According to Warren Buffet, his secretary pays a higher rate than he does…..most corporations pay very little if any taxes….Rifler….other than your obstinanced, you have very little to stand upon here.The rich already do pay a majority of taxes,.. The average working stiff does not pay a higher percentage of his or her wages in taxes than the average rich person,.. Corporations do pay taxes,.. You appear to understand very little.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Feenstra introduces social security bill

- Thread starter THE_DEVIL

- Start date

Are you using LBJ as your example of what a corrupt president can do to social security?The stated intent sounds good.

My issue is a Trump WH will start diverting funding for other projects if they decide a surplus is too large.

The guys with the $20 million dollar yachtsWho determines what the fair share is?

When I see a person with wealth I want to know what they did to achieve that wealth so I can do the same.The guys with the $20 million dollar yachts

Sounds like lost of you see it and want to take it from them. Very South Africa vibes from you guys

When I see a person with wealth I want to know what they did to achieve that wealth so I can do the same.

Sounds like lost of you see it and want to take it from them. Very South Africa vibes from you guys

You have no idea what you are talking about, AGAIN. Every single person pays taxes, everyone unless you are poor than you pay less or none at all. The rich pay more than anyone else in taxes, no exceptions and the amount they pay isn't even close to what low income people pay. The left, including Warren Buffet, try and hide that fact by claiming unearned income as income, it isn't. Are there games the wealthy can play, sure, they can borrow against assets to avoid paying taxes on income but so can anyone. As for your corporations don't pay enough taxes you are wrong again. Trump's tax cut brought down the corporate tax rate to around 21% which puts us in the middle of the pact related to other developed countries. That was to keep jobs in the U.S. and prevent our companies from leaving to other more tax friendly countries.According to Warren Buffet, his secretary pays a higher rate than he does…..most corporations pay very little if any taxes….Rifler….other than your obstinanced, you have very little to stand upon here.

And a dirty little secret that everyone knows but the left will never admit, corporations don't pay taxes anyway. They simply pass on their tax burden to their customers and ultimately everyone else so as consumers are actually paying even more taxes to the government.

I mean, corporations get their money to pay taxes by charging moreHe’s a gym teacher….

You have no idea what you are talking about, AGAIN. Every single person pays taxes, everyone unless you are poor than you pay less or none at all. The rich pay more than anyone else in taxes, no exceptions and the amount they pay isn't even close to what low income people pay. The left, including Warren Buffet, try and hide that fact by claiming unearned income as income, it isn't.

Are there games the wealthy can play, sure, they can borrow against assets to avoid paying taxes on income but so can anyone.

So, I agree that the rich pay most of the taxes in this country.And a dirty little secret that everyone knows but the left will never admit, corporations don't pay taxes anyway. They simply pass on their tax burden to their customers and ultimately everyone else so as consumers are actually paying even more taxes to the government.

But, I don't understand the Bold #1 part, at all. Claiming unearned income as income?

Bold #2 - Borrow against assets to avoid paying taxes on income? Huh?

Bold #3 - Corporations cannot "simply pass on their tax burden to consumers". Oh, they can try, but the market and competition drives prices. Please note that prices didn't drop when corporate tax rates went down.

Not trying to bash your assertions. Simply trying to understand them.

Then LET them charge more! I bet they figure ways out to reduce their costs….that has always been the genius of American business! You have gotten lazy Clarinda…..I mean, corporations get their money to pay taxes by charging more

Look at Wal-mart - using self checkout keeps them from having a lot of people running check out lanes. Saved money. NOW, they are looking at charging customers for the "service" of using self checkout. There's never enough money for them to put in their pockets. It's gross.Then LET them charge more! I bet they figure ways out to reduce their costs….that has always been the genius of American business! You have gotten lazy Clarinda…..

Corporations don’t pay taxes. They collect them.Raise taxes on wealthy corporations. Don’t steal SS.

Oh, I don’t know. Maybe he’s an adult who accepts responsibility as a small d democrat to help run this place responsibly?Why the **** would you want that?!?

