Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GDP -1.4 %

- Thread starter SIXERS24

- Start date

Getting advice is different than remembering to take the advice.Biden said he is getting advice from Larry Summers now. That's a move in the right direction at least.

Ended up just above even. There seems to be some sentiment that as long as there's no huge spending bill, and as long as gas and diesel prices level out, that inflation will level out. June employment / labor participation, and Q2 GDP numbers will drive the next big movement I think. We're a couple of weeks away from that. I have no idea what expectations are for those. It would be helpful if Biden would tone down his rhetoric.Dow up 100ish on the day 30600

Yeah, Biden once again sending mixed signals on fuel, blaming Putin, threatening more sanctions on Putin that will lead to cutting off oil from Russia, and pushing an accelerated green agenda. Biden simply doesn't care about anything but his agenda.

I simply can't believe this path is Biden's path. He has never been this radical in the past. I truly wonder who's working the puppet strings, and how they got Joe to go along.

I simply can't believe this path is Biden's path. He has never been this radical in the past. I truly wonder who's working the puppet strings, and how they got Joe to go along.

Why are you posting here instead of satisfying the terms of your debt?Down to 30990

Nevermind - I know why. You're a loser who reneges on bets. That's why.

Real gross domestic product (GDP) decreased at an annual rate of 1.6 percent in the first quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2021, real GDP increased 6.9 percent.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the decrease in real GDP was 1.5 percent. The update primarily reflects a downward revision to personal consumption expenditures (PCE) that was partly offset by an upward revision to private inventory investment (refer to "Updates to GDP"). [Full Release]

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the decrease in real GDP was 1.5 percent. The update primarily reflects a downward revision to personal consumption expenditures (PCE) that was partly offset by an upward revision to private inventory investment (refer to "Updates to GDP"). [Full Release]

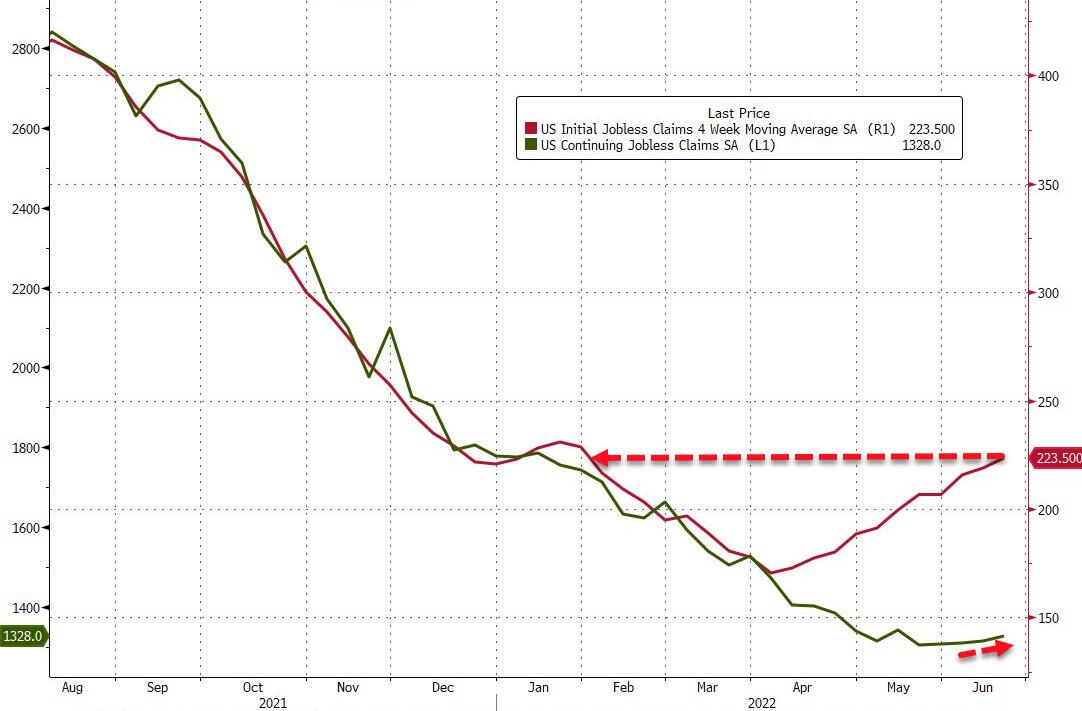

The Labor Participation Rate is underrated, IMO. It's more about who could be working as opposed to who chooses to work.

