just keep it up like this till November so everyone has to elect trump just to get out of hot water

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How is the economy right now?

- Thread starter BrianNole777

- Start date

Are you asking as an owner, farmer or just interested? Do you have yields? Soil tests?Hey farm manager: honest question

What is the going rate for cash rent for good NW Iowa land with csri of around 82? Has it gone up since last year?

Thanks for info.

My mom is the owner.....she does sharecrop.Are you asking as an owner, farmer or just interested? Do you have yields? Soil tests?

Just curious really. I am not farming but do her books.

This year corn yield: 250/acre

Beans : 66/ acre

Last edited:

wtf are you talking about?the economy is absolute chaos right now and in shambles, worst since 2008. but the media refuses to report it due to: they are shills for biden

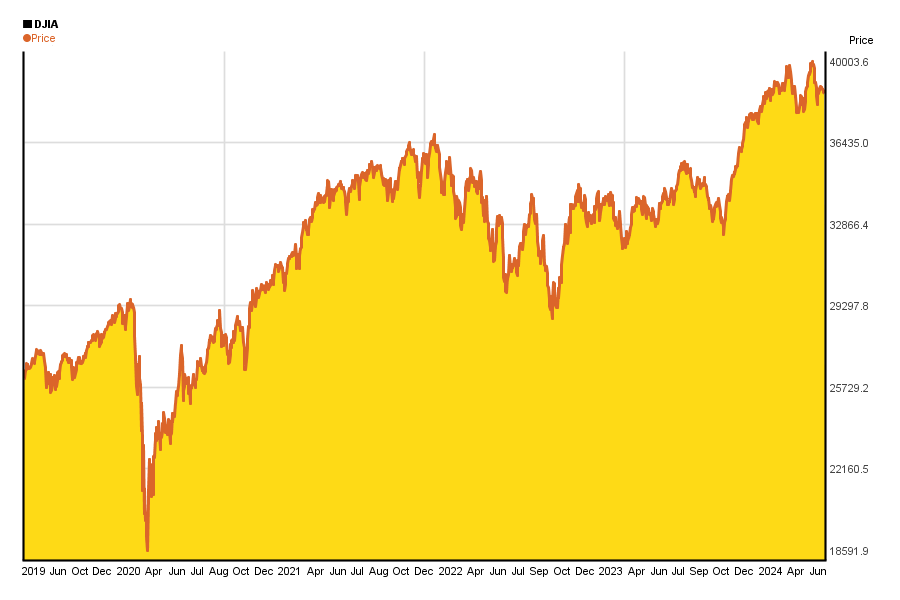

Here is the DJIA 5 year history. Look and January 2021 and look at today. The only way that your portfolio could be lower today than January 2021 is if you were heavily invested in a single sector or stock, which is, like I said, doing it wrong.

I imagine part of the issue is some are comparing current balance not to the beginning of Biden's term in January 2021, but to the peak that occurred right near the end of 2021. If you look at the S&P 500, it closed on 12/31/21 at $4766. It then dropped pretty significantly for much of 2022, bottoming out in October at $3583. It's climbed steadily since then, but at the end of 2023 was at $4769 - so essentially just got back to where it was 2 years prior.

So yeah, if you've just left things parked in a 500 index fund, you just recently got back to where you were two years ago.

If your retirement accounts are at the same dollar value they were in Jan. 2021 you have lost over 20% due to inflation. If they are up 25% from January 2021 tou are pretty much even.Economy feels like a glass house. Everything is still very expensive in comparison to what it was in 2019, but the markets seem confident and my retirement accounts are nearly back to where they were when Trump left office (which I'll take as a win compared to where they were 2 years ago), and on paper all of my real estate holdings are way up...but wages also haven't kept pace with inflation...

Some good, some not so good, but the reality is day to day costs are still very high in comparison to cash in for most.

I think you could make a pretty good argument no matter what you want the outcome to be.

