Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Feenstra introduces social security bill

- Thread starter THE_DEVIL

- Start date

The stated intent sounds good.

My issue is a Trump WH will start diverting funding for other projects if they decide a surplus is too large.

My issue is a Trump WH will start diverting funding for other projects if they decide a surplus is too large.

I bet ol’ Randy has a plan that is more secure and cheaper than the current plan, too!

$34 Trillion.

SS can be solvent w/ an increased tax on higher wage amounts.

SS can be solvent w/ an increased tax on higher wage amounts.

Yep, there were no problems until they put that f***ing cap on it. Put that back and they should be able to lower the retirement age and quit screwing the the amounts people draw.

Just take the cap off, don’t raise the rateSS can be solvent w/ an increased tax on higher wage amounts.

Yep, there were no problems until they put that f***ing cap on it. Put that back and they should be able to lower the retirement age and quit screwing the the amounts people draw.

Add a few % to the tax rate for >$150k

Tack on a 50% cap gains tax on stock buybacks that goes to SS (you pay on the gain from when the company issued the shares for the buybacks)

Raise taxes on wealthy corporations. Don’t steal SS.$34 Trillion.

You know where they get their money?Raise taxes on wealthy corporations. Don’t steal SS.

Don’t raise the rate, just take the cap completely off, if you want to raise the rate, then increase what someone making over 150k gets back in ssAdd a few % to the tax rate for >$150k

Tack on a 50% cap gains tax on stock buybacks that goes to SS (you pay on the gain from when the company issued the shares for the buybacks)

It’s always had a cap, so by your logic it has always had problems.Yep, there were no problems until they put that f***ing cap on it. Put that back and they should be able to lower the retirement age and quit screwing the the amounts people draw.

This thread will be full of misinformation about FDR’s Ponzi.

Social Security taxes were first collected in January 1937, with workers and employers each paying one percent of the first $3,000 in wages and salary.

Over twenty tax increases since then from two percent to 12.4%, and still structurally insolvent.

Lower it? LOLYep, there were no problems until they put that f***ing cap on it. Put that back and they should be able to lower the retirement age and quit screwing the the amounts people draw.

They need to raise the retirement age to at least 67 to begin benefits, make full retirement age 70.

No; the caps were raise as wages went up.It’s always had a cap, so by your logic it has always had problems.

They have not been raised for quite a while, now.

Why the **** would you want that?!?Lower it? LOL

They need to raise the retirement age to at least 67 to begin benefits, make full retirement age 70.

People are living longer.Why the **** would you want that?!?

People are working longer

The fund itself is drying up and those changes will help keep it solvent.

And with the increases in executive pay the cap should be reviewed on a periodic basis.SS can be solvent w/ an increased tax on higher wage amounts.

Because people are living longer and also many seniors want to continue working. I didn’t touch SSI until I was 68. And aside from a year off I worked until I was 71, where many of my coworkers were also “seniors”. Go into a Home Depot or a WalMart or any retail store and note the older work force. Retired part timers are filling positions others don’t want or can’t support a family on.Why the **** would you want that?!?

There’s a growing popularity and trend among older workers to delay SSI until it maxes out at 70 because of the higher benefits. If that continues then more are still paying into the system and that’s not a bad thing.

He’s a gym teacher….You know where they get their money?

Raising the retirement age isn't as easy as it sounds. Some people work more physically demanding jobs than others. It's fine where it's at. Just remove the payroll cap.

I have no interest whatsoever in working longer.Because people are living longer and also many seniors want to continue working. I didn’t touch SSI until I was 68. And aside from a year off I worked until I was 71, where many of my coworkers were also “seniors”. Go into a Home Depot or a WalMart or any retail store and note the older work force. Retired part timers are filling positions others don’t want or can’t support a family on.

There’s a growing popularity and trend among older workers to delay SSI until it maxes out at 70 because of the higher benefits. If that continues then more are still paying into the system and that’s not a bad thing.

