What do Roaring Kitty’s tweets today mean??? Anyone?

The shorts are hanging on by a thread and about to lose their grip?

Need to finish above $200 today!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

What do Roaring Kitty’s tweets today mean??? Anyone?

Me this am finding out the market was closed today.

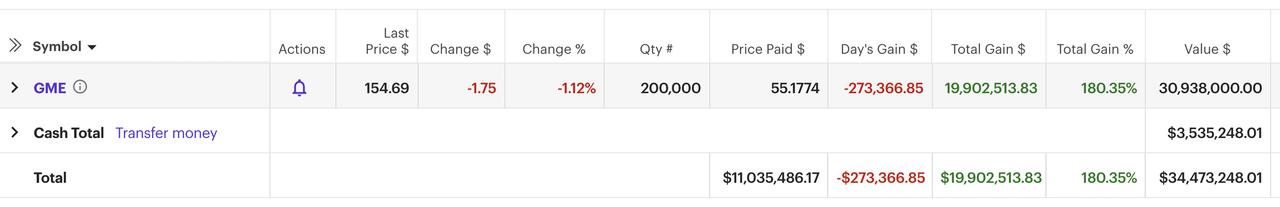

Buy HighI was looking for an exit and bought more instead. I need help

Lol, i definitely prefer a more conservative approach spread out in a handful of etf's. Im not full boglehead, but the below represents my invest and chill philosophy.I like this stock better from the sidelines

Mild gains at 8% in a month? Dude, that a great return in a month!Still hanging around. Its gone from a gambling play to hoping it takes off at some point.

In other news, I did start a Fidelity account and get some "normal" ish stocks that have all seen mild gains over the past month (8%). When I finally get out of Gamestop I will for sure be throwing it in my fidelity account

So, help me on the math here. What would that 'mild' gain be annualized?Still hanging around. Its gone from a gambling play to hoping it takes off at some point.

In other news, I did start a Fidelity account and get some "normal" ish stocks that have all seen mild gains over the past month (8%). When I finally get out of Gamestop I will for sure be throwing it in my fidelity account

So, help me on the math here. What would that 'mild' gain be annualized?

Can I interest you in 1/100 millionth of a bitcoin?Why are retail only allowed to buy for two digits and dark pools and HFTs can trade to the fourth and fifth digit?

$158.78

vs

$158.77995

Anyone?

I don’t know how to do that math 😂So, help me on the math here. What would that 'mild' gain be annualized?

So, help me on the math here. What would that 'mild' gain be annualized?

I assume it's 69%.I don’t know how to do that math 😂

420%I assume it's 69%.

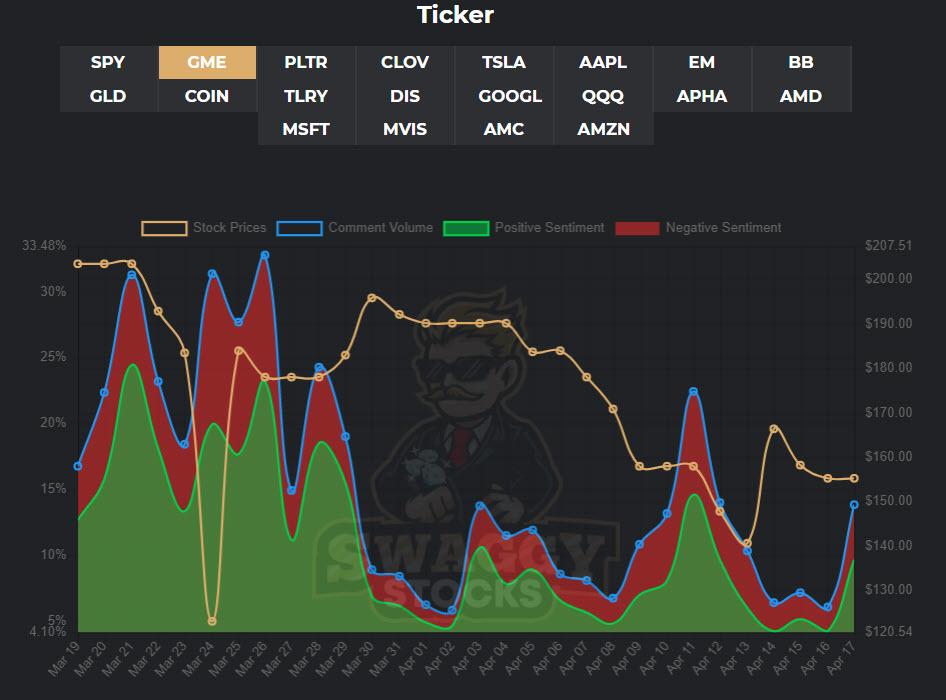

Does this mean GME is over... dying a slow painful death?Smoking gun explanation here:

“There are times where large players need to push shares to each other as part of settlement/housekeeping. These are not additional trades. It's similar to how you write a check today and the banks settle the change of the funds. Its a normal process and with the stock market, those types of trades are usually large and would cause a change in the share price.

So the Dark Pools were created as a means of large players to push shares between each other, only for housekeeping tasks, but of course, no guardrails were put on the process, so the players, quite predictably started to abuse it.

Its like floating checks. You present a check with the tacit assumption that the funds are present and able to be withdrawn. If you present a check knowing the funds are not there, then it's fraud. This is similar. They are leveraging a mechanism (like the time it takes for a check to clear) meant to facilitate the housekeeping tasks and abusing it. The SEC seems fine with this.

You can tell this is the case when you see the 39 share BUY blocks fly through dark pools, but magically, the sell blocks flow through the open exchanges. No one should ever be pushing 39 ****ing shares through a dark pool and its the most glaringly obvious evidence, but the SEC? Still out to lunch, because bribes.“

Does this mean GME is over... dying a slow painful death?

What are they going to sell?

In addition to some items others said, PC gaming is almost completely untapped. Those gamers are devoted and pay untold amounts to accessorize their setups. GME is already starting to sell gaming chairs and things like that. Plus, they plan to turn their stores into mini distribution centers, offering same day pickup while closing unprofitable stores. And with the long term debt being repaid, they can now look to make an acquisition/merger to get more entangled in the esports world.I don't get the optimism for Gamestop pivoting away from brick and mortar stores to an e-commerce model.

What are they going to sell? Video games are largely transitioning to downloads vs physical copies, so Gamestop won't sell as many games as they used to - online or otherwise.

For consoles, they're competing against Amazon, WalMart, and Target - which already to a ton of online console sales, and include free shipping, or picking it up from a store. I'm not sure how Gamestop could have an advantage over any of them.

So peripherals? Same competition as for consoles, but with the added competition of people buying direct for the manufacturers. I recently bought the daughter gaming headphones from Razer and their customer experience was terrific.

That leaves the other crap they sell - fungo characters, stickers, collectible figures, gaming-themed tshirts, etc.

I just don't get how they have a potential business model to be optimistic about.

I've had PONGF (atari) in a play account since Feb at .433. It was at 1.17 at one pt, now at 1.03. Been a wild one to watch. Supposedly they are getting into crypto and casinos and other shit.As much as today was a good day, it really is just recovery from several bad days. If it can continue throughout the rest of the week, it might take off.

I tried to jump on COIN at open, I had a limit order in for $300 and it was at $400 by the time it showed on my screen. Oh well.

another IPO I’m watching is EBET.

Sounds like you’re unfamiliar with Newegg.com.In addition to some items others said, PC gaming is almost completely untapped. Those gamers are devoted and pay untold amounts to accessorize their setups.