I think the economy is pretty good for the upper 20% of earners/ income brackets. However, for everyone else inflation has caused significant harm. Everything from a can of Campbell's condensed soup ($1.00 in 2021, $1.72 now) to a Big Mac ($3.80 then,$5.65 now) to going to a movie to buying a house costs a lot more, and that is felt disproportionately by lower income people. It's the reason so many consider the economy as being bad, imo. Unfortunately, the increased price of everything is pretty much permanent, barring a major economic depression.

Last edited:

I think for low and middle class it's pretty hard right now.

Food, rent, bills, everything feels sky high.

Food, rent, bills, everything feels sky high.

He talks about whatever the folks in right wing media tell him he should be talking about.wtf are you talking about?

While I agree with much of what you said here, part of what people are feeling is what they are being fed.If your retirement accounts are at the same dollar value they were in Jan. 2021 you have lost over 20% due to inflation. If they are up 25% from January 2021 tou are pretty much even.

I think the economy is pretty good for the upper 20% of earners/ income brackets. However, for everyone else inflation has caused significant harm. Everything from a can of Campbell's condensed soup ($1.00 in 2021, $1.72 now) to a Big Mac ($3.80 then,$5.65 now) to going to a movie to buying a house costs a lot more, and that is felt disproportionately by lower income people. It's the reason so many consider the economy as being bad, imo. Unfortunately, the increased price of everything is pretty much permanent, barring a major economic depression.

The current inflation rate is 3.1%. That obviously doesn't fix the rise in prices but given the backdrop of an average 40 year inflation rate of 3.8% it's hardly a significant problem today. While there was a drop in real income in 2022, wage growth has cut into and is now outpacing inflation, particularly among the lower and middle classes that you referenced.

Surprise: Wage growth has actually outpaced the crushing inflation over the past 2.5 years, according to the JEC Democrats

"The economy appears to be doing better than a lot of people might realize or be willing to admit," one expert says.

It's also worth noting that the unemployment rate was at 6.4% in January of 2021 while today it's at a historically low 3.1%.

I think interest rates (although not terribly high in historic context) are having the biggest negative impact on people's lives today. They're driving up the costs of everything from housing and cars, to the balances on everyone's credit card balances. I think the Fed needs to reevaluate their 2% inflation target in light of that. It's actually counterproductive to what they are trying to achieve.

Oh, and Big Macs don't cost that much. Somebody is yanking yer chain.

OK, here is what I do. I also didn't ask about drainage. Also are you using CSR1 or CSR2. The 1 is basically for taxes and 2 what is used in land comparison and are somewhat different.My mom is the owner.....she does sharecrop.

Just curious really. I am not farming but do her books.

This year corn yield: 250/acre

Beans : 66/ acre

I don't know the size and shape of the fields. I'm assuming at least 80 acres and a rectangular shape and decently drained. I also don't know the yield history.

I require farmers to provide the following:

FSA 578 with map

Scale tickets

Yield monitor maps

Crop Insurance yields that are reported on the offical form. Make sure you get the Trend Adjusted.

Most of my farms are on a flex lease

I do a formula.

Expected Yield x Expected Price x a factor

YIeld, use what is expected. I sometimes don't include lower yields as farmers have fed crop insurance available.

For price, take the Federal Crop price for spring which are almost out minus basis. I also look at USDA forecast for average price.

So, if the expected yield is 250. Price on Corn I'd use $4.50 as a target The multiplication factor ranges from 33 percent to 40 percent with both ends being rare. For non relatives or non special relationships I use

36 - 38 percent. Some owners insist on 40, but is VERY rare and not sustainable.

So 250 x 4.50 x 36% = $405. Guessing your yields are consistently 250, but I have some farms that are improved with good farmers concerned about compaction doing that or higher.

Soybean percentage factors are 40 to 45 percent with average managed 42 to 44 as an assertive "fair" amount.

On the flex, I take that formula but for a potential flex, and average local elevator price using the same day of the month Jan/Oct or Nov (you'll get the bonus later with Nov) and actual yields. A farm similar in quality to yours was over $600 on corn per acre.

Some owners try and capture a percentage of the Crop Insurance. I use 5-10 percent after $25 to offset what happened in 2012 during the drought when farmers collected crop insurance like bandits.

A few are asking for percentages of payments like Covid or MFP if there are any, but that is rare and hard to calculate

The Iowa State numbers are low for people in the know.

