consistent upwards movement. Exactly what we've been seeing apart from last week's coordinated post earnings desperate attack. The long whales know all this. They know Citadel et al want to either crush the stock (New board and co means this is out of the question at this point) or to have the MOASS to kick off ASAP in order pass the buck onto the naked option sellers in Chicago. The long whales, also having access to the public options chains as well as information we aren't privy too, are choosing a slow burn in order to prevent the shorts from covering, but also the shorts from using their OTM calls to shift the liability for securing shares to the options writers and their brokers/clearing houses.

What does this mean for you and I? As a theta driven options trader myself, I am using both shares and leaps to play this trade but will convert my long July calls to shares ASAP. The leverage is not that good due to IV (avg 2:1 leverage for ATM calls) and the theta decay and IV crush could take a toll on the calls as price action continues a slow but steady ascent to squeeze out the shorts. I made good money on covered calls these past few weeks and may continue one or two but certainly not with my full position. The MOASS could be triggered at any time, but I suspect we'll see more of the same in the short term and that it will only be triggered when the true margin calls are made by the DTCC and the longs have thoroughly vanquished Citadel and co and put them in a place that the MOASS won't save them and put the brokers or clearing houses at risk."

This is insane. Not only does GME have by far the fewest number of shares to borrow, but the fee is almost nothing. It's hard to get a sense of how far out of whack GME is with the rest of the universe from numbers, so I made a chart to help visualize the gap:

a

On the X-axis, we have the normalized available shares, which is available shares to borrow / float. On the y-axis we can see the borrow fee. I had to make this LOG SCALE in order to be able to even see anything due to how distorted the numbers are with GME. There is a general trend that as the available borrow shares goes down, you see borrow fees go up (though some stocks have generally more shares and may be more liquid, affecting these numbers). We can see that TKAT's borrow fee is quite high at 543%, given that there are almost no shares available to borrow right now.

But LOOK AT GME! GME has even fewer shares available as a percentage of its float (they even ran out last week), and yet the borrow rate is almost 0. This is so out of whack that clearly something crazy is going on. I consider this strong evidence of some kind of collusion between the banks lending shares to manipulate the borrow fees for GME. There is no way that the fee should be so low.

And now you know why the Overstock CEO went to bitcoin and gold and has tried to create a blockchain based NASDAQ.

Byrne was also developing a securities lending platform as part of Tzero, which would connect asset-rich institutional investors like pension funds (who make money by lending their stock) directly with short-sellers (who borrow stock to make trades). Both parties stand to benefit from lower fees, plus would receive a blockchain-enabled digital locate receipt that proves the shares have actually changed hands. The service takes dead aim at banks like Goldman Sachs and Morgan Stanley, which currently sit in the middle of these transactions.

I like/hope this is “the answer” to the low borrow rate.

——————————-

You're looking at it all wrong. The borrow fee being low implies that the party that actually does the lending (ie, brokers) has a strong feeling that the price of the underlying security won't drop in the near future.

Remember, borrowing a share doesn't mean you're borrowing the dollar value of the price of a share from the lender, you're expecting to get that money from the other party you sell the share to. It's the inverse of something like the interest rate on a loan - as the short seller, I have to pay a higher fee to borrow something that's a sure win on my part, which corresponds to a stock that both I and the lender think will probably go down in value.

Brokers who can lend shares right now are setting them low because they know that shorting GME is a losing proposition, otherwise they wouldn't lend the shares out - they'd short them themselves.

I'm still hanging in, 10 shares, avg 220ish I think. I've considered picking up some more in the dip, but this thing is so unpredictable

The last week or so has been eerily steady. The day traders pump and dump in the morning and it levels off. If you’re at 220/share, averaging down to 190-195/share seems like a win. It’s obviously volatile, but the potential for a breakout seems so much larger than it taking a dump.I'm still hanging in, 10 shares, avg 220ish I think. I've considered picking up some more in the dip, but this thing is so unpredictable

Go deep into r/GME and it’ll seem worthwhile. They toss around crazy numbers but there’s still a squeeze out there that’ll need to be covered.

Most importantly, just keep holding those shares. The shorts need them to cover so holding will drive the value of them up when this thing is ready to pop.

The last week or so has been eerily steady. The day traders pump and dump in the morning and it levels off. If you’re at 220/share, averaging down to 190-195/share seems like a win. It’s obviously volatile, but the potential for a breakout seems so much larger than it taking a dump.

Go deep into r/GME and it’ll seem worthwhile. They toss around crazy numbers but there’s still a squeeze out there that’ll need to be covered.

Most importantly, just keep holding those shares. The shorts need them to cover so holding will drive the value of them up when this thing is ready to pop.

What price do you think it will hit if there are no shorts? $500? And then what, that's the new fair value of GME?

What price do you think it will hit if there are no shorts? $500? And then what, that's the new fair value of GME?

This thread has nothing to do with a stock's fair price.

That being said, I'd guess it's worth $10-20/per share. They have hired some decent management, so it does have a chance. But I think it's more likely to follow the path of Blockbuster. I don't own GME, but I hope the folks on the Board who do own it, end up coming out ahead. My guess is that in the next few years. The debt-holders will end up with more. One good thing about GME is that it doesn't have a crazy amount of debt (by today's standards).

Similar threads

- Replies

- 73

- Views

- 1K

- Replies

- 6

- Views

- 179

- Replies

- 4

- Views

- 153

- Replies

- 7

- Views

- 243

ADVERTISEMENT

ADVERTISEMENT