- Sep 13, 2002

- 94,065

- 190,285

- 113

These Bidenomics are really humming!

From noted liberal rag The Wall Street Journal:

Americans’ growing paychecks surpassed inflation for the first time in two years, providing some financial relief to workers, while complicating the Federal Reserve’s efforts to tame price increases.

Inflation-adjusted average hourly wages rose 1.2% in June from a year earlier, according to the Labor Department. That marked the second straight month of seasonally adjusted gains after two years when workers’ historically elevated raises were erased by price increases.

If the trend persists, it gives Americans leeway to propel the economy through increased spending, which could help the U.S. skirt a recession. Since estimates earlier this year, economists surveyed by The Wall Street Journal have lowered the probability a recession will start in the next 12 months.

In addition to enjoying solid wage growth, Americans are taking comfort in slower price increases for everyday items—such as gasoline and groceries—that have the biggest influence on their perception of inflation.

ADVERTISEMENT

Consumer confidence in June reached its highest level since January 2022, the Conference Board said. Americans’ assessment of current economic conditions and their outlook for the future improved. Americans are nonetheless anticipating a recession within the next year, the survey found. That is likely because they are aware of the Fed’s ongoing effort to fight inflation and how that might trigger a broad economic slowdown, said Conference Board Chief Economist Dana Peterson.

The Fed has lifted its benchmark interest rate 10 times since March 2022, to a range of 5% to 5.25%, and is on track to do so again later this month. Those interest-rate hikes have contributed to a cooling in the U.S. economy, but the labor market and wage growth remain on solid footing.

Wages for manufacturing and business-services workers are also outpacing inflation. Pay gains have been narrower in the tech-heavy information sector, where several large companies have cut staff.

Federal Reserve Chair Jerome Powell signaled wage growth is still too strong for the central bank’s comfort in its inflation-fighting campaign. He said in June that wage gains had eased, but “quite gradually.” Pay raises allow consumers to purchase more expensive goods and services, which in turn supports elevated inflation.

“It’s great to see wage increases, particularly for people at the lower end of the income spectrum,” Powell said. “But we want that as part of the process of getting inflation back down to 2%, which benefits everyone.”

A tight labor market, in which job openings exceed the number of unemployed people looking for work, is a factor propelling sustained wage growth, said Bob Schwartz, a senior economist at Oxford Economics. Workers in recent years had more power to demand raises, but there are signs that trend is cooling.

“As inflation comes down, and that’s already happening, wage demands will also abate,” Schwartz said. “You’ll see the two going together.”

From noted liberal rag The Wall Street Journal:

Pay Raises Are Finally Beating Inflation After Two Years of Falling Behind

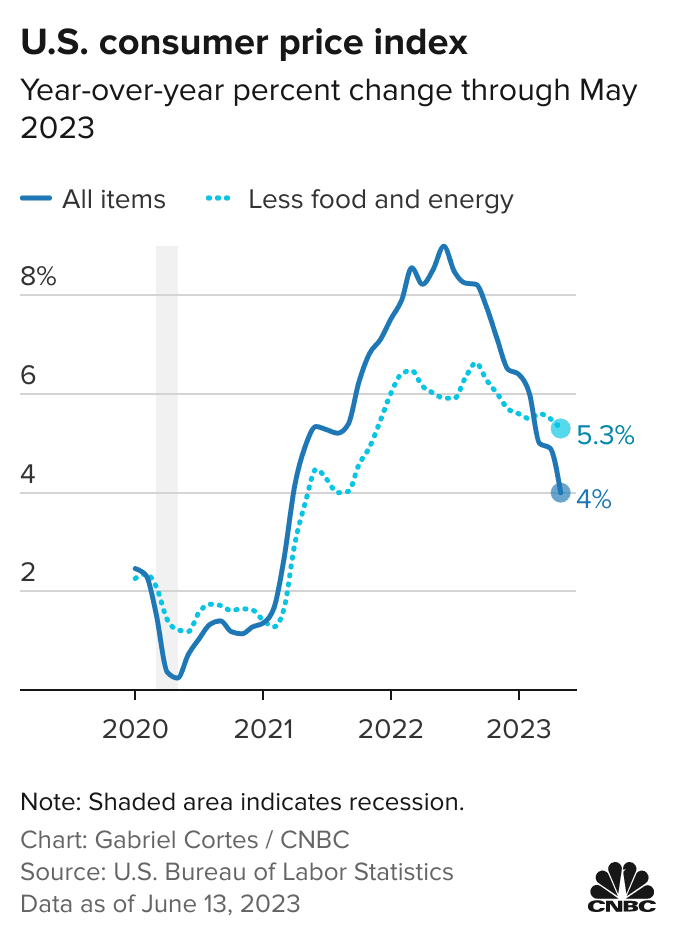

Wages rise more than 4% while consumer prices increase 3%

Americans’ growing paychecks surpassed inflation for the first time in two years, providing some financial relief to workers, while complicating the Federal Reserve’s efforts to tame price increases.

Inflation-adjusted average hourly wages rose 1.2% in June from a year earlier, according to the Labor Department. That marked the second straight month of seasonally adjusted gains after two years when workers’ historically elevated raises were erased by price increases.

If the trend persists, it gives Americans leeway to propel the economy through increased spending, which could help the U.S. skirt a recession. Since estimates earlier this year, economists surveyed by The Wall Street Journal have lowered the probability a recession will start in the next 12 months.

Lower gasoline prices brighten consumers’ moods

Not adjusting for inflation, private-sector workers’ hourly wages were up more than 4% in June from a year earlier. Those gains have eased over the past year, but remain enough to outpace inflation this summer. Overall consumer prices in June rose 3% from a year earlier, down sharply from a four-decade high a year prior.In addition to enjoying solid wage growth, Americans are taking comfort in slower price increases for everyday items—such as gasoline and groceries—that have the biggest influence on their perception of inflation.

ADVERTISEMENT

Consumer confidence in June reached its highest level since January 2022, the Conference Board said. Americans’ assessment of current economic conditions and their outlook for the future improved. Americans are nonetheless anticipating a recession within the next year, the survey found. That is likely because they are aware of the Fed’s ongoing effort to fight inflation and how that might trigger a broad economic slowdown, said Conference Board Chief Economist Dana Peterson.

The Fed has lifted its benchmark interest rate 10 times since March 2022, to a range of 5% to 5.25%, and is on track to do so again later this month. Those interest-rate hikes have contributed to a cooling in the U.S. economy, but the labor market and wage growth remain on solid footing.

Elevated raises at odds with Fed’s goal

Raises for lower-income workers were particularly strong in early 2023. Restaurants, hotels and similar businesses hired at a brisk pace to cater to customers eager for services that were limited initially in the Covid-19 pandemic. While leisure and hospitality employment gains have slowed in recent months, workers in the industry saw their hourly pay rise faster than overall wage growth and inflation.Wages for manufacturing and business-services workers are also outpacing inflation. Pay gains have been narrower in the tech-heavy information sector, where several large companies have cut staff.

Federal Reserve Chair Jerome Powell signaled wage growth is still too strong for the central bank’s comfort in its inflation-fighting campaign. He said in June that wage gains had eased, but “quite gradually.” Pay raises allow consumers to purchase more expensive goods and services, which in turn supports elevated inflation.

“It’s great to see wage increases, particularly for people at the lower end of the income spectrum,” Powell said. “But we want that as part of the process of getting inflation back down to 2%, which benefits everyone.”

A tight labor market, in which job openings exceed the number of unemployed people looking for work, is a factor propelling sustained wage growth, said Bob Schwartz, a senior economist at Oxford Economics. Workers in recent years had more power to demand raises, but there are signs that trend is cooling.

“As inflation comes down, and that’s already happening, wage demands will also abate,” Schwartz said. “You’ll see the two going together.”