So to answer your question, your rent is low so I would not lower it. My best guess without knowing the area I would be in the $325-$380 range depending on the relationship.

If you know the value of the land you can also compare that.

Land values are about $200 per CSR2 point which would put your farm at $16000 to $17000 but could be higher (or maybe lower but not likely). A 2 percent return to cash flows is historically low but not in today's market. That would put you at about $330.

Again, I know nothing about your farm or the tenant relationship.

If your farm is consistently near 250 on corn and mid sixties on beans I would be curious why. Cyst pressure below the university threshold is a possible factor.

You can get the actual productivity index off of most soil test maps. You can pay $50 for a month subscription to Surety (or ask a farm manager) or use Web Soil Survey which is a bit clunky and it's hard to get precise boundaries.

If the yield on corn is consistently near $250 on average years, I would start looking at soil test results. It's not the high cash rent farmers wanting to stay awhile that are typically mining the soil of nutrients. It's the good old boy that everyone trusts that runs it down. Eventually low fertility will be a big cost to you as on average it takes 4 pounds of elemental K to raise a test 1 point and 9 pounds of P.

Sometimes it's worth hiring a manager. But if you learn it's not rocket science. I don't trust the majority of farm managers but there are good ones out there. Good luck!

You might be right about Big Mac, I don't eat a McDonald's, just Googled and that's the answer that popped up. I did buy a Wendy's single (burger only, no combo) at a truck stop in Albert Lea MN the other day and it was $7.11 with tax. But my point is that the effects of inflation are baked in, and almost everything costs a lot more than it did 3 years ago. Sure, the most recent monthly government figures show that those 120% prices increased at "only" and additional 3.1% year over year, but that is 3.7% more if you compare it to a baseline 3 years ago (1.2 ×1.031).While I agree with much of what you said here, part of what people are feeling is what they are being fed.

The current inflation rate is 3.1%. That obviously doesn't fix the rise in prices but given the backdrop of an average 40 year inflation rate of 3.8% it's hardly a significant problem today. While there was a drop in real income in 2022, wage growth has cut into and is now outpacing inflation, particularly among the lower and middle classes that you referenced.

Surprise: Wage growth has actually outpaced the crushing inflation over the past 2.5 years, according to the JEC Democrats

"The economy appears to be doing better than a lot of people might realize or be willing to admit," one expert says.fortune.com

It's also worth noting that the unemployment rate was at 6.4% in January of 2021 while today it's at a historically low 3.1%.

I think interest rates (although not terribly high in historic context) are having the biggest negative impact on people's lives today. They're driving up the costs of everything from housing and cars, to the balances on everyone's credit card balances. I think the Fed needs to reevaluate their 2% inflation target in light of that. It's actually counterproductive to what they are trying to achieve.

Oh, and Big Macs don't cost that much. Somebody is yanking yer chain.

My point is that stuff costs a lot more, and normal people are feeling it, which causes their perception that the economy is doing poorly. I agree that interest rates play a part of that, but the increase in the money supply that created the inflation is the biggest factor, imo. And given current and future levels of government spending and projected Fed policy, I don't see the inflation rate falling much further any time soon. So prices will continue to increase on top of the damage already done.

Last edited:

Saw an article in WSJ last week breaking down food cost mix.You might be right about Big Mac, I don't eat a McDonald's, just Googled and that's the answer that popped up. I did buy a Wendy's single (burger only, no combo) at a truck stop in Albert Lea MN the other day and it was $7.11 with tax. But my point is that the effects of inflation are baked in, and almost everything costs a lot more than it did 3 years ago. Sure, the most recent montly government figures show that those 120% prices increased at "only" and additional 3.1% year over year, but that is 3.7% more if you compare it to a baseline 3 years ago (1.2 ×1.031).

My point is that stuff costs a lot more, and normal people are feeling it, which causes their perception that the economy is doing poorly. I agree that interest rates play a part of that, but the increase in the money supply that created the inflation is the biggest factor, imo. And given current and future levels of government spending and projected Fed policy, I don't see the inflation rate falling much further any time soon. So prices will continue to increase on top of the damage already done.