I also marvel at how so many people look strictly at "new jobs created" instead of total jobs or difference in total jobs.

I'm guessing you will agree.

That adjustment doesn't bode well for the Q2 GDP number, which is expected July 28 I think. I'd hate to be the person presenting that number to the White House before it's released. I'd love to be a fly on the wall to see how much pressure there is to keep the GDP growth above 0.Real gross domestic product (GDP) decreased at an annual rate of 1.6 percent in the first quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2021, real GDP increased 6.9 percent.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the decrease in real GDP was 1.5 percent. The update primarily reflects a downward revision to personal consumption expenditures (PCE) that was partly offset by an upward revision to private inventory investment (refer to "Updates to GDP"). [Full Release]

R

Recession of 2022 baby!!That adjustment doesn't bode well for the Q2 GDP number, which is expected July 28 I think. I'd hate to be the person presenting that number to the White House before it's released. I'd love to be a fly on the wall to see how much pressure there is to keep the GDP growth above 0.

Biden's speech today continues to blame Putin for everything. He's now floating the idea of price controls on Russian oil. Putin is undoubtedly laughing, and China too, because China will get the oil, and Europe and Turkey won't.R

Recession of 2022 baby!!

These sanctions against Russia are really bad news for European competitiveness because of the premiums they’re paying on energy. It’s why France and Germany (and Italy, and on…) would like Zelensky to bend the knee.Biden's speech today continues to blame Putin for everything. He's now floating the idea of price controls on Russian oil. Putin is undoubtedly laughing, and China too, because China will get the oil, and Europe and Turkey won't.

China seems to benefit from this more than the U.S. as they’re getting discounted oil, and will presumably become Russia’s consumer goods exporter in place of the European goods disappearing from the shelf.

I wonder why Biden never gets challenged on the effect of these things when it really doesn't take much critical thinking to predict what will happen based on what's already happening. Russia's oil exports have barely slowed; they've simply been redirected to China and a few other countries. China is laughing at us.These sanctions against Russia are really bad news for European competitiveness because of the premiums they’re paying on energy. It’s why France and Germany (and Italy, and on…) would like Zelensky to bend the knee.

China seems to benefit from this more than the U.S. as they’re getting discounted oil, and will presumably become Russia’s consumer goods exporter in place of the European goods disappearing from the shelf.