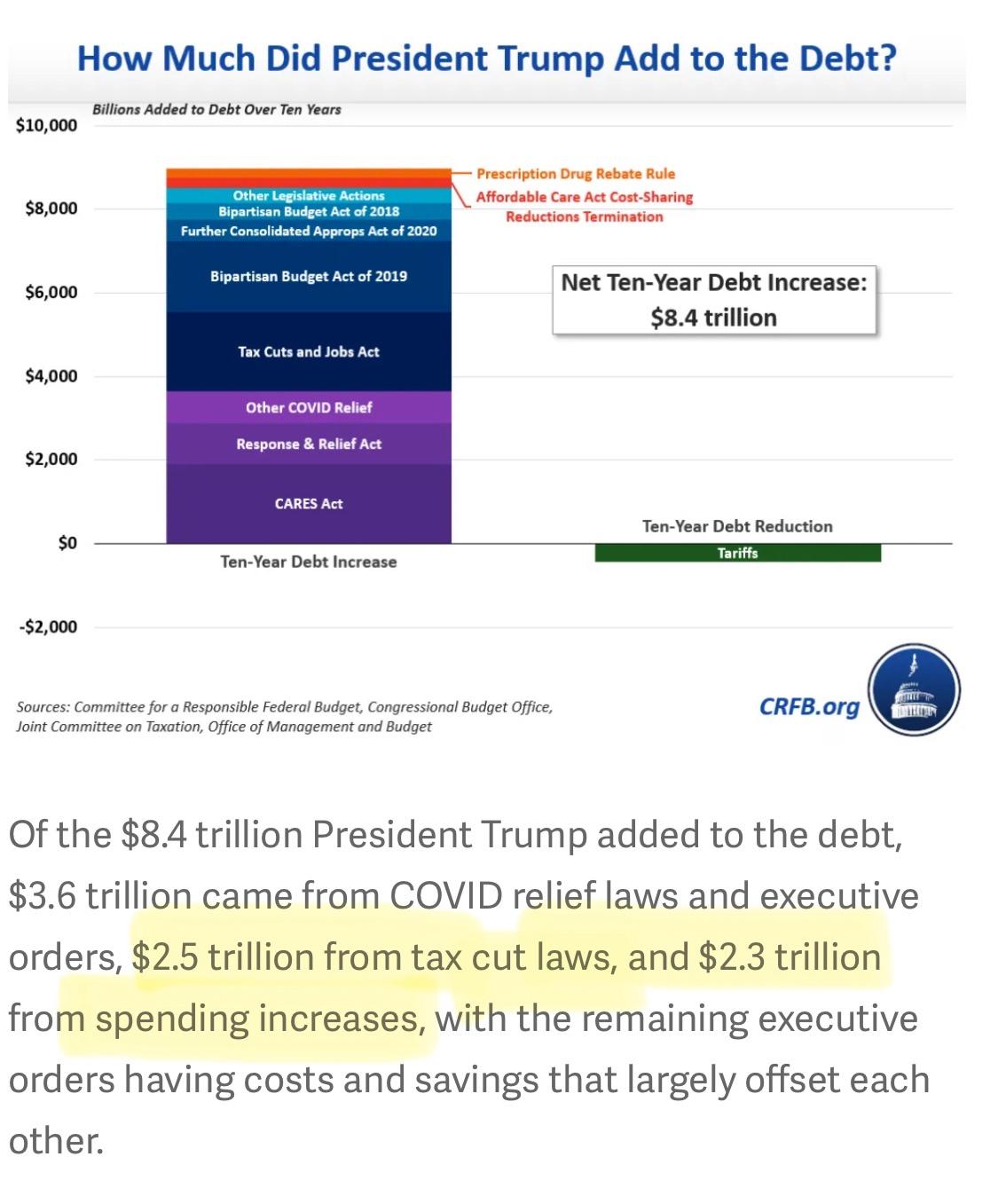

Part of it, certainly.W and Trump tax cuts

Top 1% of earners pay 40% of income tax, but, yeah, we don’t tax rich people. JFC.Meanwhile let's not tax rich people…

Not a Ponzi scheme.Worst Ponzi scheme ever for people that make good money

We collectively do, as small d democrats via our reps.Who determines what the fair share is?

I disagree. Trump sucked fiscally.Nobody was better at managing the national debt than Trump. I say we give him another shot at fixing entitlement programs.

It’s not, but he won’t discuss the numbers with you.Please tell me this is sarcasm.

“Balanced Budget” = No borrowing?I was posting from an article that says the US treasury says 7.8 under Trump.

They are operating at a 1.5 trillion deficit right now. So if Biden wins 4 more years that’s another $6 trillion.

Neither party in Washington honestly gives two shots about the national debt. It’s a talking point for elections.

I let’s ally think they should be required to pass a balance budget each year. Increase taxes across the board and draconian spending cuts.

Fact-checking Joe Biden on debt accumulated under Donald Trump

Assigning debt to a particular president can be misleading because so much traces back to bipartisan legislation on Social Security and Medicare.www.statesman.com

They don’t. That’s spin.When they pay a smaller tax rate than their fvcking secretaries

There is a lot of misunderstanding of the tax codes and corporate business in this thread.

This is so uninformed.The “rich” should pay a majority of taxes, dumbass….they are the ones with the money! They should probably pay more…..why should a working stiff who punches “in and out” daily pay a higher percentage of his/her wagers than a “rich” person? Why shouldn’t a corporation pay income taxes? Corporations are nothing more than tax dodges…..we all understand that!

He said that, but it is misleading. Buffet was including his unrealized capital gains.According to Warren Buffet, his secretary pays a higher rate than he does…..most corporations pay very little if any taxes….Rifler….other than your obstinanced, you have very little to stand upon here.

Now we can fight about whether unrealized capital gains should be taxed (no), but they are not today and his statement was harmful, giving ammo to those seeking victim status.

Wait a minute: Unearned income (e.g. investment income) IS income.So, I agree that the rich pay most of the taxes in this country.

But, I don't understand the Bold #1 part, at all. Claiming unearned income as income?