Restaurant inflation is much higher than grocery inflation.

People eat out way more than 20 years ago.

This results in a jump in percentage of food costs going to restaurant has jumped from 20% to 50% of the total spent on food.

Now with two working parents eating out more is expected so no doubt it is a hardship on lower middle class.

Uh -it’s barely outpaced inflation.The posters complaining in this thread just can't seem to admit things didn't collapse when Turd got booted.

And we ALL remember his quote about "Your 401k will tank if Biden is elected"!

You don't have to be a big risk taker to have made lots of $$$ since January 2021.

Woopie…

In todays market, there is little reason to do crop share. That could change if they have +6 mil in assets and the estate tax exemption gets rolled back and their estate plan requires material participation or she is building SS credit. Neither is likely.My mom is the owner.....she does sharecrop.

Just curious really. I am not farming but do her books.

This year corn yield: 250/acre

Beans : 66/ acre

So here is one if those places where we see opinion and reality diverge. The biggest factor in the initial surge in inflation was in fact supply chain disruptions as a result of Covid shutdowns worldwide. All those ships sitting out in the ocean waiting to unload goods at workerless ports wasn't a figment of your imagination. Much of China was shut down for well over a year resulting in catastrophic shortages of parts and finished goods in the U.S.. The government stepped in to avoid a depression which resulted in too much money chasing too little supply. That was the root cause of the inflation that we saw. Over the past 2 years the American economy has been one of if not the best developed economies performance wise by almost any measure, inflation included.You might be right about Big Mac, I don't eat a McDonald's, just Googled and that's the answer that popped up. I did buy a Wendy's single (burger only, no combo) at a truck stop in Albert Lea MN the other day and it was $7.11 with tax. But my point is that the effects of inflation are baked in, and almost everything costs a lot more than it did 3 years ago. Sure, the most recent monthly government figures show that those 120% prices increased at "only" and additional 3.1% year over year, but that is 3.7% more if you compare it to a baseline 3 years ago (1.2 ×1.031).

My point is that stuff costs a lot more, and normal people are feeling it, which causes their perception that the economy is doing poorly. I agree that interest rates play a part of that, but the increase in the money supply that created the inflation is the biggest factor, imo. And given current and future levels of government spending and projected Fed policy, I don't see the inflation rate falling much further any time soon. So prices will continue to increase on top of the damage already done.

I wish government spending was lower and taxes were higher, but with respect growing the money supply, it's been much slower since 2021 and it's actually been shrinking pretty significantly for the past year.

Eating out is a hardship?Saw an article in WSJ last week breaking down food cost mix.

Restaurant inflation is much higher than grocery inflation.

People eat out way more than 20 years ago.

This results in a jump in percentage of food costs going to restaurant has jumped from 20% to 50% of the total spent on food.

Now with two working parents eating out more is expected so no doubt it is a hardship on lower middle class.

Stuff had been incredibly inexpensive for many years and suddenly it wasn't. People now need to make some choices, shop around a bit, look for sales and, god forbid, do without something they want on occasion.

Wages are up, particularly at the lower income levels. Unemployment is historically low. People are still buying and the economists continue to be more encouraging about the upcoming year. The economy is doing great but that's inconvenient for some to admit, thus all the wailing and gnashing of teeth.

Now if we could just get everything else on board with this. Inflation of everything else the past few years has been a bit much.But,honestly, adjusted for inflation the price of a gallon a gas has been stable for decades. Since 1950 the average price of gas in 2023 dollars has been around $3. It’s gone down significantly since 2012.

I feel bad for strippers that are still having dollar bills thrown at them. That should be up to 5 or 10 dollar bills at minimum by now.

Sarcasm?Uh -it’s barely outpaced inflation.

Woopie…

Cause if you match the stock market vs inflation when inflation spiked...it's no contest.

Many of the people who complain about the price of things are too lazy to shop around and do some research before buying. They will also pay $12 for a sub at Subway when they can get the same thing at Publix for $7, simply because they have to go inside Publix. They could save even more if they bought the ingredients and made their own sandwhich, but that would take more effort. BTW, those $12 subs at Subway will stay at that price as long as enough people keep buying them.Eating out is a hardship?