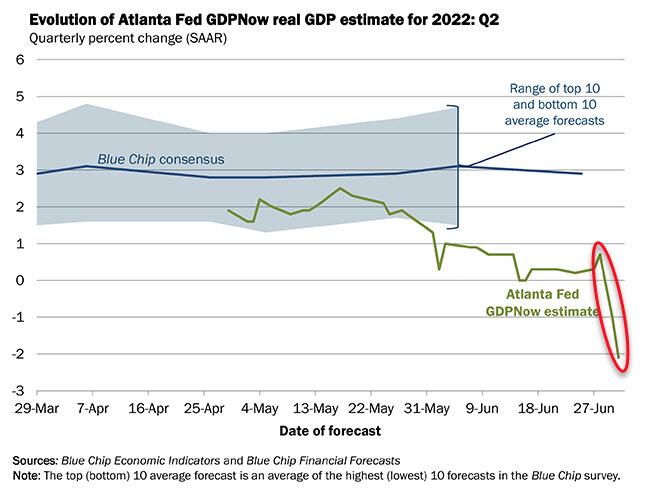

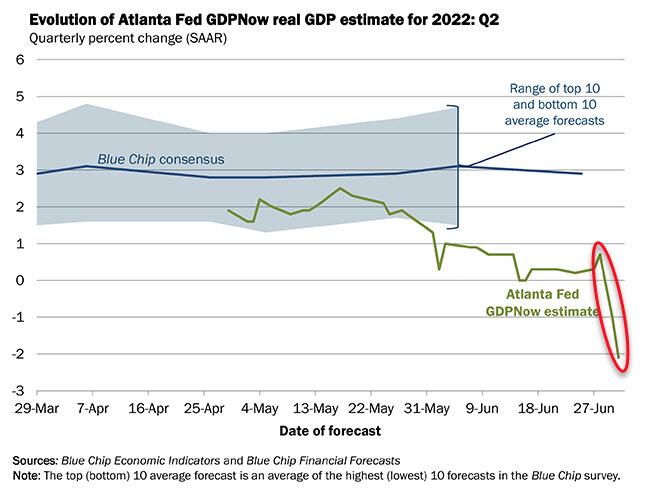

The GDPNow model estimate for real GDP has collapsed in recent days, growth in the second quarter of 2022 has been cut to a contractionary -2.1%, down from -1.0% on June 30, down from 0.0% on June 15, down from +0.9% on June 6, down from 1.3% on June 1, and down from 1.9% on May 27.

Looks like the Federal Reserve increased the balance sheet in June, after a decline in May?

Federal Reserve Board - Recent balance sheet trends

The Federal Reserve Board of Governors in Washington DC.

www.federalreserve.gov

The Fed's QE may be over, and QT may be just starting (it won't last long), but don't think the Fed free money giveaway is ending any time soon. In fact, for a handful of happy, mostly anonymous counterparties, the real free-money bonanza has just begun!Looks like the Federal Reserve increased the balance sheet in June, after a decline in May?

Federal Reserve Board - Recent balance sheet trends

The Federal Reserve Board of Governors in Washington DC.www.federalreserve.gov

Case in point: the Fed's reverse repo facility. While one can debate for hours why there is a record $2.330 trillion in cash parked at the Fed's overnight facility and what it means for systemic plumbing problems, the fact is that there is a record $2.33 trillion in cash parked at the Fed's overnight facility, doing nothing.

Well not nothing: it was nothing when rates were zero, but at 1.55% which is the current reverse repo rate, that $2.33 trillion is a golden goose for the 108 counterparties that are parking cash at the facility, a mixture of money market funds, banks, GSEs and various other financial intermediaries.

How big is this particular Golden Goose? The chart below shows the payment in interest that the Fed makes day on this record $2.33 trillion in funds: as of today it amounts to just over $100 million every single day! That's right, more than $100 million in interest payments on funds parked with the Fed, which is by definition the world's only risk-free counterparty!

But wait, there's more!

Remember excess reserves? Well, technically excess reserves ended in March 2020 when the Fed reduced reserve requirement ratios to zero, thus converting the trillions in reserves held at the Fed from "excess reserves: to plain old "reserves" and which as of today amount to $3.13 trillion.

Whatever they are called now, however, reserves parked at the Fed (which is technically an incorrect phrase since the reserves are created by the Fed) also collect interest, and as of today, the Fed's Interest on (Excess) Reserves rate, or IOER, is 1.65%. This translates into $141 million in daily interest payments every single day to the various banks (mostly foreign) whose reserves are parked at the Fed!

Combining the two we get nearly a quarter billion, or to be precise $242 million and rising, in interest payments by the Fed - this is money which is printed into existence - every single day.

All of the above is with the Fed Funds rate at 1.75%. As a reminder, the Fed hopes to keep hiking at least another 175bps (or more) in the next 6 months, which will push the rate to 3.50% and will mean that the Fed will be paying half a billion in interest every single day to a handful of mostly unknown counterparties every day, money which for said counterparties is also known as (riskless) profit and which is only the result of the Fed's previous money printing.