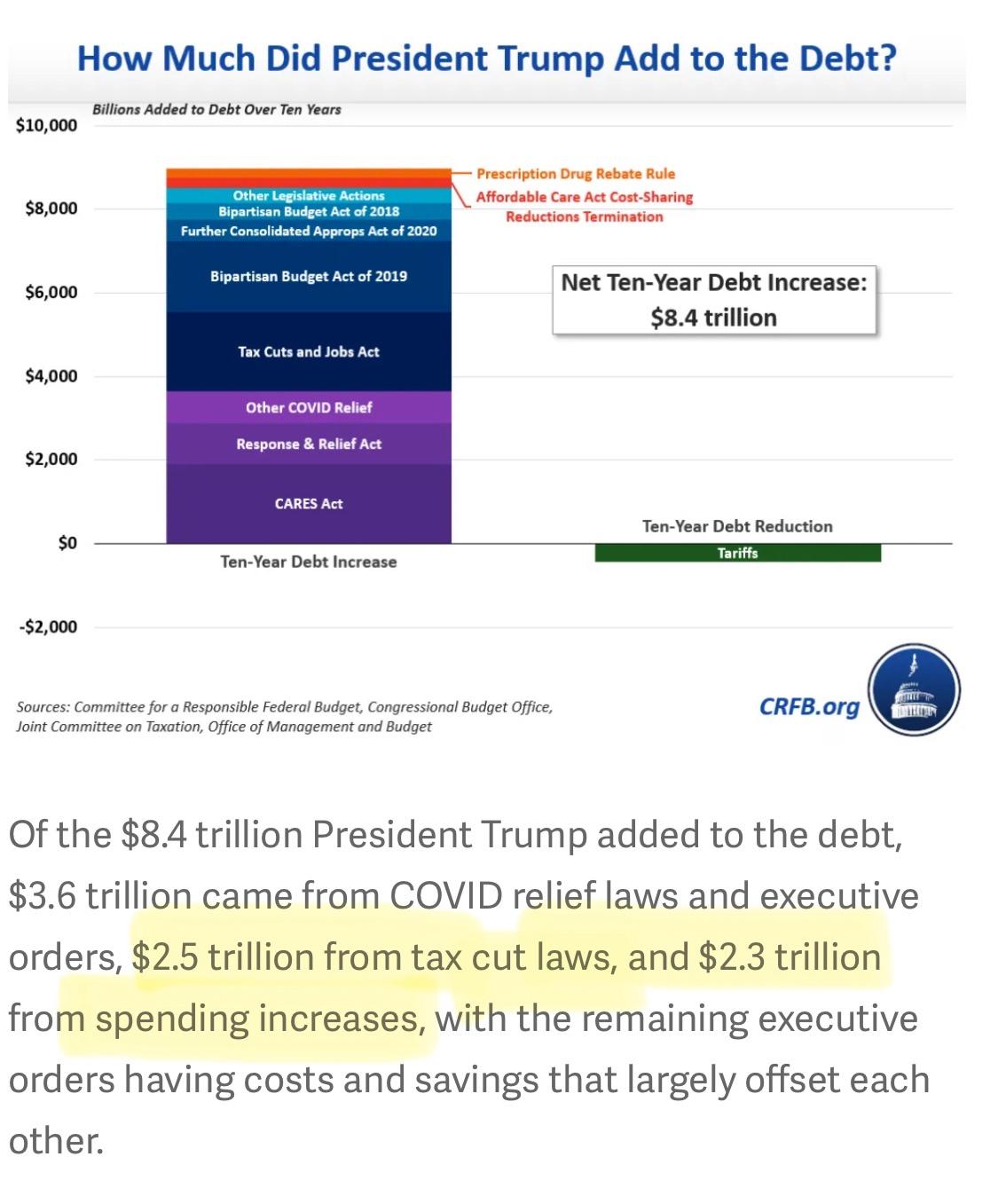

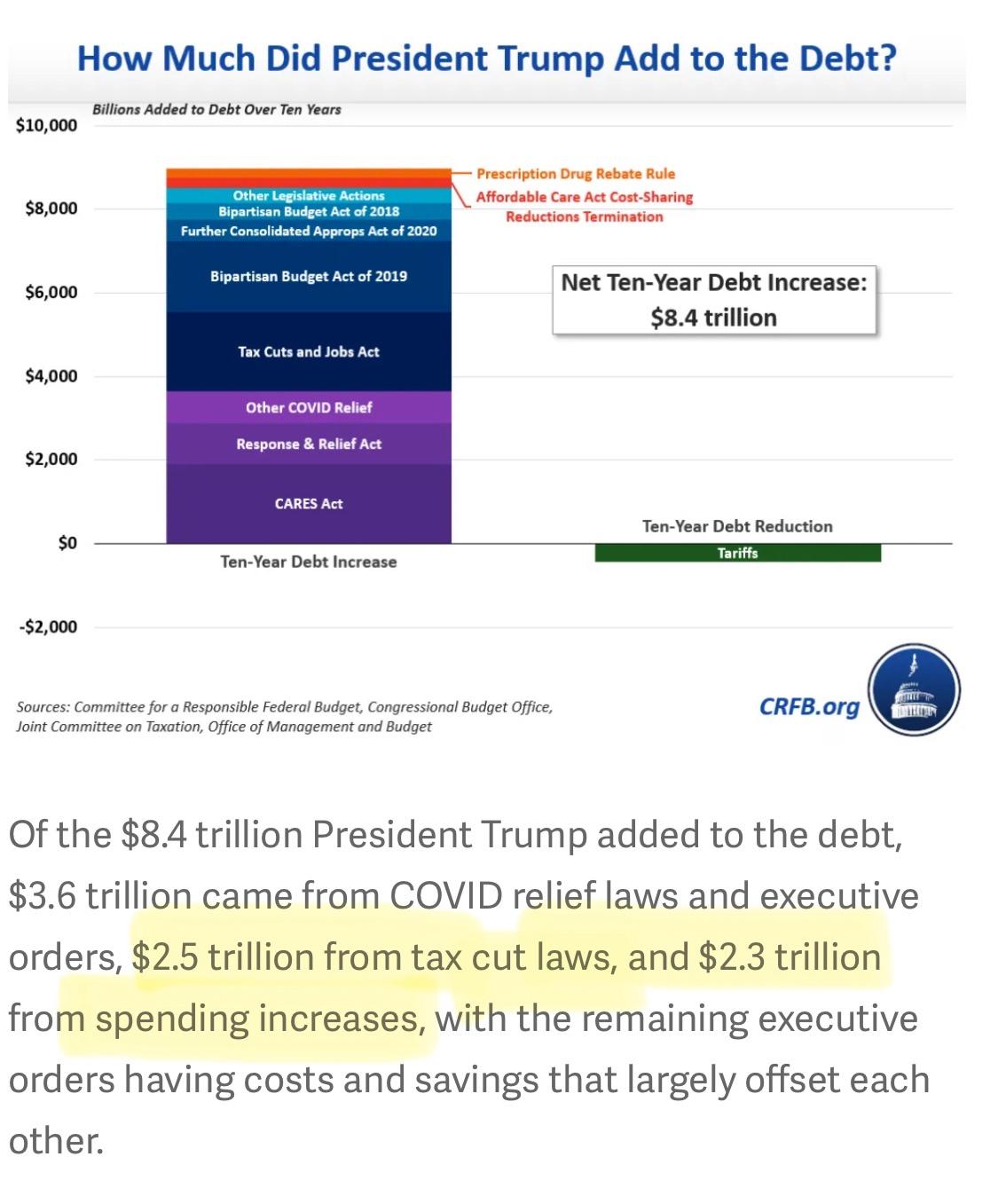

$34 Trillion.

W and Trump tax cuts

Meanwhile let's not tax rich people and give them breaks like Trump did.$34 Trillion.