Stuff had been incredibly inexpensive for many years and suddenly it wasn't. People now need to make some choices, shop around a bit, look for sales and, god forbid, do without something they want on occasion.

Wages are up, particularly at the lower income levels. Unemployment is historically low. People are still buying and the economists continue to be more encouraging about the upcoming year. The economy is doing great but that's inconvenient for some to admit, thus all the wailing and gnashing of teeth.

Thanks for the info.OK, here is what I do. I also didn't ask about drainage. Also are you using CSR1 or CSR2. The 1 is basically for taxes and 2 what is used in land comparison and are somewhat different.

I don't know the size and shape of the fields. I'm assuming at least 80 acres and a rectangular shape and decently drained. I also don't know the yield history.

I require farmers to provide the following:

FSA 578 with map

Scale tickets

Yield monitor maps

Crop Insurance yields that are reported on the offical form. Make sure you get the Trend Adjusted.

Most of my farms are on a flex lease

I do a formula.

Expected Yield x Expected Price x a factor

YIeld, use what is expected. I sometimes don't include lower yields as farmers have fed crop insurance available.

For price, take the Federal Crop price for spring which are almost out minus basis. I also look at USDA forecast for average price.

So, if the expected yield is 250. Price on Corn I'd use $4.50 as a target The multiplication factor ranges from 33 percent to 40 percent with both ends being rare. For non relatives or non special relationships I use

36 - 38 percent. Some owners insist on 40, but is VERY rare and not sustainable.

So 250 x 4.50 x 36% = $405. Guessing your yields are consistently 250, but I have some farms that are improved with good farmers concerned about compaction doing that or higher.

Soybean percentage factors are 40 to 45 percent with average managed 42 to 44 as an assertive "fair" amount.

On the flex, I take that formula but for a potential flex, and average local elevator price using the same day of the month Jan/Oct or Nov (you'll get the bonus later with Nov) and actual yields. A farm similar in quality to yours was over $600 on corn per acre.

Some owners try and capture a percentage of the Crop Insurance. I use 5-10 percent after $25 to offset what happened in 2012 during the drought when farmers collected crop insurance like bandits.

A few are asking for percentages of payments like Covid or MFP if there are any, but that is rare and hard to calculate

The Iowa State numbers are low for people in the know.

So to answer your question, your rent is low so I would not lower it. My best guess without knowing the area I would be in the $325-$380 range depending on the relationship.

If you know the value of the land you can also compare that.

Land values are about $200 per CSR2 point which would put your farm at $16000 to $17000 but could be higher (or maybe lower but not likely). A 2 percent return to cash flows is historically low but not in today's market. That would put you at about $330.

Again, I know nothing about your farm or the tenant relationship.

If your farm is consistently near 250 on corn and mid sixties on beans I would be curious why. Cyst pressure below the university threshold is a possible factor.

You can get the actual productivity index off of most soil test maps. You can pay $50 for a month subscription to Surety (or ask a farm manager) or use Web Soil Survey which is a bit clunky and it's hard to get precise boundaries.

If the yield on corn is consistently near $250 on average years, I would start looking at soil test results. It's not the high cash rent farmers wanting to stay awhile that are typically mining the soil of nutrients. It's the good old boy that everyone trusts that runs it down. Eventually low fertility will be a big cost to you as on average it takes 4 pounds of elemental K to raise a test 1 point and 9 pounds of P.

Sometimes it's worth hiring a manager. But if you learn it's not rocket science. I don't trust the majority of farm managers but there are good ones out there. Good luck!

Since my mom sharecrop 50/50 with a good neighbor farmer with her land she is not really looking to change that long term arrangement. He is a good stewart of her land but never know when he might retire or have health problems.

I have analyzed her crop costs and revenue and like to compare her net w fair market value of cash rent.

Depends on price of corn and beans.In todays market, there is little reason to do crop share. That could change if they have +6 mil in assets and the estate tax exemption gets rolled back and their estate plan requires material participation or she is building SS credit. Neither is likely.

Last 3 years better with the share arrangement.