Last edited:

‘Uncomfortably high’: What economists say about the chance of recession.

The range of forecasts is wide, but economists generally see a rising probability that the U.S. economy will shrink.

It's weird, I don't know much about it but if you look at the trends I have posted its like right when it looks like it's really going to tank it recovers slightly. I'm not sure if that's just people trying to buy the dip or what.We are in a recession.

We just won't know officially until July 28th at 8:30 AM EST.

It's weird, I don't know much about it but if you look at the trends I have posted its like right when it looks like it's really going to tank it recovers slightly. I'm not sure if that's just people trying to buy the dip or what.

The "Plunge Protection Team" (PPT) is a colloquial name given to the Working Group on Financial Markets. Created in 1988 to provide financial and economic recommendations to the U.S. President during turbulent market times, this group is headed by the Secretary of the Treasury; other members include the Chair of the Board of Governors of the Federal Reserve, the Chair of the Securities and Exchange Commission and the Chair of the Commodity Futures Trading Commission (or the aides or officials they designate to represent them).I don't get it.

The name "Plunge Protection Team" was coined by The Washington Post and first applied to the group in 1997.The Washington Post and first applied to the group in 1997.

- The "Plunge Protection Team" (PPT) is a colloquial name given to the Working Group on Financial Markets by The Wall Street Journal.The Wall Street Journal.

- The Plunge Protection Team's official mission is to advise the U.S. president during times of economic and stock market turbulence.

- Critics fear the Plunge Protection Team doesn't just advise, but actively intervenes to prop up stock prices—colluding with banks to rig the market, in effect.

So you think they are putting money into the markets to delay the tank? Wouldn't they lose thier ass in the long run?The "Plunge Protection Team" (PPT) is a colloquial name given to the Working Group on Financial Markets. Created in 1988 to provide financial and economic recommendations to the U.S. President during turbulent market times, this group is headed by the Secretary of the Treasury; other members include the Chair of the Board of Governors of the Federal Reserve, the Chair of the Securities and Exchange Commission and the Chair of the Commodity Futures Trading Commission (or the aides or officials they designate to represent them).

The name "Plunge Protection Team" was coined by The Washington Post and first applied to the group in 1997.The Washington Post and first applied to the group in 1997.

- The "Plunge Protection Team" (PPT) is a colloquial name given to the Working Group on Financial Markets by The Wall Street Journal.The Wall Street Journal.

- The Plunge Protection Team's official mission is to advise the U.S. president during times of economic and stock market turbulence.

- Critics fear the Plunge Protection Team doesn't just advise, but actively intervenes to prop up stock prices—colluding with banks to rig the market, in effect.

Officially our Federal Reserve doesn’t print money to buy stocks. BOJ does, and I read last year they were up to owning something like 7% of the shares listed on the Tokyo exchange.So you think they are putting money into the markets to delay the tank? Wouldn't they lose thier ass in the long run?

So they hedge the money using the Japanese market?Officially our Federal Reserve doesn’t print money to buy stocks. BOJ does, and I read last year they were up to owning something like 7% of the shares listed on the Tokyo exchange.

The market seems to be indicating we are in a recession now. Bond yields have been falling pretty steeply over the last two weeks or so. The Fed has been buying bonds which is odd since the rhetoric has been the opposite. I thought initially to prevent a collapse in the bond market, they might be reducing the balance sheet gradually, and actually increasing some months, but it could also be due to the recession. The 2 and 5 yr have inverted. Also commodities like oil and copper have been falling pretty drastically.

Last edited:

No, I mentioned BOJ because they are straight printing money to buy stocks. I don’t think that is happening here - yet.So they hedge the money using the Japanese market?

https://www.marketwatch.com/amp/story/time-for-fed-to-disprove-ppt-conspiracy-theory-2010-01-05

Similar threads

- Replies

- 41

- Views

- 577

- Replies

- 3

- Views

- 184

- Replies

- 6

- Views

- 127

ADVERTISEMENT

ADVERTISEMENT