Bold #2 - Borrow against assets to avoid paying taxes on income? Huh?

Bold #3 - Corporations cannot "simply pass on their tax burden to consumers". Oh, they can try, but the market and competition drives prices. Please note that prices didn't drop when corporate tax rates went down.

Not trying to bash your assertions. Simply trying to understand them.

What the poster meant was “unrealized income” (e.g. gains in stock values).

He's one, yes.Are you using LBJ as your example of what a corrupt president can do to social security?

Stuff like this sounds very reasonable. Until you get to the details. Some professions can’t work to 70 years old. Construction? Paramedic? Police? Your body breaks.People are living longer.

People are working longer

The fund itself is drying up and those changes will help keep it solvent.

Why should I work longer just so that millionaires and billionaires can avoid a tax increase?

Realized unearned income should be subjectWait a minute: Unearned income (e.g. investment income) IS income.

What the poster meant was “unrealized income” (e.g. gains in stock values).

To payroll taxes.

yep lets get into the hands of financial advisors and wall street. They really have the little guys interest in mind.Worst Ponzi scheme ever for people that make good money

You missed the point completely. If you don’t believe the richest Americans are the ones who decide what is fair, talk to me when you come back to earth.When I see a person with wealth I want to know what they did to achieve that wealth so I can do the same.

Sounds like lost of you see it and want to take it from them. Very South Africa vibes from you guys

“The normal must care for themselves. Self-government means self-support.” - Calvin CoolidgeStuff like this sounds very reasonable. Until you get to the details. Some professions can’t work to 70 years old. Construction? Paramedic? Police? Your body breaks.

Why should I work longer just so that millionaires and billionaires can avoid a tax increase?

Realized unearned income should be subject

To payroll taxes.

No,.. If it's realized "unearned" income, (ie: interest income), it would by definition, not be subject to payroll taxes,.. Income taxes, yes. Payroll taxes, no.

So, you think people should pay a 15.3% tax on interest, dividends, capital gains, rental income, etc., in addition to income tax??Realized unearned income should be subject

To payroll taxes.

I'm not sure he meant that.He said that, but it is misleading. Buffet was including his unrealized capital gains.

Now we can fight about whether unrealized capital gains should be taxed (no), but they are not today and his statement was harmful, giving ammo to those seeking victim status.

The bulk of Buffet's income is likely dividends and capital gains - both taxed at a favorable rate.

His secretary pays 7.65% in social security and Medicare tax plus regular income tax.

The reality is this, the old liberal mantra about just up the taxes on the rich is nothing but a scam. The 1% (rich) in this country pay 99% of all the taxes anyway. You can only get so much milk out of a cow and increasing the taxes on the 1% in this country every other day will ultimately backfire.Stuff like this sounds very reasonable. Until you get to the details. Some professions can’t work to 70 years old. Construction? Paramedic? Police? Your body breaks.

Why should I work longer just so that millionaires and billionaires can avoid a tax increase?

The SS fund is going dry, collecting benefits as young as 62 is ridiculous the minimum age must be raised somewhere between 66 - 70. I would prefer it be 70.

People working longer provides many benefits, it allows them more time to save for retirement, it allows them more time to contribute to social security and extends the life of the SS fund.

Social Security disability is in need of 100% total overhaul, you have perfectly healthy people in their 20's and 30's ripping off the system collecting disability when only a 6 month diet would get them up and off of collecting our tax money.

But that makes them greedy don’t you know. Of course most 401/IRA/Teacher Pension Funds still expect those corporations to do whatever they need to do to provide income and growth so what are corporations gonna do?I mean, corporations get their money to pay taxes by charging more

So let's complain about corporate greed and then force everyone to work for them for a couple extra years.Oh, I don’t know. Maybe he’s an adult who accepts responsibility as a small d democrat to help run this place responsibly?

Why? It’s not part of “payroll”.Realized unearned income should be subject

To payroll taxes.

It’s always a matter of choice/opportunity/circumstances.I have no interest whatsoever in working longer.

I retired and was looking forward to it and planned all sorts of projects and stuff. After a year I was so bored I just jumped at a part time job that I did for three years and enjoyed. After COVID I decided I should get out and about while I was still in reasonable health so I retired again at 71. I made friends there who were in a similar situation and just wanted to earn a few dollars to pay for travel. The point is that more of us are living longer and are willing able and interested in remaining in the workplace.

Exhibit A is our current ballot choices in November.

Congress recognizes this and has already raised the age at which we’re required to start the 401/IRA RMD.

The truth is it’s not the 1930’s anymore and life expectancy has extended and the workplace has drastically been altered.

The top 1% currently pay right at 43% of all taxes collected.You’re right, they pay a higher share of taxes than they receive as a share of income.

It’s not fair, it’s progressive.

Sounds fair to me. 🙄

Similar threads

- Replies

- 8

- Views

- 176

- Replies

- 63

- Views

- 947

- Replies

- 0

- Views

- 62

- Replies

- 2

- Views

- 85

ADVERTISEMENT

ADVERTISEMENT