Last three years have averaged 5-6.75 / bu. Corn.

Last year: 250 bu ×.5 = 125 × 5.20= 650 gross less inputs of 500.×.5= 250= 400/ acre.

Cash rent around here was less than 300.

Plus can deduct addl. farm expenses on farm schedule to reduce tax liability as active farmer.

If prices dip(like this year )not so clear cut.

Over long haul it is better for her while maintaining goodwill with tenant who helps her out with snow removal and some maintenance.

All those things go into the equation. However, very little ground would rent under 300 unless the landowner doesn't really know. Also, and I have no skin in the game, much of the time a later accounting shows some issues.Thanks for the info.

Since my mom sharecrop 50/50 with a good neighbor farmer with her land she is not really looking to change that long term arrangement. He is a good stewart of her land but never know when he might retire or have health problems.

I have analyzed her crop costs and revenue and like to compare her net w fair market value of cash rent.

Depends on price of corn and beans.

Last 3 years better with the share arrangement.

Last three years have averaged 5-6.75 / bu. Corn.

Last year: 250 bu ×.5 = 125 × 5.20= 650 gross less inputs of 500.×.5= 250= 400/ acre.

Cash rent around here was less than 300.

Plus can deduct addl. farm expenses on farm schedule to reduce tax liability as active farmer.

If prices dip(like this year )not so clear cut.

Over long haul it is better for her while maintaining goodwill with tenant who helps her out with snow removal and some maintenance.

Gotcha...I wonder if guys paying higher cash rent are going get burned this year with 4 dollar corn and 10 dollar beans...back to the even worse prices from 2014-2019.All those things go into the equation. However, very little ground would rent under 300 unless the landowner doesn't really know. Also, and I have no skin in the game, much of the time a later accounting shows some issues.

Well, since 2011, the typical returns have been about 250-400k for a 1500 acre farmer. I think it was 2016 where there was a hole and this year might be break even (maybe lower if you count all fixed costs. Not too worried. It's farmers driving up land prices. Before ethanol you did a 2 year rotation hoping to make money on one of them. Pretty good deal now.Gotcha...I wonder if guys paying higher cash rent are going get burned this year with 4 dollar corn and 10 dollarWbeans...back to the

if prices go lower yet then maybe rent adjustments. But who wants to spend money on an asset and get a 2.5 percent return on cash flows. If you have other questions or need help on a soil test, just ask. Lot's of farmers do recreational tillage and so many new 36 row planters on 20 inch rows with a new tractor been bought in the past year. Landowners give in too much. 16k ground for under 300? Not much since in that.

Money supply is the key component to inflation. Supply chain disruptions cause temporary increases, but those prices decline when the disruptions cease and supply levels are restored. Inflation of the money supply causes more lasting, often permanent, increase in prices.So here is one if those places where we see opinion and reality diverge. The biggest factor in the initial surge in inflation was in fact supply chain disruptions as a result of Covid shutdowns worldwide. All those ships sitting out in the ocean waiting to unload goods at workerless ports wasn't a figment of your imagination. Much of China was shut down for well over a year resulting in catastrophic shortages of parts and finished goods in the U.S.. The government stepped in to avoid a depression which resulted in too much money chasing too little supply. That was the root cause of the inflation that we saw. Over the past 2 years the American economy has been one of if not the best developed economies performance wise by almost any measure, inflation included.

I wish government spending was lower and taxes were higher, but with respect growing the money supply, it's been much slower since 2021 and it's actually been shrinking pretty significantly for the past year.

Check out the 5 year level at the link below. The chart describes it much better than words do, imo. It shows that money supply remains highly inflated and explains current price levels.

Prices of goods and services will continue to increase from current levels, and people will continue to find things out of reach that were affordable a few years ago. Among those are home ownership, which has become unaffordable for those with median household incomes. I saw one estimate that the ratio of home prices to household median income is the highest it's been in over 70 years. The economy might be "OK" by certain technical measures, but when people can't afford stuff they need or want it is simply bad to them.

US M2 Money Supply

In depth view into US M2 Money Supply including historical data from 1959 to 2023, charts and stats.

