Starting in 2020, there were so many retirees receiving Social Security benefits that the program barely broke even for the year.

The following year, 2021, was even worse. Social Security ran a deficit for the first time ever and had to dip into its trust fund to make ends meet.

This trend kept up in 2022 and 2023 as well. In fact, the program loses so much money now that its trust fund is shrinking rapidly, and Social Security projects it will fully be depleted by 2033.

One of the many, many reasons this is so important is because Social Security will no longer be a BUYER of US government bonds. It will be a SELLER. And that’s a big deal.

For the past 90+ years, Social Security always invested its annual surplus into government bonds… which essentially gave politicians an extra pile of cash each year to spend.

But now this cash flow will reverse. Instead of Social Security sending its surplus to the Treasury, the Treasury Department now must repay the debt that it owes to Social Security.

This nearly $3 trillion repayment will happen gradually over the next ten years. And then, of course, in 2033, Social Security will be out of money and require a multi-trillion-dollar bailout.

Unfortunately, the Treasury Department doesn’t have the money to repay this $3 trillion debt, let alone another $5 to $10 trillion to bail out Social Security.

This means that, in addition to the $20 TRILLION in new debt that the CBO is projecting over the next ten years, the Treasury Department will have to borrow an ADDITIONAL $3 trillion to repay Social Security. And then even more to bail out the program

(So, this means that the government will need to find someone to buy $23++ trillion of government bonds over the next ten years… which is just an absurd amount of money.

And it will have to do this at a time when it has lost some of its biggest investors; again, Social Security can no longer afford to buy bonds. And many of America’s biggest foreign bondholders, including China and Japan, are also not buying any more bonds.

So, who is going to buy all this new debt?

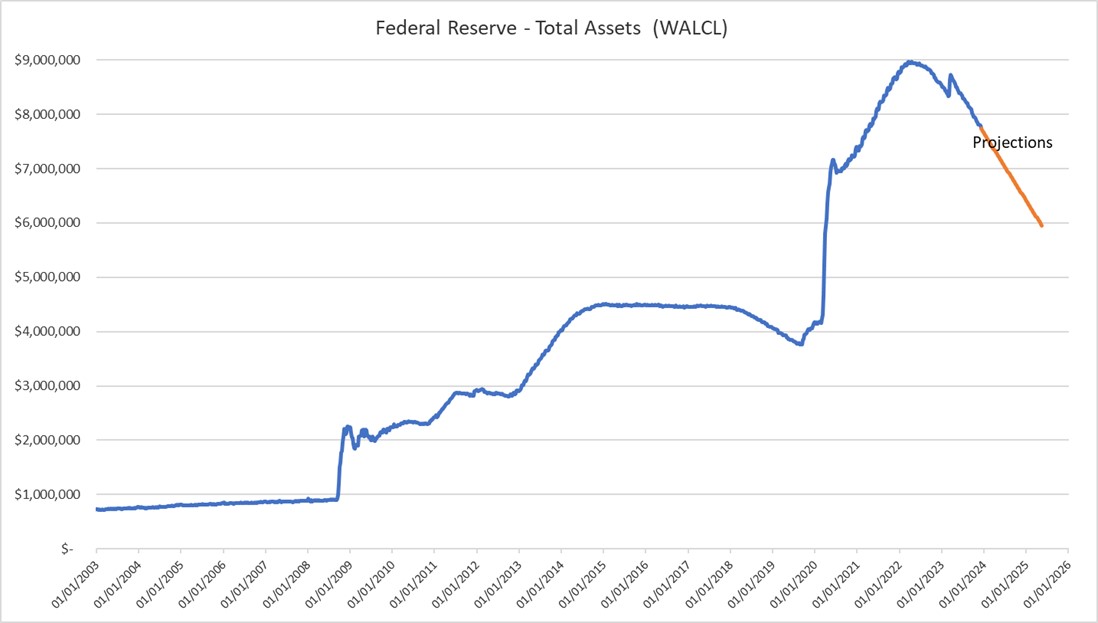

The only realistic option is the Federal Reserve. And this is nothing new for the Fed.

During the pandemic, for example, the Fed magically created about $4 trillion in new money, then used that money to buy US government bonds.

Of course, their $4 trillion in new money also helped create the highest inflation in four decades.

So, if buying $4 trillion of government bonds led to 9% inflation, what’s going to happen when the Fed has to create $20+ trillion to buy government bonds?

----

"We can guarantee cash payments from here on out, what we cannot guarantee is the purchasing power of that cash." -Alan Greenspan during remarks on Social Security, Feb 16, 2005

The following year, 2021, was even worse. Social Security ran a deficit for the first time ever and had to dip into its trust fund to make ends meet.

This trend kept up in 2022 and 2023 as well. In fact, the program loses so much money now that its trust fund is shrinking rapidly, and Social Security projects it will fully be depleted by 2033.

One of the many, many reasons this is so important is because Social Security will no longer be a BUYER of US government bonds. It will be a SELLER. And that’s a big deal.

For the past 90+ years, Social Security always invested its annual surplus into government bonds… which essentially gave politicians an extra pile of cash each year to spend.

But now this cash flow will reverse. Instead of Social Security sending its surplus to the Treasury, the Treasury Department now must repay the debt that it owes to Social Security.

This nearly $3 trillion repayment will happen gradually over the next ten years. And then, of course, in 2033, Social Security will be out of money and require a multi-trillion-dollar bailout.

Unfortunately, the Treasury Department doesn’t have the money to repay this $3 trillion debt, let alone another $5 to $10 trillion to bail out Social Security.

This means that, in addition to the $20 TRILLION in new debt that the CBO is projecting over the next ten years, the Treasury Department will have to borrow an ADDITIONAL $3 trillion to repay Social Security. And then even more to bail out the program

(So, this means that the government will need to find someone to buy $23++ trillion of government bonds over the next ten years… which is just an absurd amount of money.

And it will have to do this at a time when it has lost some of its biggest investors; again, Social Security can no longer afford to buy bonds. And many of America’s biggest foreign bondholders, including China and Japan, are also not buying any more bonds.

So, who is going to buy all this new debt?

The only realistic option is the Federal Reserve. And this is nothing new for the Fed.

During the pandemic, for example, the Fed magically created about $4 trillion in new money, then used that money to buy US government bonds.

Of course, their $4 trillion in new money also helped create the highest inflation in four decades.

So, if buying $4 trillion of government bonds led to 9% inflation, what’s going to happen when the Fed has to create $20+ trillion to buy government bonds?

----

"We can guarantee cash payments from here on out, what we cannot guarantee is the purchasing power of that cash." -Alan Greenspan during remarks on Social Security, Feb 16, 2005