Meanwhile let's not tax rich people and give them breaks like Trump did.

We are taxing the rich,.. Who do you think pays a majority of current taxes?, the poor?

We are taxing the rich,.. Who do you think pays a majority of current taxes?, the poor?

But not their fair share

Who determines what the fair share is?But not their fair share

But not their fair share

Just how many times will we continue to go back after their fair share?...

$34 Trillion.

Nobody was better at managing the national debt than Trump. I say we give him another shot at fixing entitlement programs.

Biden will exceed himNobody was better at managing the national debt than Trump. I say we give him another shot at fixing entitlement programs.

Biden left out that the debt on his watch is on pace to exceed Trump’s one-term debt accumulation by the end of his current term, Jan. 20, 2025. During his first three years, Biden had already accumulated $6.32 trillion in debt. For his final year, the nonpartisan Congressional Budget Office has projected a deficit of $1.582 trillion. Add those two figures together, and you get $7.902 trillion as Biden’s four-year total.

Biden will exceed him

Biden left out that the debt on his watch is on pace to exceed Trump’s one-term debt accumulation by the end of his current term, Jan. 20, 2025. During his first three years, Biden had already accumulated $6.32 trillion in debt. For his final year, the nonpartisan Congressional Budget Office has projected a deficit of $1.582 trillion. Add those two figures together, and you get $7.902 trillion as Biden’s four-year total.

I believe $8.4 trillion is a larger #.

Math.

And you’re minimizing the 10-year contribution of Trump’s tax cuts to Biden’s “debt”

I was posting from an article that says the US treasury says 7.8 under Trump.I believe $8.4 trillion is a larger #.

Math.

And you’re minimizing the 10-year contribution of Trump’s tax cuts to Biden’s “debt”

They are operating at a 1.5 trillion deficit right now. So if Biden wins 4 more years that’s another $6 trillion.

Neither party in Washington honestly gives two shots about the national debt. It’s a talking point for elections.

I let’s ally think they should be required to pass a balance budget each year. Increase taxes across the board and draconian spending cuts.

Fact-checking Joe Biden on debt accumulated under Donald Trump

Assigning debt to a particular president can be misleading because so much traces back to bipartisan legislation on Social Security and Medicare.

www.statesman.com

Who determines what the fair share is?

When they pay a smaller tax rate than their fvcking secretaries

The “rich” should pay a majority of taxes, dumbass….they are the ones with the money! They should probably pay more…..why should a working stiff who punches “in and out” daily pay a higher percentage of his/her wagers than a “rich” person? Why shouldn’t a corporation pay income taxes? Corporations are nothing more than tax dodges…..we all understand that!We are taxing the rich,.. Who do you think pays a majority of current taxes?, the poor?

The “rich” should pay a majority of taxes, dumbass….they are the ones with the money! They should probably pay more…..why should a working stiff who punches “in and out” daily pay a higher percentage of his/her wagers than a “rich” person? Why shouldn’t a corporation pay income taxes? Corporations are nothing more than tax dodges…..we all understand that!

The rich already do pay a majority of taxes,.. The average working stiff does not pay a higher percentage of his or her wages in taxes than the average rich person,.. Corporations do pay taxes,.. You appear to understand very little.

Who's a helluva lot smarter than you are, two time Trump voter. Dupe.He’s a gym teacher….

The wealthy love uneducated Republican voters.The rich already do pay a majority of taxes,.. The average working stiff does not pay a higher percentage of his or her wages in taxes than the average rich person,.. Corporations do pay taxes,.. You appear to understand very little.

He’s a gym teacher….

Maybe he's an Ivy League gym teacher grad.

You’re right, they pay a higher share of taxes than they receive as a share of income.But not their fair share

It’s not fair, it’s progressive.

Similar threads

- Replies

- 8

- Views

- 176

- Replies

- 63

- Views

- 947

- Replies

- 0

- Views

- 62

- Replies

- 2

- Views

- 84

ADVERTISEMENT

ADVERTISEMENT