Last edited:

It's been going down since the end of 2022. The growth was astronomical through 2020 and the 1st quarter of 2021 before slowing dramatically. Look at the chart on the bottom.Check out the 5 year level. The chart describes it much better than words do, imo. Money supply remains highly inflated.

US M2 Money Supply

In depth view into US M2 Money Supply including historical data from 1959 to 2023, charts and stats.ycharts.com

US M2 Money Supply YoY

In depth view into US M2 Money Supply YoY including historical data from 1960 to 2023, charts and stats.

you know how we know the economy is horrible? the left keeps inventing new things like christian supremacy and russia bs. that's to cover up low biden approval ratings because of his bidenomics.

It was a little over 15 T in 2020, went to 19T by Jan 2021, went up to 21.7 T in mid 2022, and has now declined to 20.9T. With the money supply still 40% higher than 2020 it's silly to expect prices to do anything but continue to increase.It's been going down since the end of 2022. The growth was astronomical through 2020 and the 1st quarter of 2021 before slowing dramatically. Look at the chart on the bottom.

US M2 Money Supply YoY

In depth view into US M2 Money Supply YoY including historical data from 1960 to 2023, charts and stats.ycharts.com

Not sarcasm.Sarcasm?

Cause if you match the stock market vs inflation when inflation spiked...it's no contest.

S&P is up about 3%/yr over inflation since the vegetable took over.

Wow. What a rocket ship.

Grasping at straws again.Not sarcasm.

S&P is up about 3%/yr over inflation since the vegetable took over.

Wow. What a rocket ship.

Fact is your original post was wildly inaccurate.

Be better.

This place is largely for nut whack jobs to attack those that disagree rather than discussion. A sign of our nation where 2 incompetent nuts are running for president and the main choices and posters are so sold out to one side or the other the can't live in reality like the 2 candidates. Couple that with successful coaches that do not normal things

That makes us normal I guess.

We need a gaslighters anonymous thread.

That makes us normal I guess.

We need a gaslighters anonymous thread.

you know how we know the economy is horrible? the left keeps inventing new things like christian supremacy and russia bs. that's to cover up low biden approval ratings because of his bidenomics.

'cause Fox News told me so and we just know it's bad 'cause a democrat is in office.

People thought the Obama and Clinton economies were bad and that we needed the republicans to save us. How did that go?

About as well as NAFTA and Trade Wars with China.'cause Fox News told me so and we just know it's bad 'cause a democrat is in office.

People thought the Obama and Clinton economies were bad and that we needed the republicans to save us. How did that go?

Just facts and data.Grasping at straws again.

Fact is your original post was wildly inaccurate.

Be better.

Sorry libtards hate those.

Your original post was patently false.Just facts and data.

Sorry libtards hate those.

You said the stock market "barely" kept up with inflation.

Look when inflation started and compare that to where the rise in the stock market vs inflation is at any point in the last 18bmonths or any time frame you want to pick.

You're the target audience for Trump and Radical Right media.

3% sucks when cd’s are paying more.Your original post was patently false.

You said the stock market "barely" kept up with inflation.

Look when inflation started and compare that to where the rise in the stock market vs inflation is at any point in the last 18bmonths or any time frame you want to pick.

You're the target audience for Trump and Radical Right media.

Saw an article in WSJ last week breaking down food cost mix.

Restaurant inflation is much higher than grocery inflation.

People eat out way more than 20 years ago.

This results in a jump in percentage of food costs going to restaurant has jumped from 20% to 50% of the total spent on food.

Now with two working parents eating out more is expected so no doubt it is a hardship on lower middle class.

But cooking is HARD!

We eat out a lot less, and I have also become far less brand loyal at the grocery store as well. I know when I'm being taken for a ride by Big Food. I'll consume your competitor's products until you reform yourselves, corporate gluttons.

What are you arguing???3% sucks when cd’s are paying more.

You're all over the map.

You seem desperate.

Are you desperate?

Similar threads

- Replies

- 14

- Views

- 298

- Replies

- 144

- Views

- 2K

- Replies

- 25

- Views

- 309

ADVERTISEMENT

ADVERTISEMENT